[CBSE] Q. 90 Solution of Fundamentals of Partnership Firms TS Grewal (2025-26)

Solution of Question number 90 of the Fundamentals of partnership firm chapter TS Grewal Book CBSE 2025-26 Edition

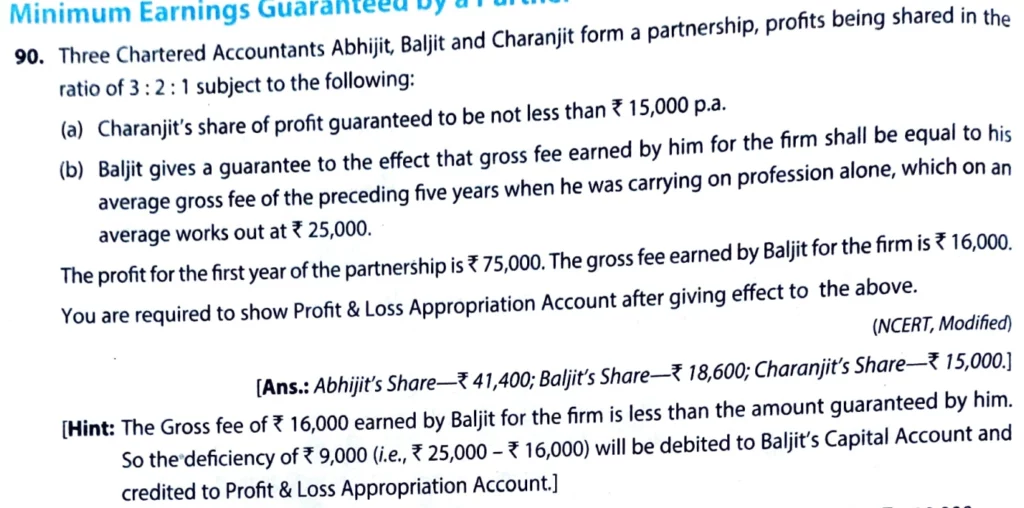

Three Chartered Accountants Abhijit, Baljit, and Charanjit form a partnership, profits being shared in the ratio of 3:2:1 subject to the following:

a) Charanjit’s share of profit is guaranteed to be not less than ₹ 15,000 p.a.

b) Baljit gives a guarantee to the effect that the gross fee earned by him for the firm shall be equal to his average gross fee of the preceding five years when he was carrying on his profession alone, which on average works out at ₹ 25,000.

The Profit for the first year of the partnership is ₹ 75,000. The gross fee earned by Baljit for the firm is ₹ 16,000.

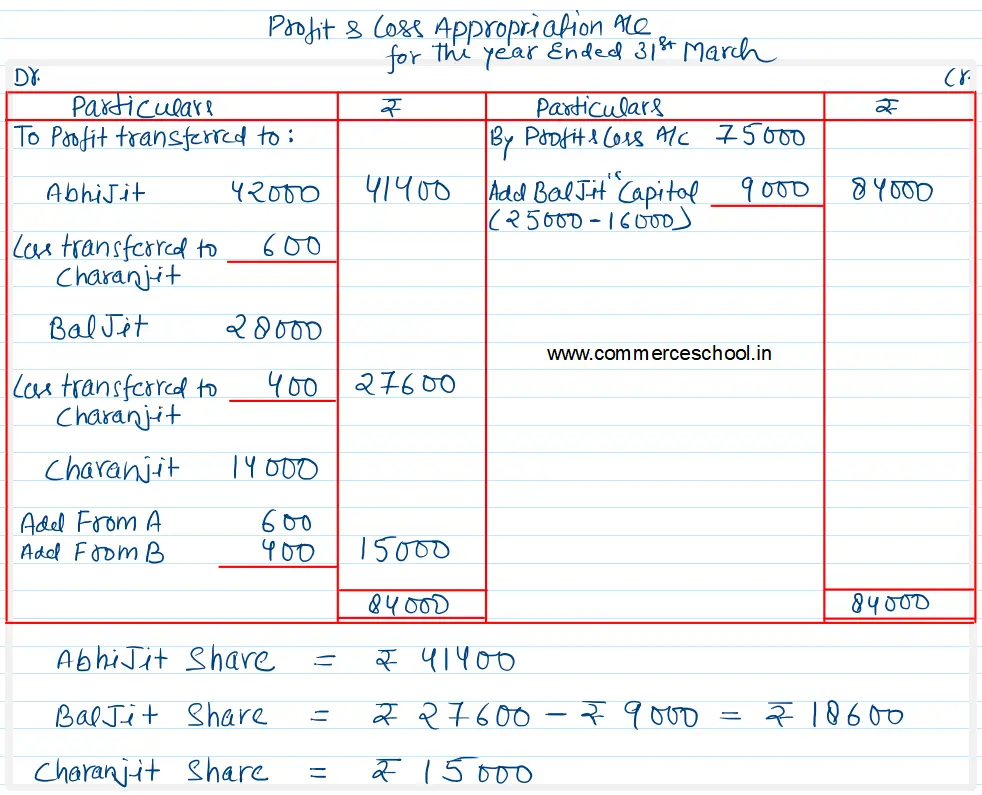

You are required to show Profit and Loss Appropriation Account after giving effect to the above.

[Ans: Abhijit’s Share – ₹ 41,400; Baljit’s Share – ₹ 18,600; Charanjit’s Share – ₹ 15,000.]

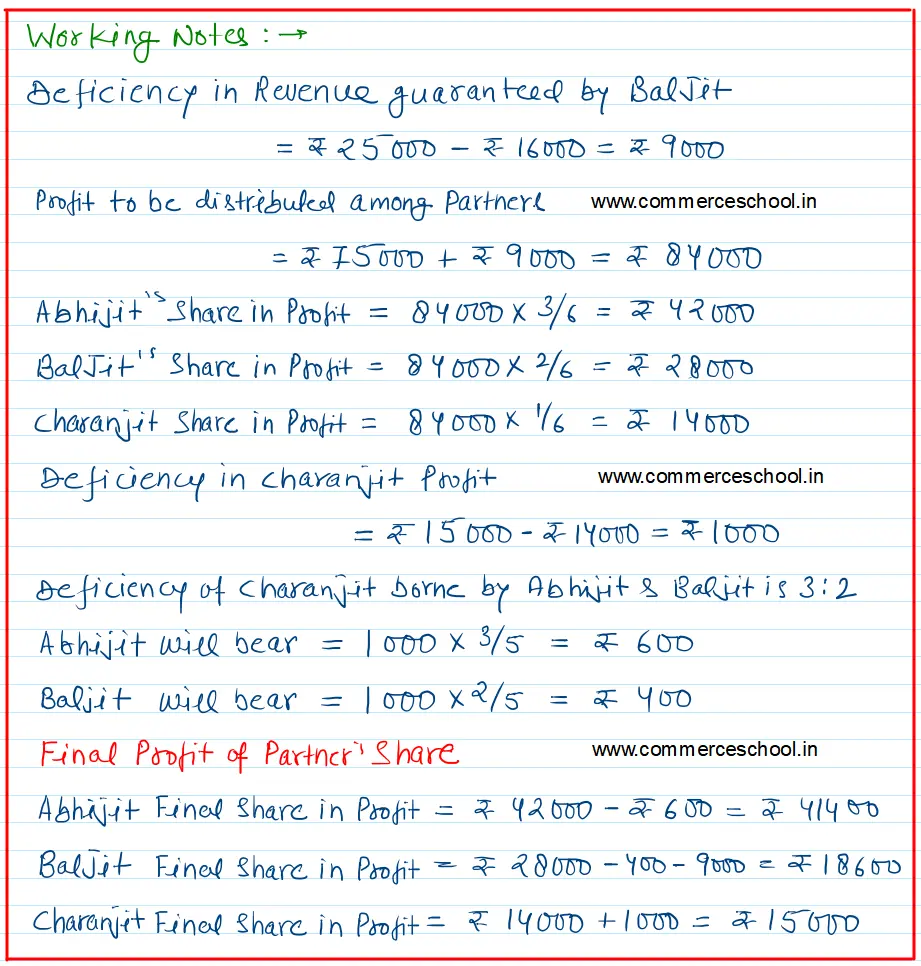

Solution:-

Note:-

Note:- The Gross fee of ₹ 16,000 earned by Baljit for the firm is less than the amount guaranteed by him. So the deficiency of ₹ 9,000 (i.e., ₹ 25,000 – ₹ 16,000) will be debited to Baljit’s Capital Account and Credited to Profit & Loss Appropriation Account.

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |