[CBSE] Q 11, Q 12 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 11 and 12 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

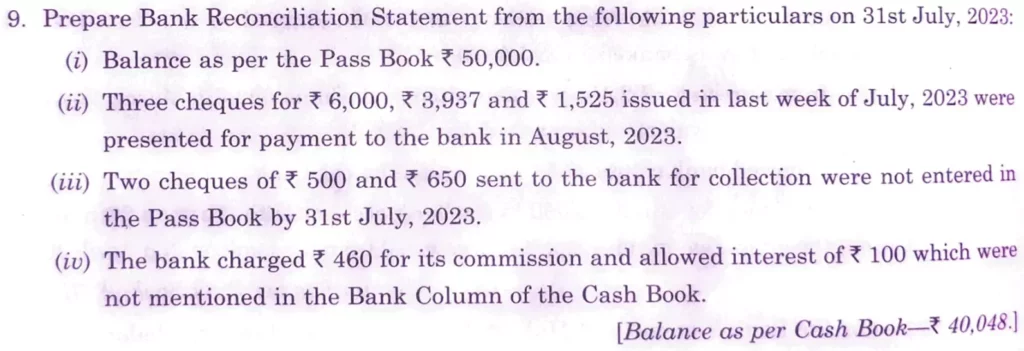

Q. 11. Prepare Bank Reconciliation Statement from the following particulars on 31st July, 2024:

(i) Balance as per the Pass Book ₹ 50,000.

(ii) Three cheques for ₹ 6,000; ₹ 3,937 and ₹ 1,525 issued in last week of July, 2023 were presented for payment to the Bank in August, 2023.

(iii) Two cheques of ₹ 500 and ₹ 650 sent to the bank for collection were not entered in the Pass Book by 31st July, 2023.

(iv) The bank charged ₹ 460 for its commission and allowed interest of ₹ 100 which were not mentioned in the Bank Column of the Cash Book.

[Balance as per Cash Book – ₹ 40,048.]

Solution:-

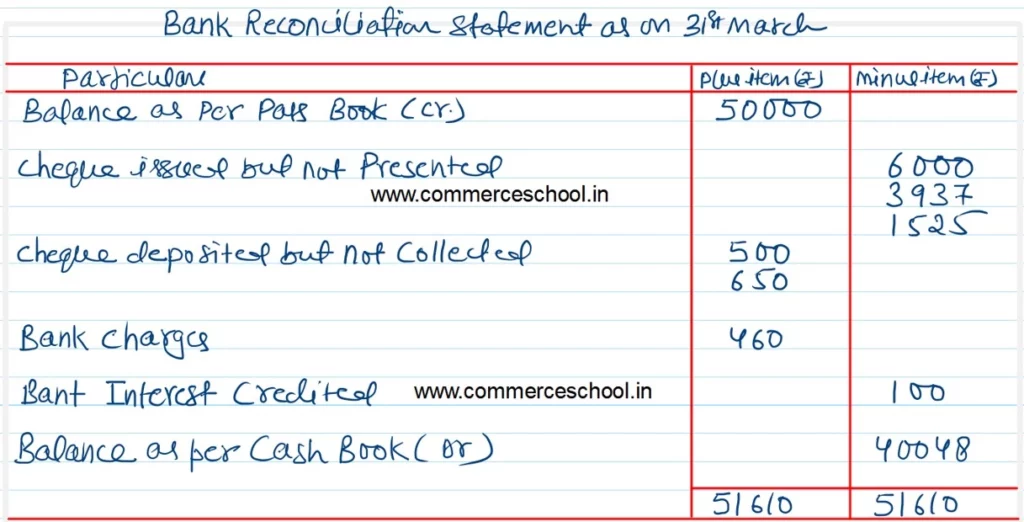

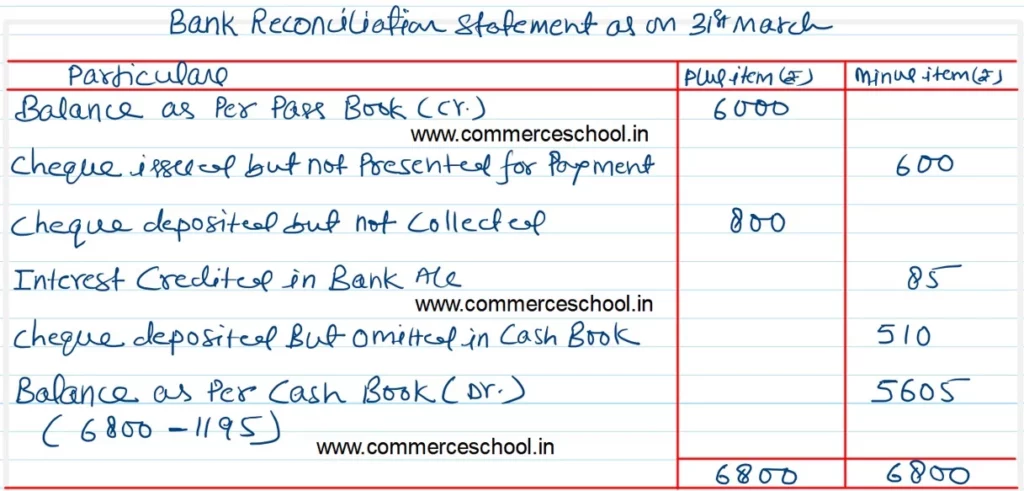

Q. 12. Draw Bank Reconciliation Statement showing adjustment between your Cash Book and Pass Book as on 31st March, 2024:

(i) On 31st March, 2023 your pass book showed a balance of ₹ 6,000 to your credit.

(ii) Before that date, you had issued cheques amounting to ₹ 1,500 of which cheques of ₹ 900 have been presented for payment.

(iii) A cheque of ₹ 800 paid by you into the bank on 29th March, 2023 is not yet credited in pass book.

(iv) There was a credit of ₹ 85 for interest on Current Account in the pass book.

(v) On 31st March, 2023 a cheque for ₹ 510 received by you and was paid into bank but the same was omitted to be entered in Cash Book.

[Balance as per Cash Book – ₹ 5,605.]

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board