[CBSE] Q 33 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

[CBSE] Q 33 Bank Reconciliation Statement Solutions TS Grewal class 11 (2025-26)

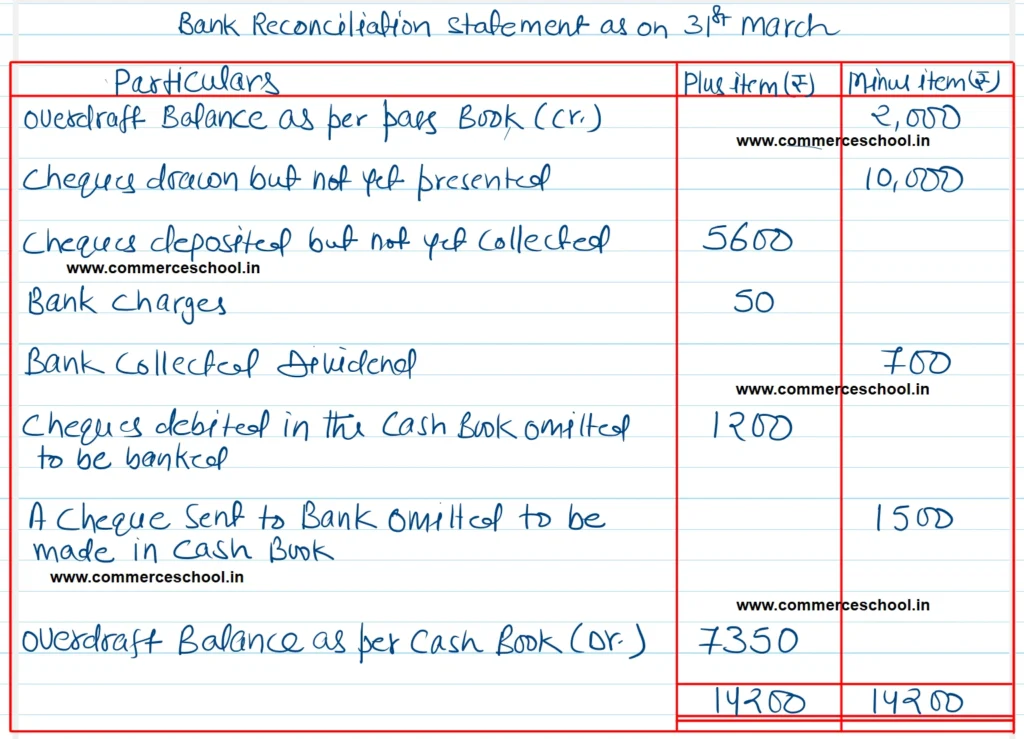

Q. 33. On 31st March, 2025, the pass book of a businessman shows a debit balance of ₹ 2,000.

You are required to prepare Bank Reconciliation Statement as on 31st March, 2025 from the following particulars:

(i) Cheques amounting to ₹ 16,000 drawn on 25th March of which cheques of ₹ 6,000 were encashed up to 31st March

(ii) Cheques worth ₹ 10,000 were deposited in March, 2025, out of which cheques of ₹ 4,400 could only be collected.

(iii) Bank charges ₹ 50 and dividend of ₹ 700 on shares collected by bank could not be shown in the Cash Book.

(iv) A cheque of ₹ 1,200 debited in the Cash Book was omitted to be banked.

(v) A cheque of ₹ 1,500 was sent to the bank but its entry was omitted to be made in Cash Book.

[Ans.: Overdraft as per Cash Book – ₹ 7,350.]

Solution:-

Below is the list of all solutions of the Bank Reconciliation statement TS Grewal CBSE Board