Q. 100 DK Goel Retirement of Partner Solutions Class 12 CBSE (2024-25)

Here are the solutions of Question number 100 Retirement of Partner chapter 5 of DK Goel Class 12 CBSE (2024-25).

K, L and M were partners in a firm sharing profits in the ratio of 5 : 3 : 2. On 31.3.2021 the Balance Sheet of the firm was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 30,000 | Bank | 20,000 |

| K’s Capital | 40,000 | Debtors Less: Provision for Bad Debts | 14,000 |

| L’s Capital | 36,000 | Building | 1,00,400 |

| M’s Capital | 32,000 | Profit and Loss Account | 3,600 |

| 1,38,000 | 1,38,000 |

L retired from the firm on the following terms:

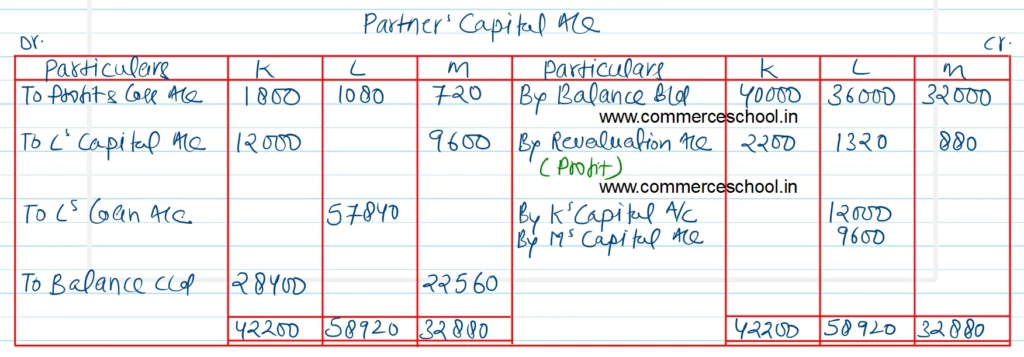

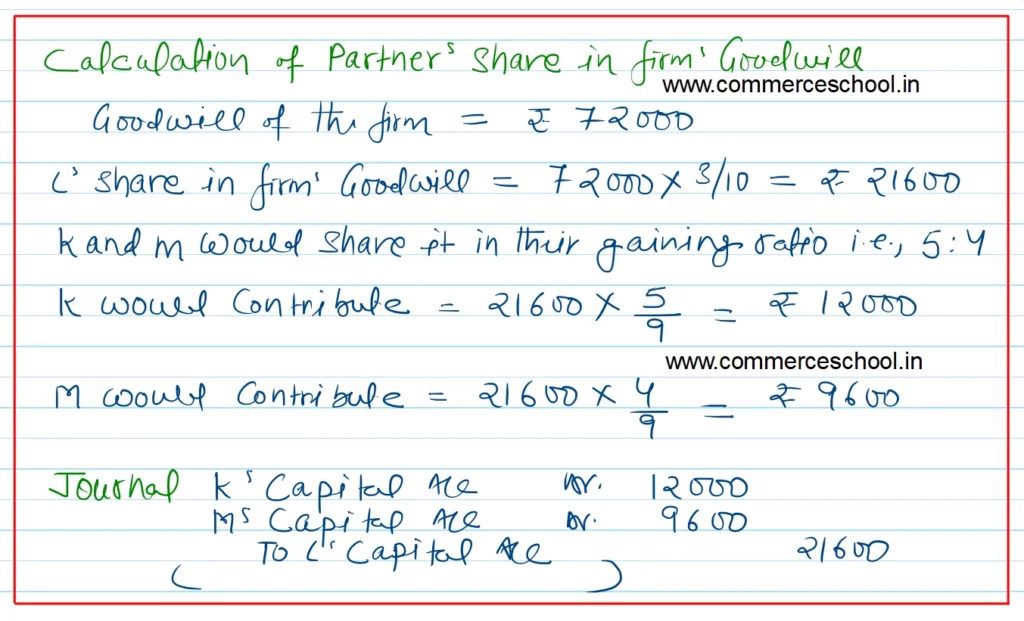

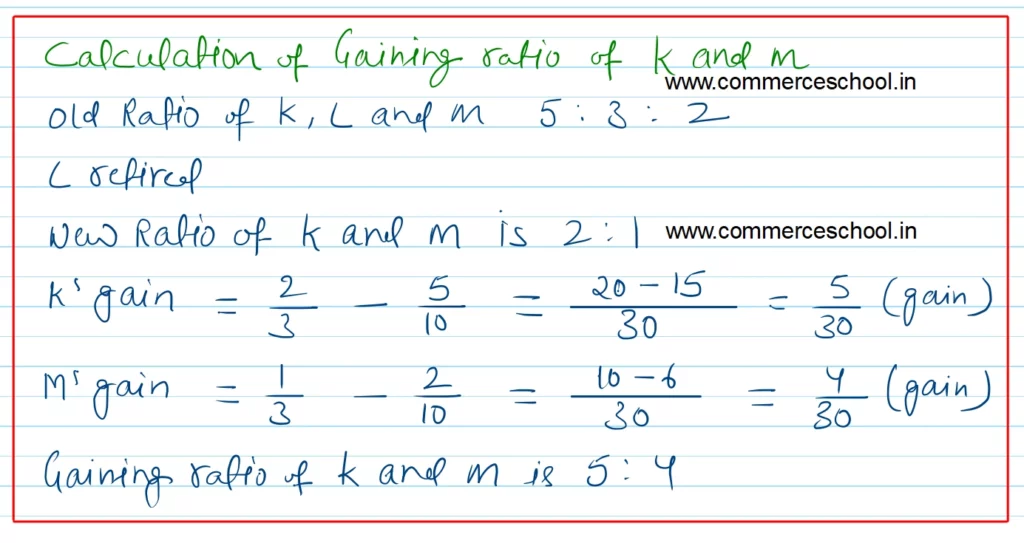

(I) The new profit sharing ratio between K and M will be 2 : 1.

(ii) Goodwill of the firm is valued at ₹ 72,000.

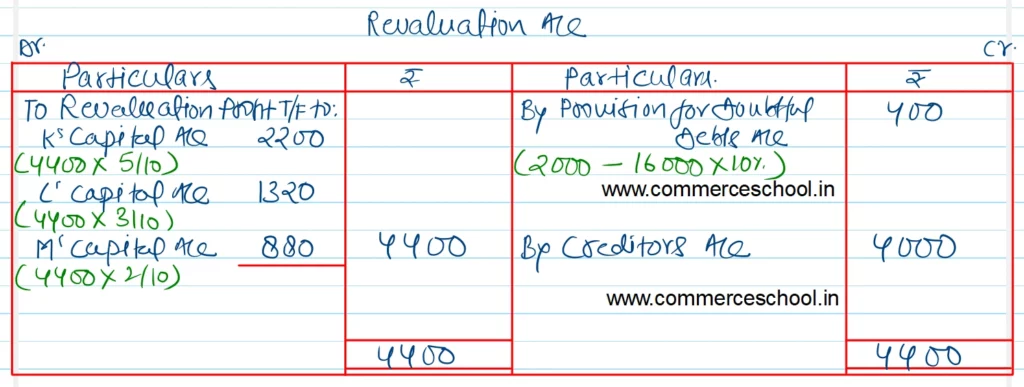

(iii) Provision for bad debts is to be made at the rate of 10% on debtors.

(iv) Creditors of ₹ 4,000 will not be claimed.

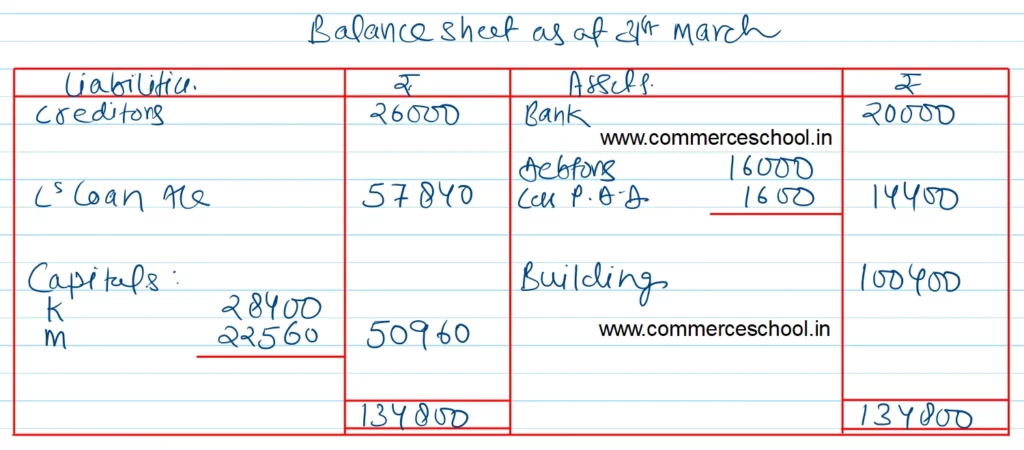

Prepare Revaluation Account, Partner’s Capital Accounts and Balance Sheet of K and M after L’s retirement.

[Ans. Gain on Revaluation ₹ 4,400; L’s Loan A/c ₹ 57,840; Capitals K ₹ 28,400 and M ₹ 22,560; B/S Total ₹ 1,34,800.]

Solution:-