[CBSE] Q 9, Q 10 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 9 and 10 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

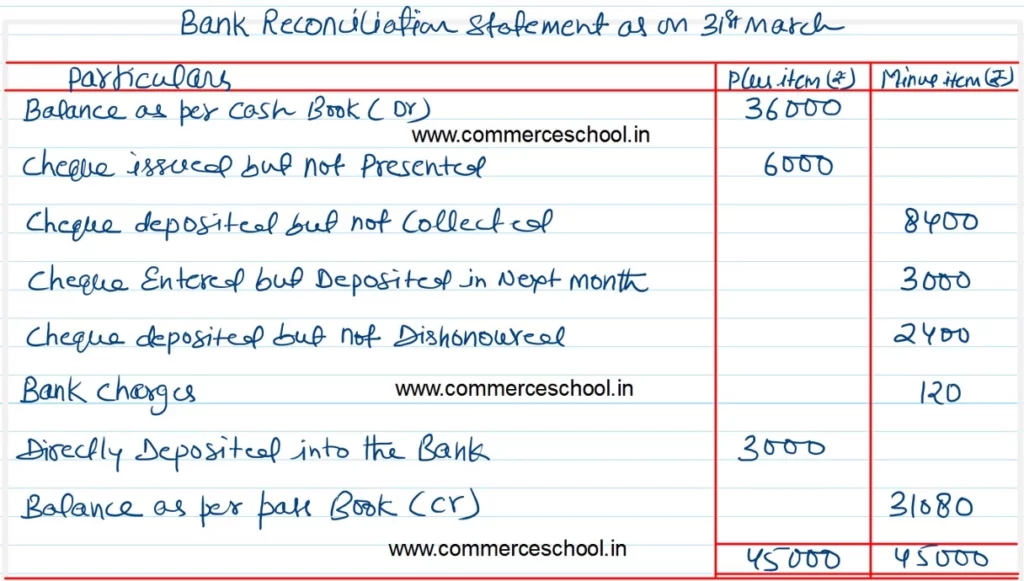

Q. 9. Prepare a Bank Reconciliation Statement as on 31st March, 2023 from the following:

(i) On 31st March, 2023, Cash Book of a firm showed bank balance of ₹ 36,000 (Dr.).

(ii) Cheques had been issued for ₹ 30,000, out of which cheques of ₹ 24,000 were presented for payment.

(iii) Cheques of ₹ 8,400 were deposited in the bank on 28th March, 2023 but has not been credited by the bank. Also, a cheque of ₹ 3,000 entered in the Cash Book on 30th March, 2023 was banked on 3rd April.

(iv) A cheque from Suresh for ₹ 2,400 was deposited in the bank on 26th March, 2023 was dishonoured, advice was received on 2nd April, 2023.

(v) Pass Book showed bank charged of ₹ 120 debited by the bank.

(vi) One of the Debtors deposited ₹ 3,000 in the bank account of the firm on 26th March, 2023, but the intimation in this respect was received from the bank on 2nd April, 2023.

[Balance as per Pass Book – ₹ 31,080.]

Solution:-

Q. 10. A Bank Reconciliation Statement is prepared as on 31st March, 2023 starting with debit balance as per Cash Book.

State whether the following transactions will be shown in the Bank Reconciliation Statement by adding or deducting these from the given balance giving reason:

(i) Bank had wrongly debited the account by ₹ 25,000 on 1st March, 2023 and reversed on 3rd April, 2023.

(ii) Receipts Side of the Cash Book was overcast by ₹ 100.

(iii) Payments Side of the Cash Book was overcast by ₹ 1,000.

(iv) Receipts Side of the Cash Book was undercast by ₹ 1,000.

(v) Payments Side of the Cash Book was undercast by ₹ 10,000.

(vi) Cheque for ₹ 10,000 issued but was not recorded in the Cash Book.

(vii) Bill of Exchange of ₹ 5,000 was deposited for collection which was not recorded in the Cash Book. Bank had collected the bill and had credited the account.

[Transactions to be added: (iii), (iv), (vii); Transactions to be deducted: (i), (ii), (v), (vi).]

Solution:-

(i) Deducted:

₹ 25,000 will be deducted from Cash Book since it is not recorded in cash book. By deducting the amount, the cash book balance will reduce and will be at par with Bank Pass Book balance.

(ii) Deducted

₹ 500 will be deducted from Cash Book since receipts side of the cash book wrongly totalled more. By deducting the amount, the cash book balance will reduce and will be at par with Bank Pass Book balance.

(iii) Added

₹ 5,000 will be added to the Cash Book since payments side of the cash book wrongly totalled more. It reduces the cash book balance wrongly. By adding the amount, the cash book balance will increase and will be at par with Bank Pass Book balance

(iv) Added

₹ 5,000 will be added to the Cash Book Since Receipts side of the cash book wrongly totalled less. By adding the amount, the cash book balance will increase and will be at par with Bank Pass Book balance.

(v) Deducted

₹ 20,000 will be deducted to the Cash Book since payments side of the cash book wrongly totalled less. It increases the Cash book Balance. By deducting the amount, the cash book balance will reduce and will be at par with Bank Book balance.

(vi) Deducted

₹ 10,000 will be deducted to the Cash Book. Since cheques issued not recorded in cash book increases the Cash book balance. By deducting the amount, the cash book balance will reduce and will be at par with Bank Book balance.

(vii) Added

₹ 5,000 will be added to the Cash Book. Since Cheques deposited not recorded in Cash book decreases the Cash book balance. By adding the amount, the cash book balance will increase and will be at par with Bank Book balance.

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board