[CBSE] Q. 10 Dissolution of Partnership Firm Solution TS Grewal Class 12 (2025-26)

Solution to Question number 10 of the Dissolution of Partnership Firm Chapter of TS Grewal Book (2025-26) Edition for the CBSE Board.

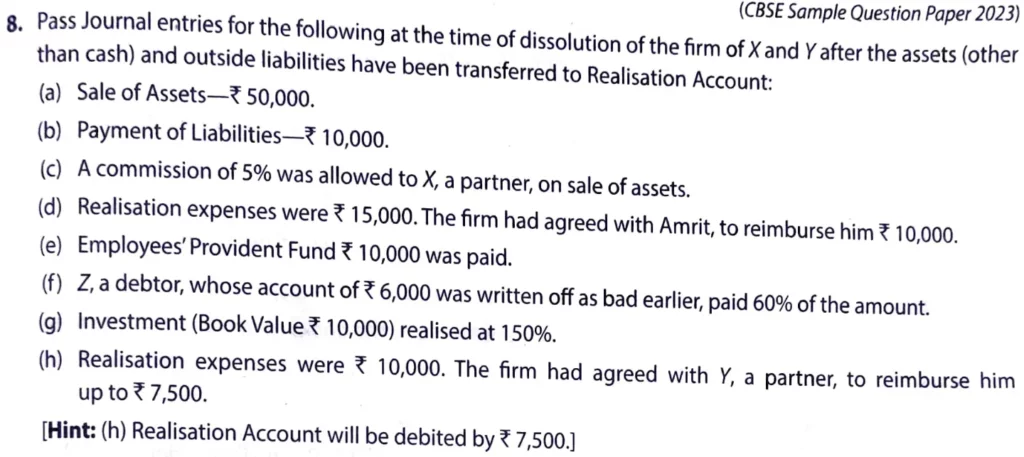

Pass, Journal entries for the following at the time of dissolution of the firm of X and Y after the various assets (other than cash) and outside liabilities have been transferred to Realisation Account:

(a) Sale of Assets – ₹ 50,000.

(b) Payment of Liabilities – ₹ 10,000.

(c) A commission of 5% allowed to X, a partner, on sale of assets.

(d) Realisation expenses were ₹ 15,000. The firm had agreed with Amrit, to reimburse him ₹ 10,000.

(e) Employees Provident Fund ₹ 10,000.

(f) Z, a debtor, whose account of ₹ 6,000 was written off as bad earlier, paid 60% of the amount.

(g) Investment (Book Value ₹ 10,000) realised at 150%.

(h) Realisation expenses were ₹ 10,000. The firm had agreed with Krishan, a partner, to reimburse him up to ₹ 7,500.

Solution:-

Here is the list of solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | `Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |