[CBSE] Q. 31 Solution of Accounting Ratios TS Grewal Class 12 (2025-26)

Solution of Question 31 Accounting Ratios of TS Grewal Book 2025-26 session CBSE Board?

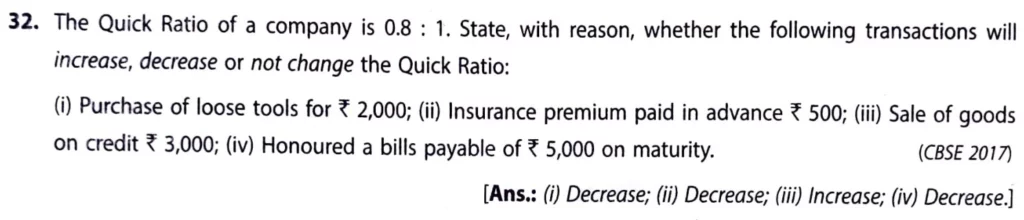

The Quick Ratio of a company is 0.8 : 1. State, with reason, whether the following transactions will increase, decrease or not change the Quick Ratio:

(i) Purchase of loose tools for ₹ 2,000; (ii) Insurance premium paid in advance ₹ 500; (iii) Sale of goods on credit ₹ 3,000; (iv) Honoured a bills payable of ₹ 5,000 on maturity.

[Ans.: (i) Decrease, (ii) Decrease; (iii) Increase; (iv) Decrease.]

Solution:-

(i) Purchase of loose tools for ₹ 2,000;

The quick ratio measures the ability of a company to pay its current liabilities using quick assets, which typically exclude inventory and prepaid expenses. Loose tools are generally considered inventory, so their purchase would reduce the quick assets by ₹ 2,000.

Here’s the impact:

Before purchase

- Quick assets: ₹ 80,000

- Current liabilities: ₹ 1,00,000

- Quick ratio: = 80,000/1,00,000 = 0.8 : 1

After purchase

- Quick assets: ₹ 80,000 – ₹ 2,000 = ₹ 78,000

- Current liabilities: ₹ 1,00,000 (unchanged)

- Quick ratio: 78,000/1,00,000 = 0.78 : 1

Impact: The quick ratio decreases from 0.8 : 1 to 0.78 : 1 due to the reduction in quick assets from the purchase of loose tools. This reflects a slightly reduced ability to cover current liabilities with quick assets.

(ii) Insurance Premium paid in advance ₹ 500

The quick ratio reflects a company’s ability to cover its current liabilities using its most liquid assets, excluding inventory and prepaid expenses. Since an insurance premium paid in advance of ₹ 500 becomes a prepaid expense, it is no longer considered a quick asset. Hence, this reduces quick assets.

Before Payment:

- Quick assets: ₹ 80,000

- Current liabilities: ₹ 1,00,000

- Quick ratio: 80,000/1,00,000 = 0.8 : 1

After Payment:

- Quick assets: ₹ 80,000 – ₹ 500 = ₹ 79,500

- Current liabilities: ₹ 1,00,000 (unchanged)

- Quick ratio: 79,500/1,00,000 = 0.795 : 1

Impact: The quick ratio decreases slightly from 0.8 : 1 to approximately 0.795 : 1 due to the reduction in quick assets. This reflects a marginally decreased liquidity position.

(iii) Sale of goods on credit ₹ 3,000

In the case of a sale of goods on credit, it results in an increase in trade receivables, which are considered part of quick assets. Since current liabilities remain unchanged, the quick ratio will improve.

Before Sale:

- Quick assets: ₹ 80,000

- Current liabilities: ₹ 1,00,000

- Quick ratio: 80,000/1,00,000 = 0.8 : 1

After Sale:

- Quick assets: ₹ 80,000 + ₹ 3,000 = ₹ 83,000

- Current liabilities: ₹ 1,00,000 (unchanged)

- Quick ratio: 83,000/1,00,000 = 0.83 : 1

Impact: The quick ratio increases from 0.8 : 1 to 0.83 : 1 due to the addition of ₹ 3,000 to quick assets from the credit sale. This reflects an improved liquidity position.

(iv) Honoured a bills payable of ₹ 5,000 on maturity.

Honoring a bill payable means settling a liability by paying it off. This reduces current liabilities while also reducing quick assets (as cash or bank balance is used for payment). However, the effect on the quick ratio depends on the relative reduction in quick assets and current liabilities.

Before Payment:

- Quick assets: ₹ 80,000

- Current liabilities: ₹ 1,00,000

- Quick ratio: 80,000/1,00,000 = 0.8 : 1

After Payment:

- Quick assets: ₹ 80,000 – ₹ 5,000 = ₹ 75,000

- Current liabilities: ₹ 1,00,000 – ₹ 5,000 = ₹ 95,000

- Quick ratio: 75,000/95,000 = 0.789 : 1

Impact: The quick ratio slightly decreases from 0.8 : 1 to approximately 0.789 : 1 due to the reduction in both quick assets and current liabilities, with a greater proportional impact on quick assets.

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Questions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |

| 105 | Question – 105 |

| 106 | Question – 106 |

| 107 | Question – 107 |

| 108 | Question – 108 |

| 109 | Question – 109 |

| 110 | Question – 110 |

| S.N | Questions |

| 111 | Question – 111 |

| 112 | Question – 112 |

| 113 | Question – 113 |

| 114 | Question – 114 |

| 115 | Question – 115 |

| 116 | Question – 116 |

| 117 | Question – 117 |

| 118 | Question – 118 |

| 119 | Question – 119 |

| 120 | Question – 120 |

| S.N | Questions |

| 121 | Question – 121 |

| 122 | Question – 122 |

| 123 | Question – 123 |

| 124 | Question – 124 |

| 125 | Question – 125 |

| 126 | Question – 126 |

| 127 | Question – 127 |

| 128 | Question – 128 |

| 129 | Question – 129 |

| 130 | Question – 130 |

| S.N | Questions |

| 131 | Question – 131 |

| 132 | Question – 132 |

| 133 | Question – 133 |

| 134 | Question – 134 |

| 135 | Question – 135 |

| 136 | Question – 136 |

| 137 | Question – 137 |

| 138 | Question – 138 |

| 139 | Question – 139 |

| 140 | Question – 140 |

| S.N | Questions |

| 141 | Question – 141 |

| 142 | Question – 142 |

| 143 | Question – 143 |

| 144 | Question – 144 |

| 145 | Question – 145 |

| 146 | Question – 146 |

| 147 | Question – 147 |

| 148 | Question – 148 |

| 149 | Question – 149 |

| 150 | Question – 150 |

| S.N | Questions |

| 151 | Question – 151 |

| 152 | Question – 152 |

| 153 | Question – 153 |

| 154 | Question – 154 |

| 155 | Question – 155 |

| 156 | Question – 156 |

| 157 | Question – 157 |

| 158 | Question – 158 |

| 159 | Question – 159 |

| 160 | Question – 160 |

| S.N | Questions |

| 161 | Question – 161 |

| 162 | Question – 162 |

| 163 | Question – 163 |

| 164 | Question – 164 |

| 165 | Question – 165 |

| 166 | Question – 166 |

| 167 | Question – 167 |

| 168 | Question – 168 |

| 169 | Question – 169 |

| 170 | Question – 170 |

| S.N | Questions |

| 171 | Question – 171 |

| 172 | Question – 172 |

| 173 | Question – 173 |

| 174 | Question – 174 |

| 175 | Question – 175 |

| 176 | Question – 176 |

| 177 | Question – 177 |

| 178 | Question – 178 |

| 179 | Question – 179 |

| 180 | Question – 180 |

| 181 | Question – 181 |

| 182 | Question – 182 |

| 183 | Question – 183 |

| 184 | Question – 184 |