[CBSE] Q 13, 14 Journal Solution TS Grewal Class 11 (2025-26)

Are you looking for the solution of Question number 13 and 14 of Journal chapter TS Grewal class 11 CBSE Board 2025-26?

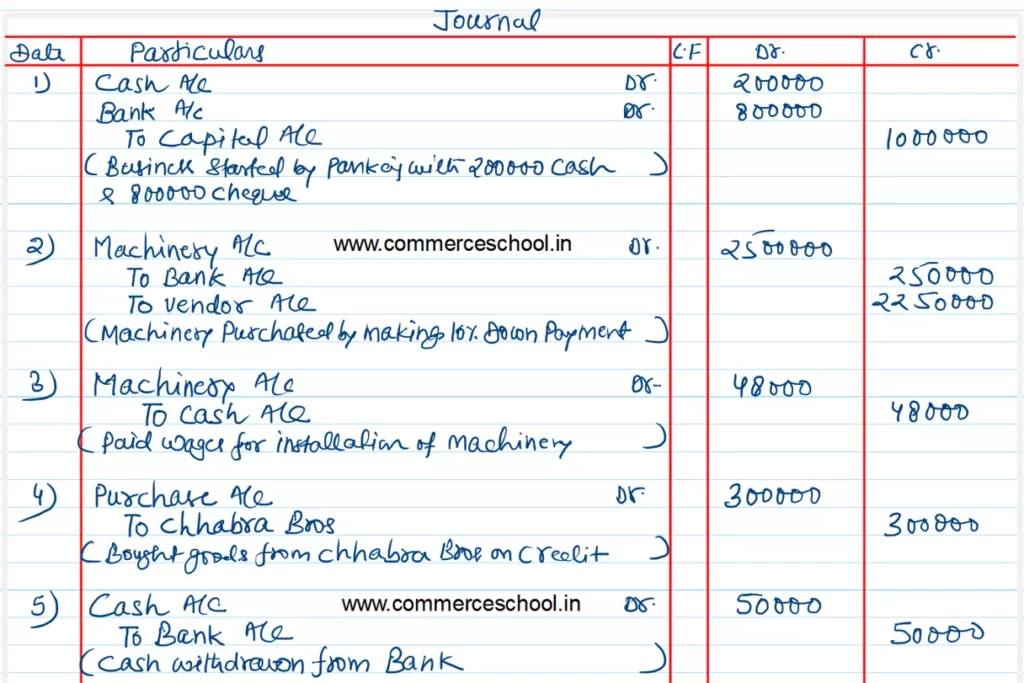

Q. 13. Pass Journal entries for the following transactions:

(a) Pankaj started business with cash ₹ 2,00,000 and Bank ₹ 8,00,000.

(b) Bought a machinery for ₹ 25,00,000 by making a down-payment of 10%.

(c) Paid ₹ 48,000 as wages for installation of machine.

(d) Bought goods from Chhabra Bros. ₹ 3,00,000.

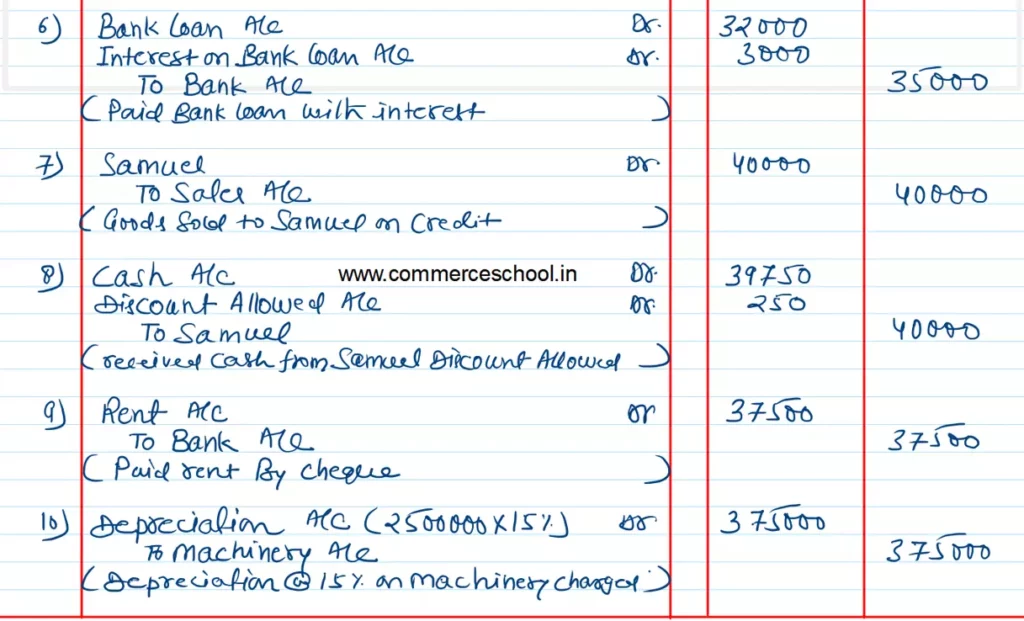

(e) Withdrawn from bank ₹ 50,000.

(f) Repaid bank loan ₹ 35,000 including interest of ₹ 3,000.

(g) Sold goods to Samuel ₹ 40,000.

(h) Received from Samuel ₹ 39,750, discount allowed ₹ 250.

(i) Paid rent of ₹ 37,500 by cheque.

(j) Provide depreciation on machinery at 15% per annum.

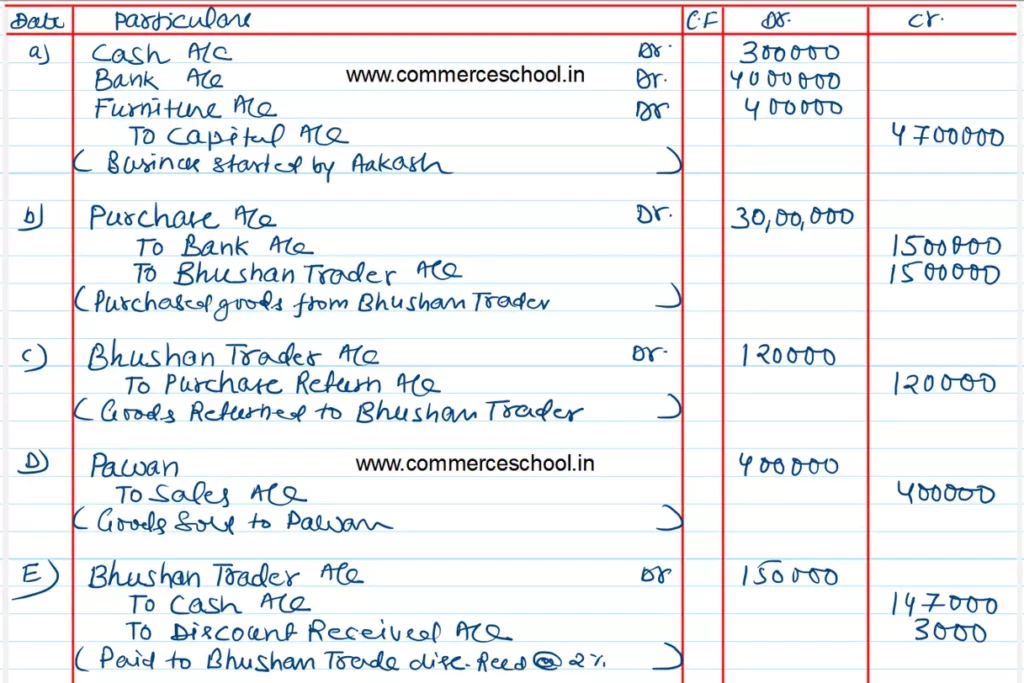

Solution:-

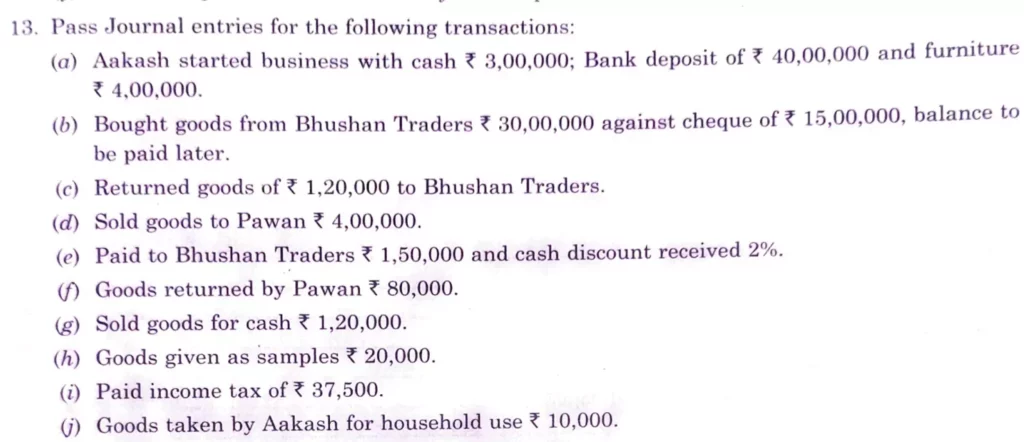

Q. 14. Pass Journal entries for the following transactions:

(a) Aakash started business with cash ₹ 3,00,000; Bank deposit of ₹ 40,00,000 and furniture ₹ 4,00,000.

(b) Bought goods from Bhushan Traders ₹ 30,00,000 against cheque of ₹ 15,00,000, balance to be paid later.

(c) Returned good of ₹ 1,20,000 to Bhushan Traders:

(d) Sold goods to Pawan ₹ 4,00,000.

(e) Paid to Bhushan Traders ₹ 1,50,000 and cash discount received 2%.

(f) Goods returned by Pawan ₹ 80,000.

(g) Sold goods for cash ₹ 1,20,000.

(h) Goods given as samples ₹ 20,000.

(i) Paid income tax of ₹ 37,500.

(j) Goods taken by Aakash for household use ₹ 10,000.

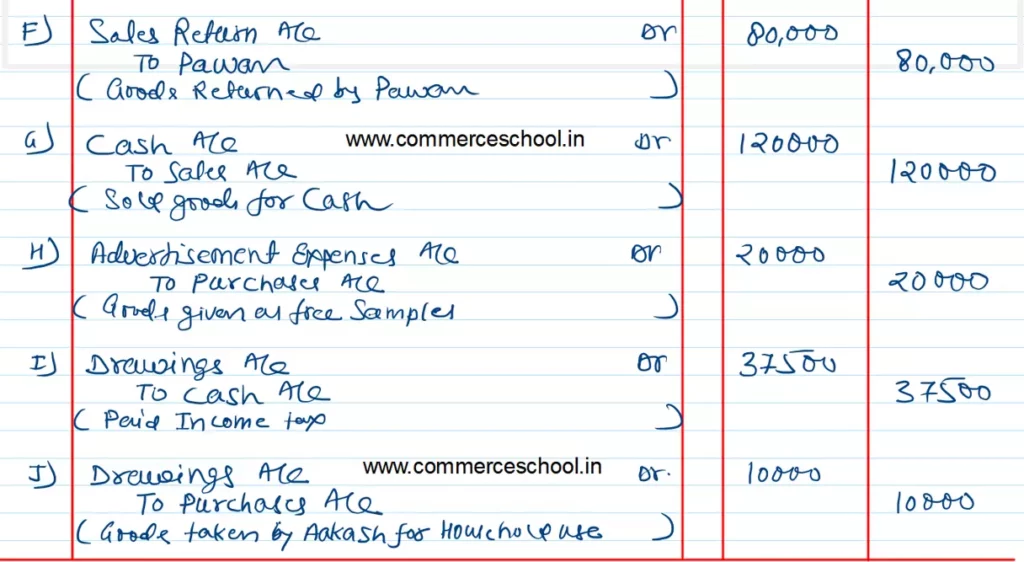

Solution:-

Below are the links of all solutions