[CBSE] Q 23, Q 24 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

Solution of Question number 23 and 24 Bank Reconciliation statement TS Grewal Class 11 CBSE Board 2025-26 Session

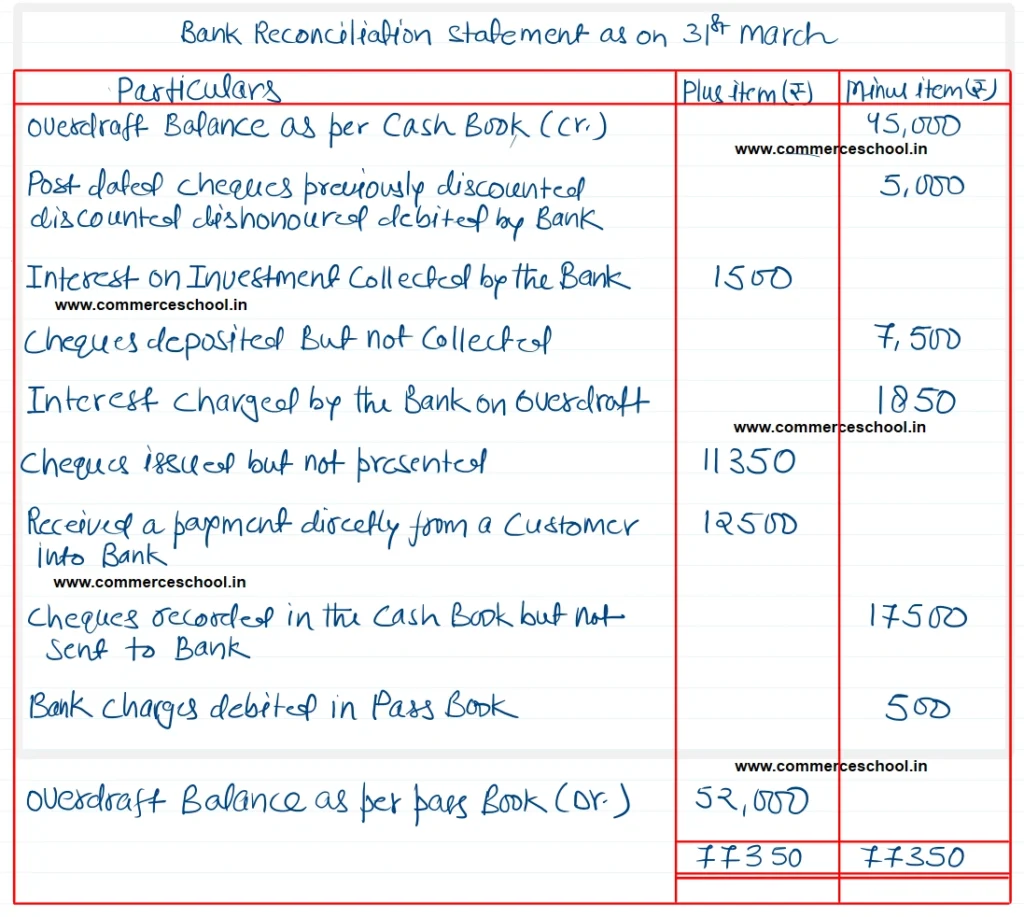

Q23. Overdraft balance shown by the bank column in the Cash Book of Vivek is ₹ 45,000. Prepare Bank Reconciliation Statement as on 31st December, 2017:

(i) A post-dated cheque of ₹ 5,000 previously discounted with the bank had been dishonoured and debited in the pass book.

(ii) Interest on investment collected by the bank and credited in the Pass Book ₹ 1,500.

(iii) Cheques deposited into bank but not yet collected ₹ 7,500.

(iv) Interest charged by the bank on overdraft balance ₹ 1,850.

(v) Cheques issued but not yet presented for payment ₹ 11,350.

(vi) Received a payment directly from a customer into bank account ₹ 12,500.

(vii) Cheques recorded in the Cash Book but not sent to the Bank for collection was ₹ 17,500.

(viii) Bank Charges debited as per Pass Book ₹ 500.

[Overdraft balance as per Pass Book – ₹ 52,000.]

Solution:-

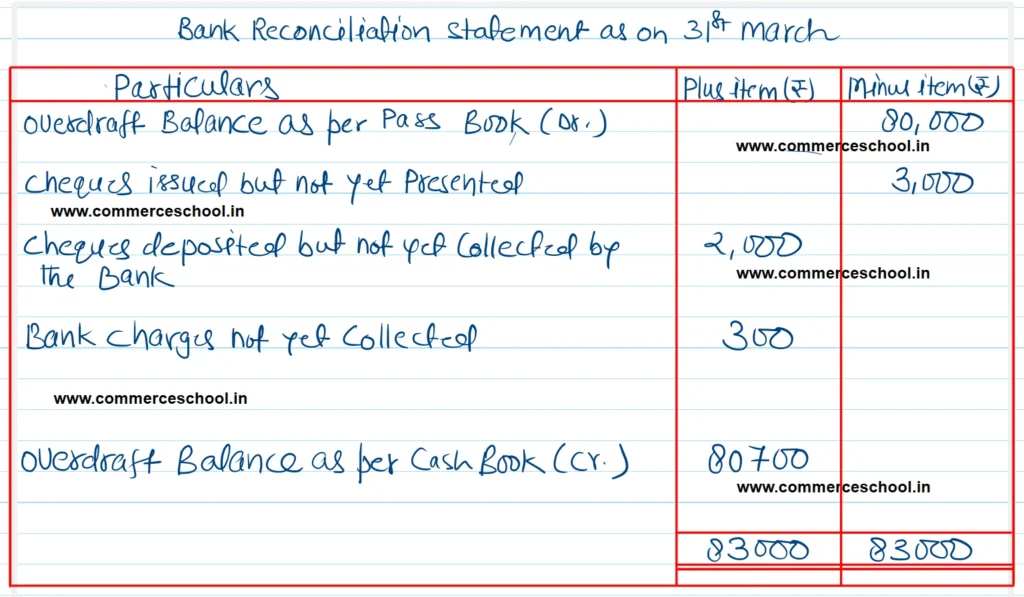

Q. 24. Prepare a Bank Reconciliation Statement from the following:

| ₹ | |

| (i) Bank Overdraft as per Pass Book | 80,000 |

| (ii) Cheques issued but not presented for payment | 3,000 |

| (iii) Cheques deposited but not yet collected by the bank | 2,000 |

| (iv) Bank charges not yet recorded in Cash Book | 300 |

[Ans.: Overdraft as per Cash Book – ₹ 80,700.]

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board