[CBSE] Q. 72 Solution of Fundamentals of Partnership Firms TS Grewal (2025-26)

Solution of Question number 72 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2025-26 Edition

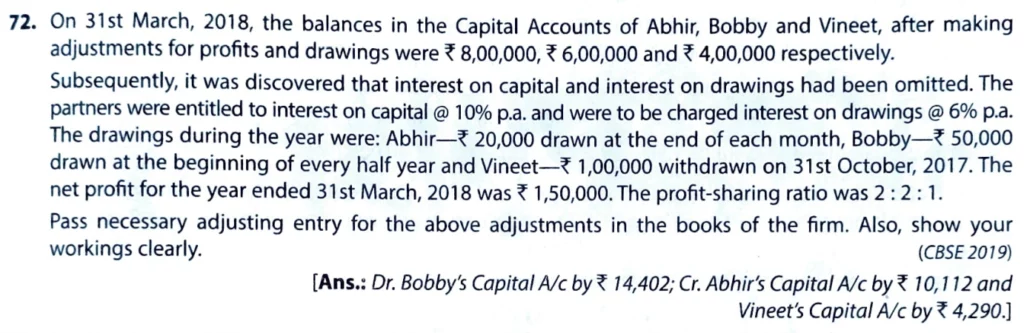

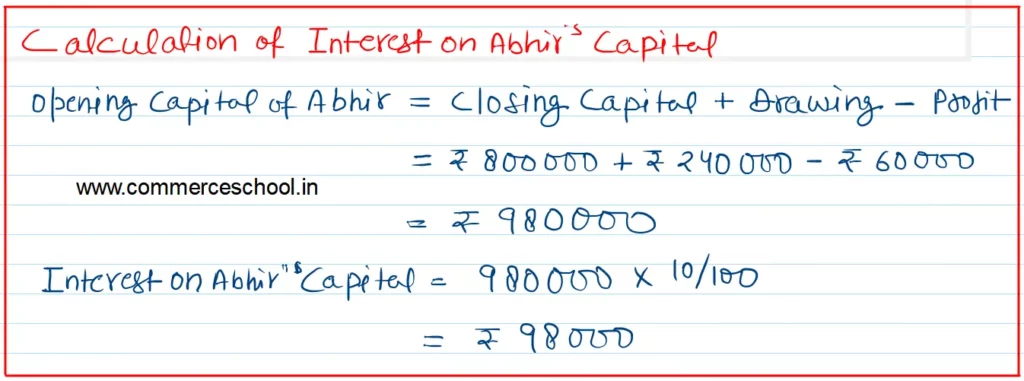

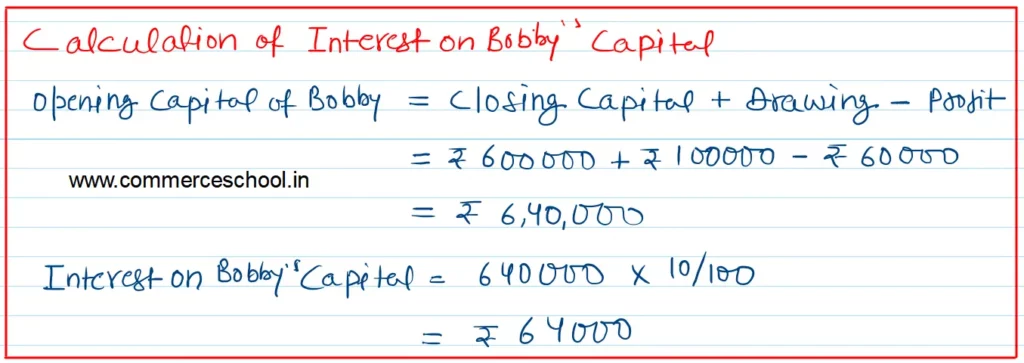

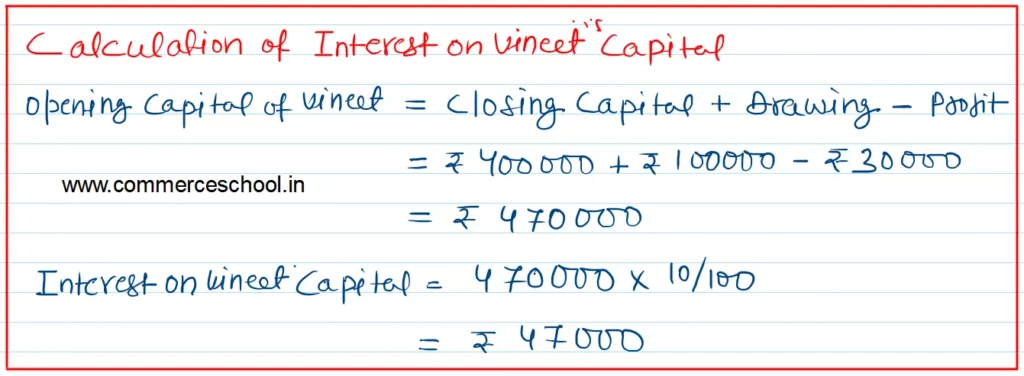

On 31st March 2018, the balances in the Capital Accounts of Abhir, Bobby and Vineet, after making adjustments for profits and drawings were ₹ 8,00,000, ₹ 6,00,000, and ₹ 4,00,000 respectively.

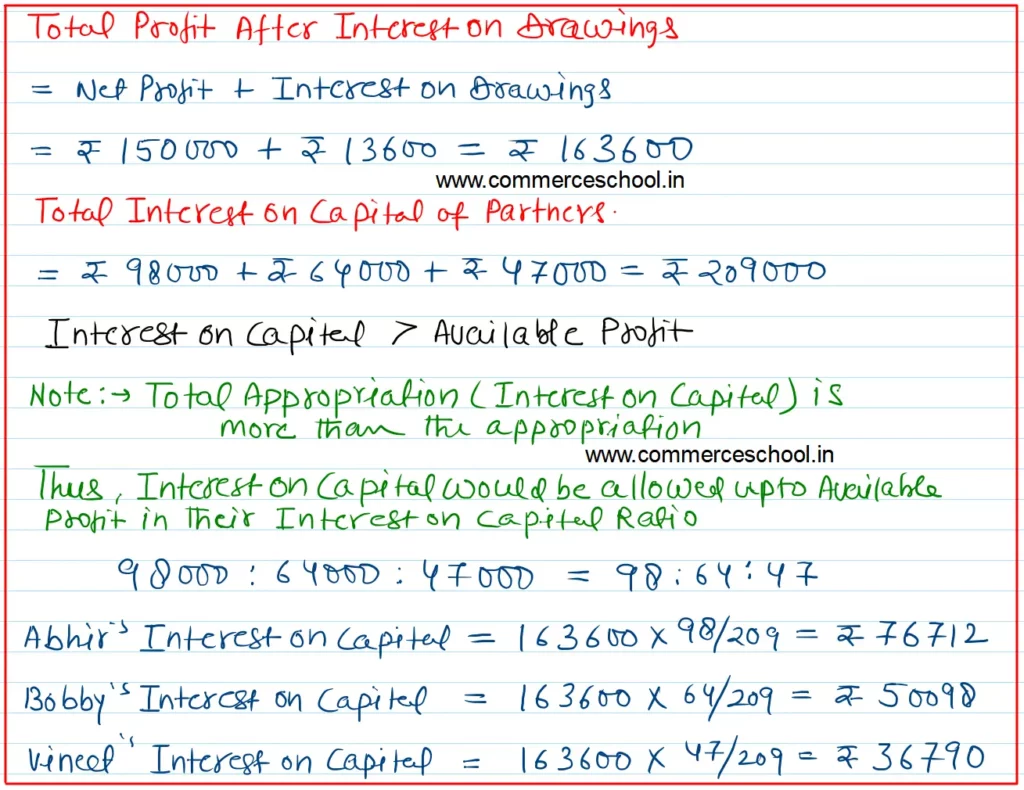

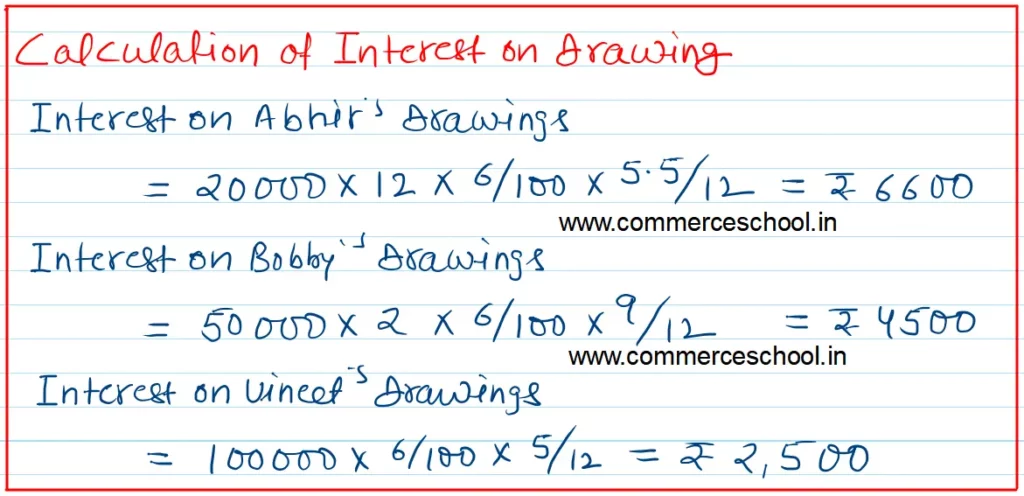

Subsequently, it was discovered that interest on capital and interest on drawings had been mitted. The partners were entitled to interest on capital @ 10% p.a. and were to be charged interest on drawings @ 6% p.a. The drawings during the year were: Abhir – ₹ 20,000 drawn at the end of each month, Bobby – ₹ 50,000 drawn at the beginning of every half year, and Vineet – ₹ 1,00,000 withdrawn on 31st October 2017. The net profit for the year ended 31st March 2018 was ₹ 1,50,000. The profit-sharing ratio was 2 : 2 : 1.

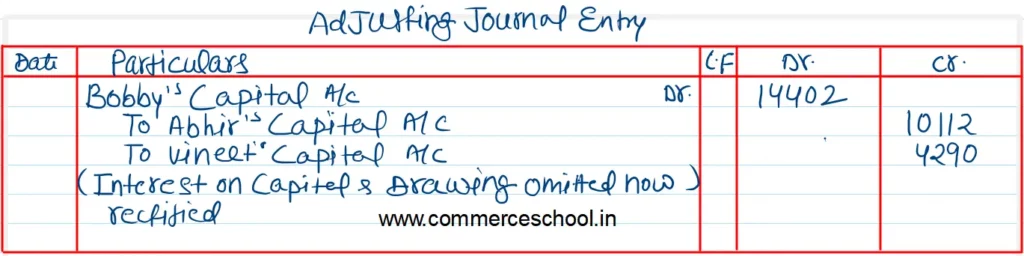

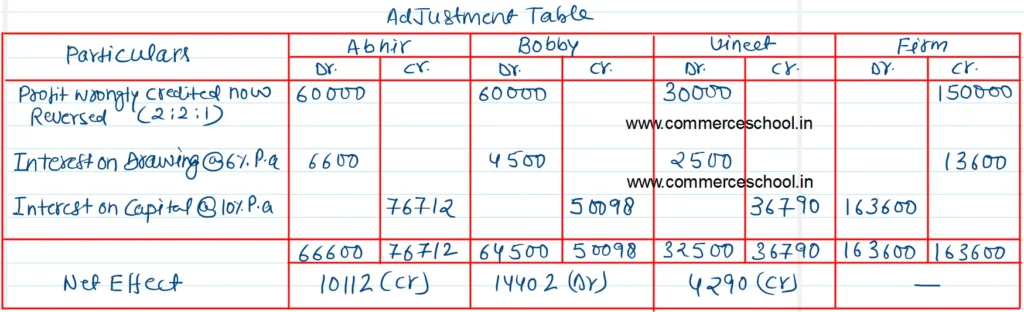

Pass necessary adjusting entries for the above adjustments in the books of the firm. Also, show your workings clearly.

[Ans: Dr. Bobby’s Capital A/c by ₹ 14,402; Cr. Abhir’s Capital A/c by ₹ 10,112 and Vineet’s Capital A/c by ₹ 4,290.]

Solution:-

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |