[CBSE] Q 1, Q 2 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 1 and 2 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

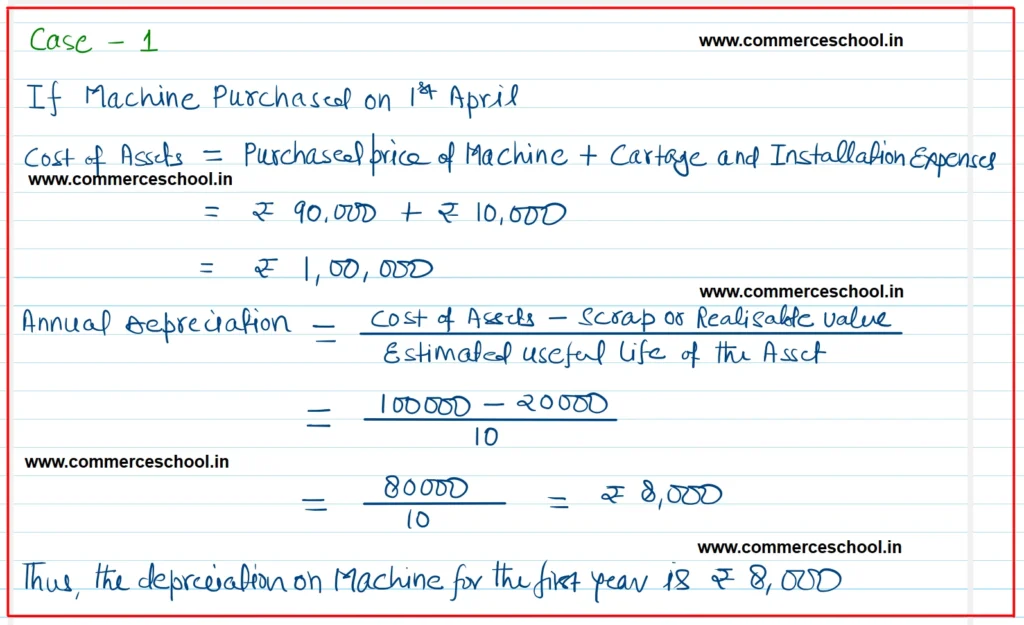

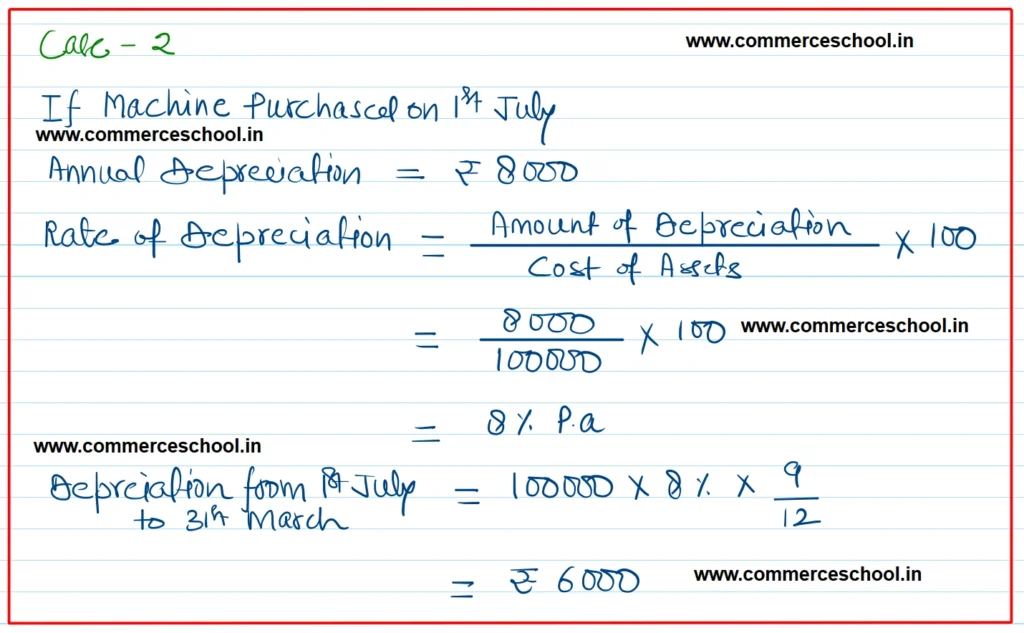

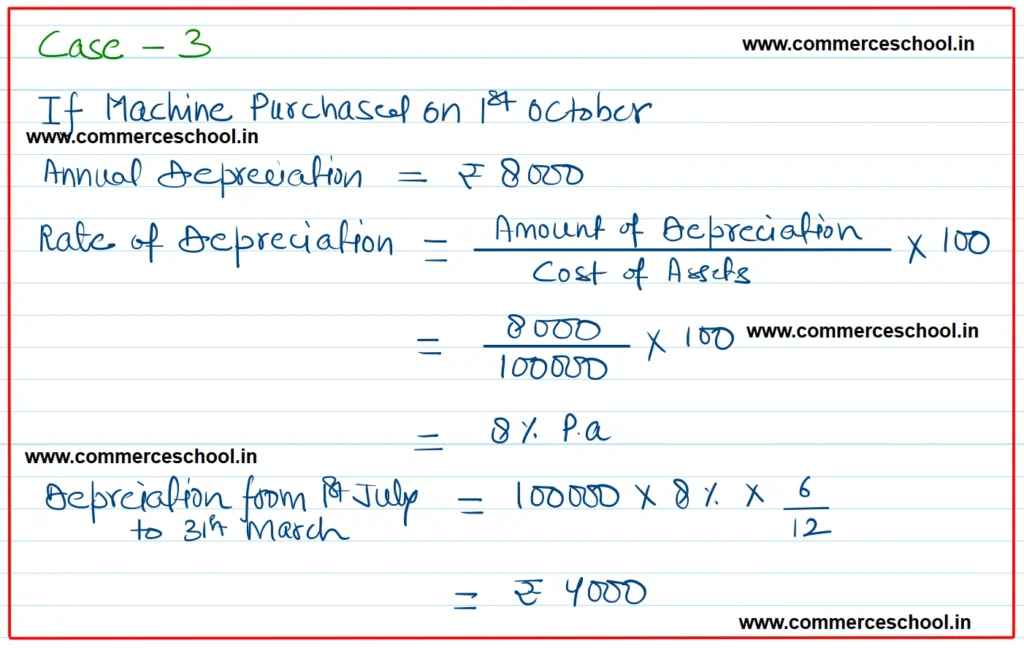

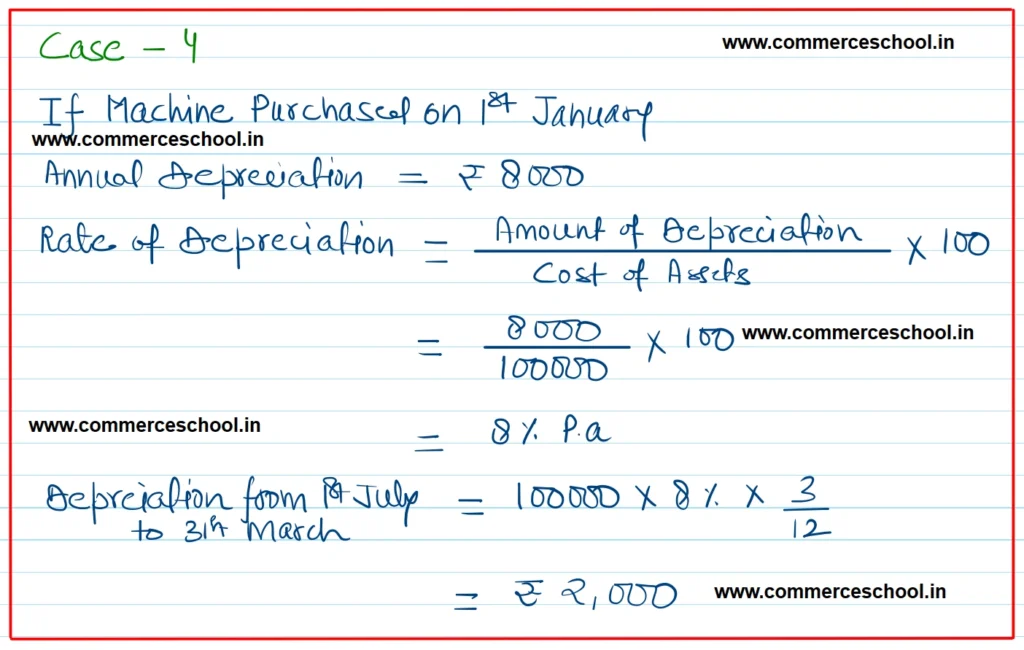

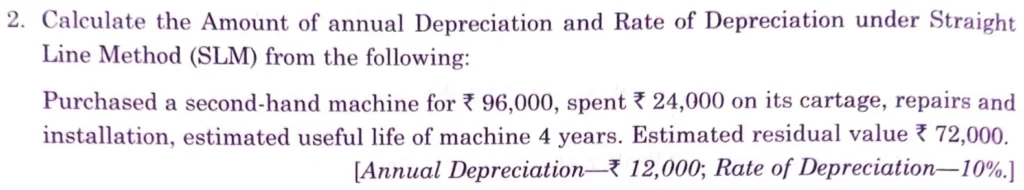

Q. 1. Tushar purchased a machine for ₹ 90,000. Expenses incurred on its cartage and installation are ₹ 10,000.

The residual value at the end of its expected useful life of 10 years is estimated at ₹ 20,000. Calculate the amount of depreciation by Straight Line Method for the first year ending 31st March, 2025, if the machine is purchased on:

(a) 1st April, 2024

(b) 1st July, 2024.

(c) 1st October, 2024.

(d) 1st January, 2025.

[Ans. (a) ₹ 8,000; (b) ₹ 6,000; (c) ₹ 4,000; (d) ₹ 2,000.]

Solution:-

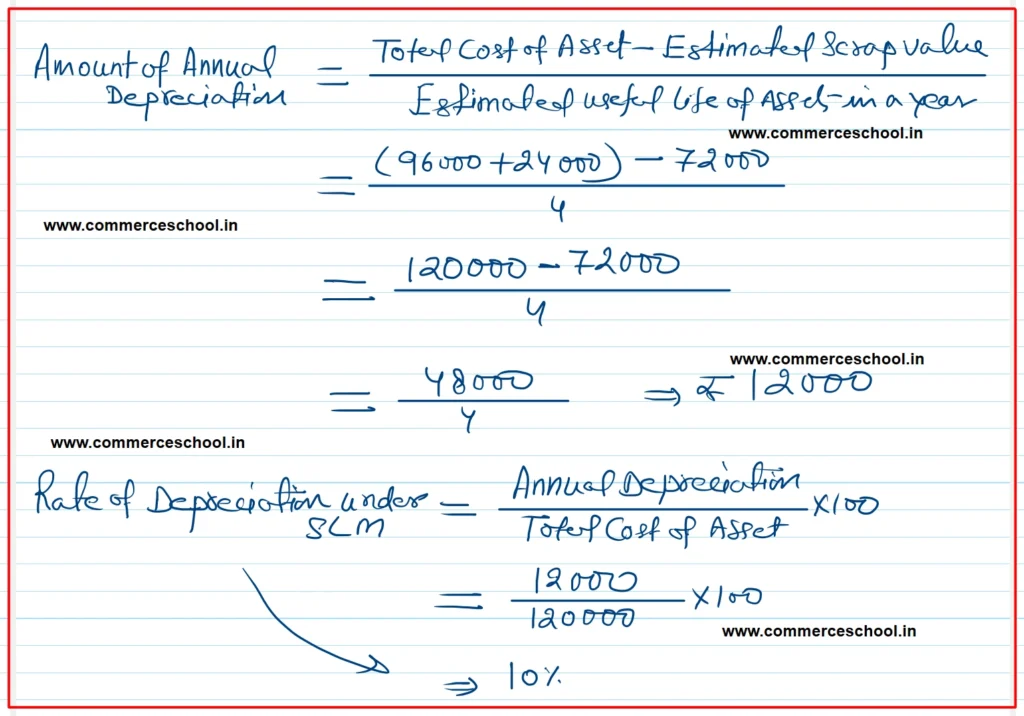

Q. 2. Calculate the Amount of annual Depreciation and Rate of Depreciation under Straight Line Method (SLM) from the following:

Purchased a second -hand machine for ₹ 96,000, spent ₹ 24,000 on its cartage, repairs and installation, estimated useful life of machine 4 years. Estimated residual value ₹ 72,000.

[Annual Depreciation – ₹12,000; Rate of Depreciation -10%.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.

pls show full step of 1st question