[CBSE] Q 13, Q 14 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 13 and 14 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

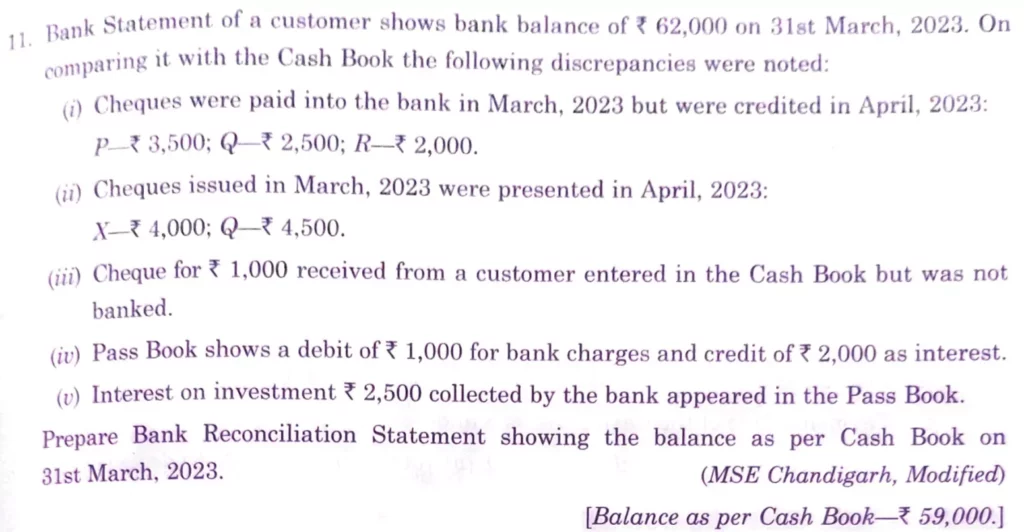

Q. 13. Bank Statement of a customer shows bank balance of ₹ 62,000 on 31st March, 2023. On comparing it with the Cash Book the following discrepancies were noted:

(i) Cheques were paid into the bank in March, 2023 but were credited in April, 2023:

P – ₹ 3,500; Q – ₹ 2,500; R – ₹ 2,000.

(ii) Cheques issued in March, 2022 were presented in April, 2023:

X – ₹ 4,000; Q – ₹ 4,500.

(iii) Cheques for ₹ 1,000 received from a customer entered in the Cash Book but was not banked.

(iv) Pass Book shows a debit of ₹ 1,000 for bank charges and credit of ₹ 2,000 as interest.

(v) Interest on investment ₹ 2,500 collected by the bank appeared in the Pass Book.

Prepare Bank Reconciliation Statement showing the balance as per Cash Book on 31st March, 2023.

[Balance as per Cash Book – ₹ 59,000.]

Solution:-

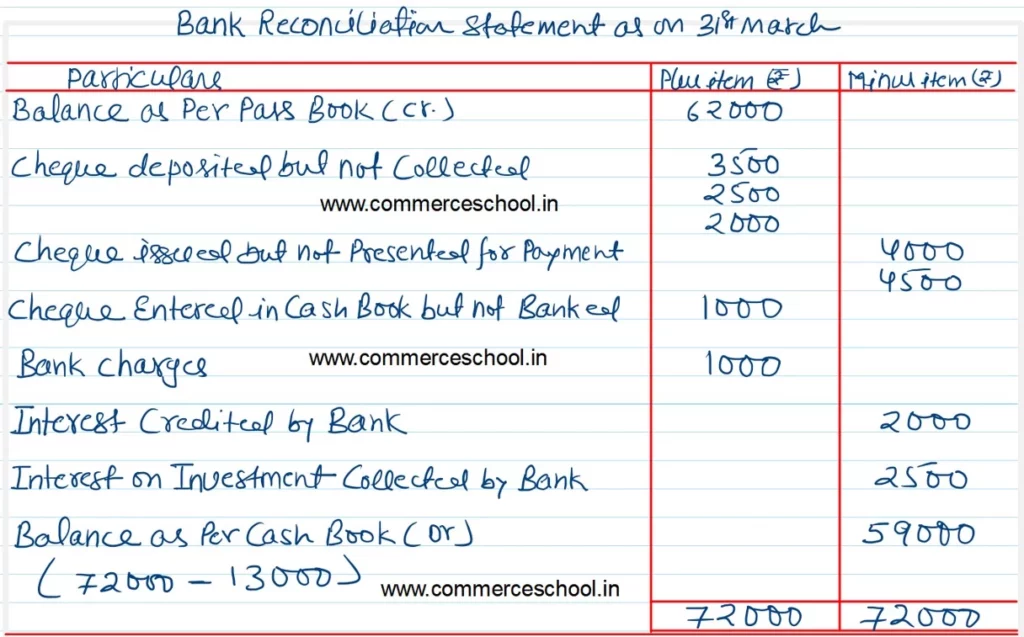

Q. 14. Prepare Bank Reconciliation Statement as on 30th September, 2024 from the following particulars:

| (i) Bank Balance as per Pass Book. | 10,000 |

| (ii) Cheques deposited into bank but no entry was passed in Cash Book. | 500 |

| (iii) Cheque received and entered in Cash Book but not sent to bank. | 1,200 |

| (iv) Insurance premium paid directly by the bank. | 800 |

| (v) Bank charges entered twice in the Cash Book. | 20 |

| (vi) Cheque received entered twice in Cash Book. | 1000 |

| (vii) Bill discounted dishonoured not recorded in the Cash Book. | 5000 |

[Balance as per Cash Book – ₹ 17,480.]

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board

good answers but not much understandable

good answers