[CBSE] Q 3, Q 4 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 3 and 4 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

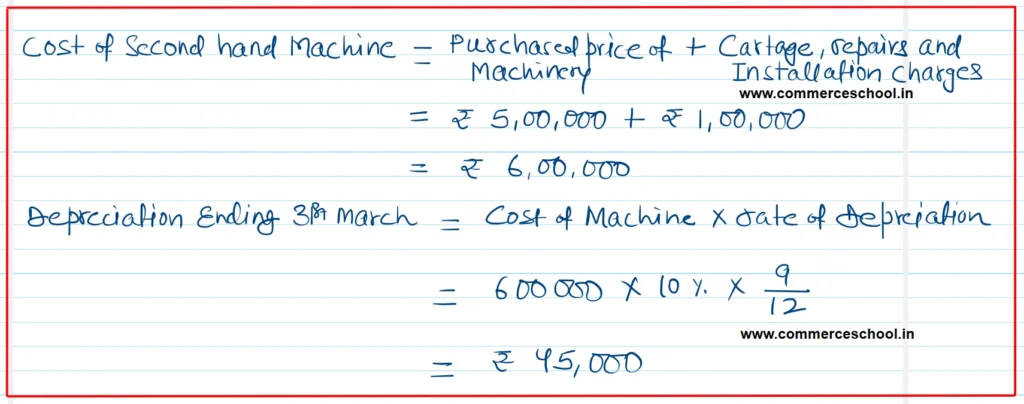

Q. 3. On 1st Junly, 2024, Raja Ltd. purchased a second-hand machine for ₹ 5,00,000 and spent ₹ 1,00,000 on its cartage, repairs and installation.

Calculate the amount of depreciation @ 10% p.a. according to Straight Line Method for the year ending on 31st March, 2025.

[Ans.: ₹ 45,000.]

Solution:-

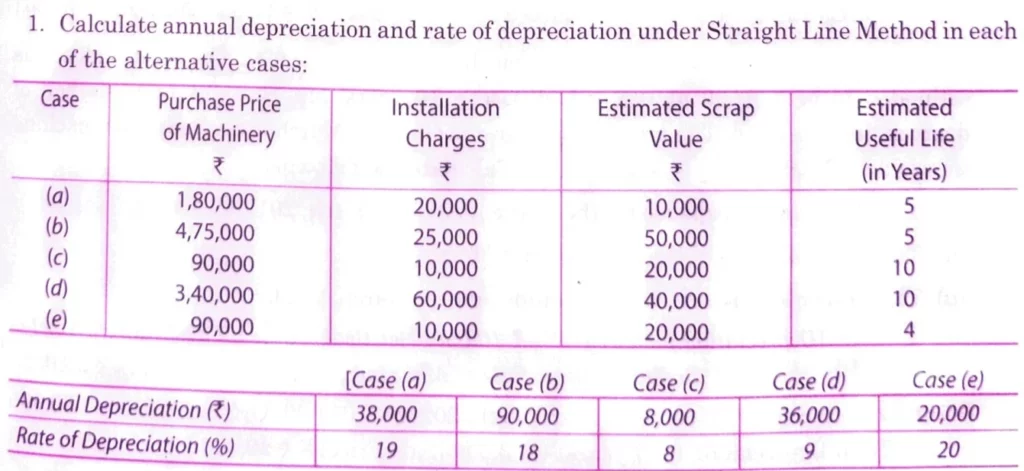

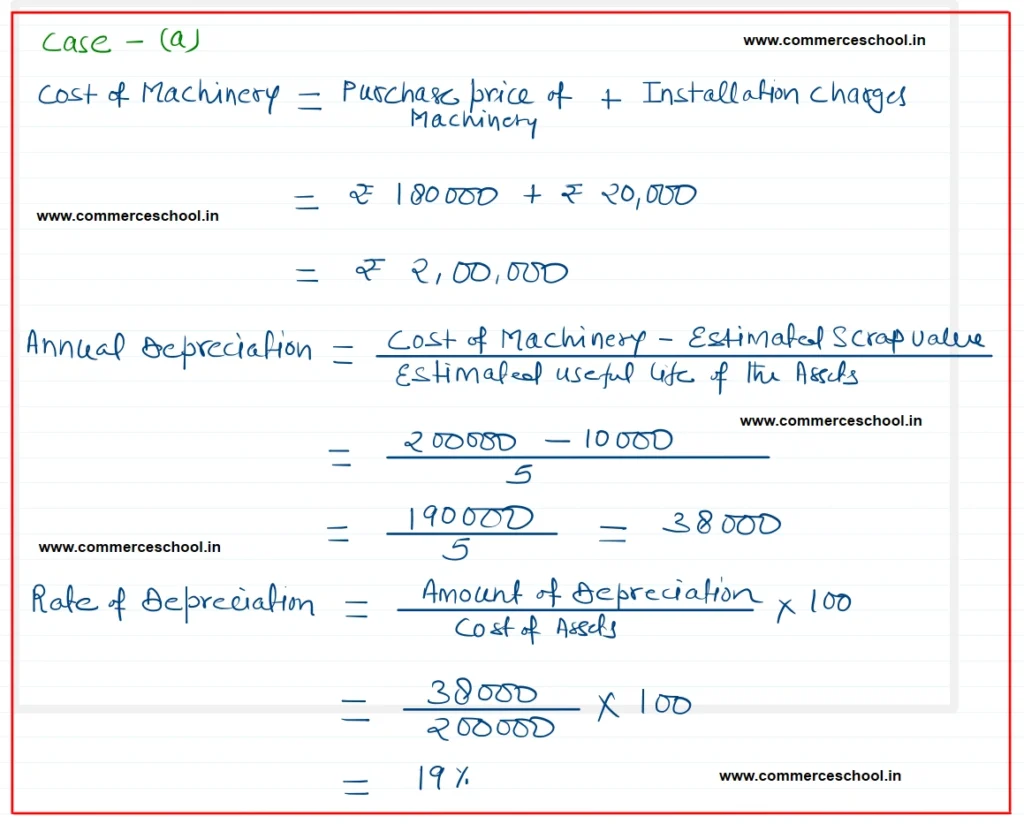

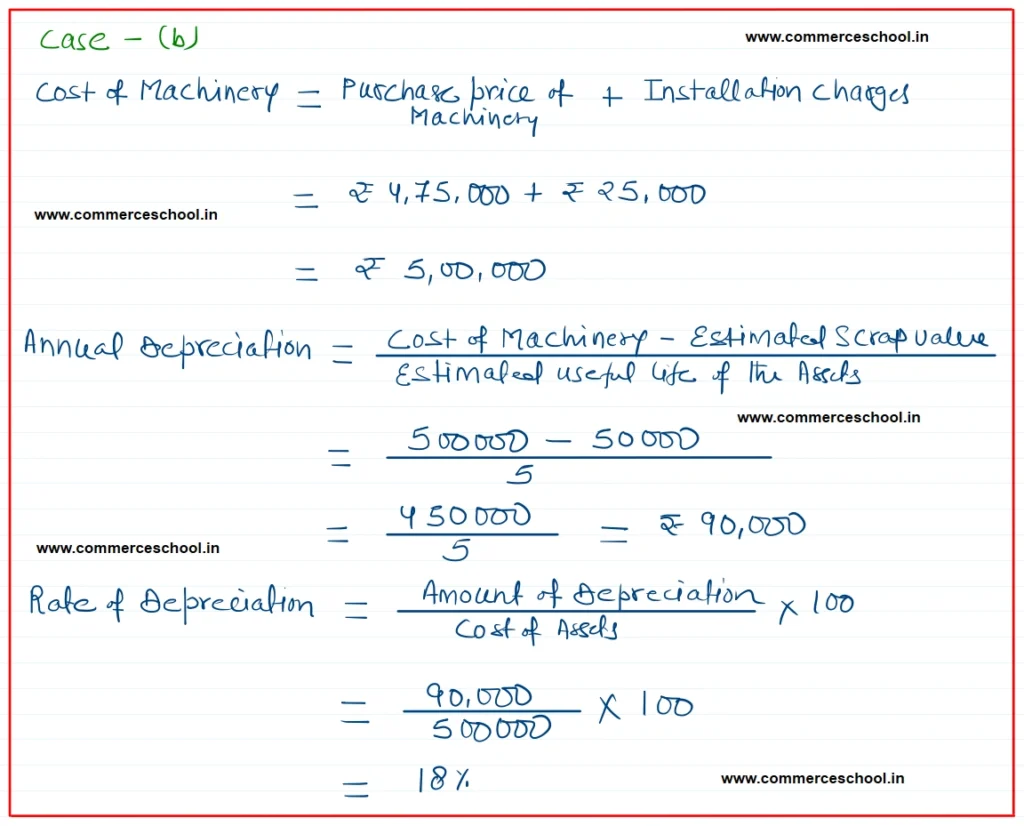

Q. 4. Calculate annual depreciation and rate of depreciation under the Straight Line Method in each of the alternative cases:

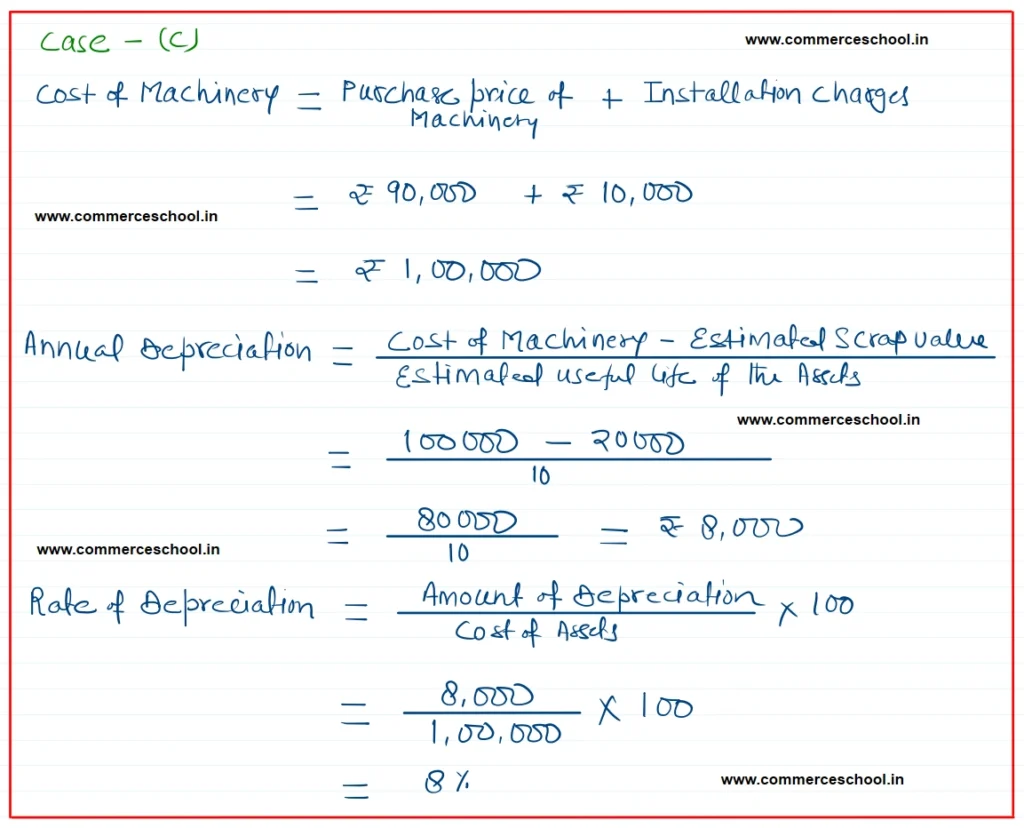

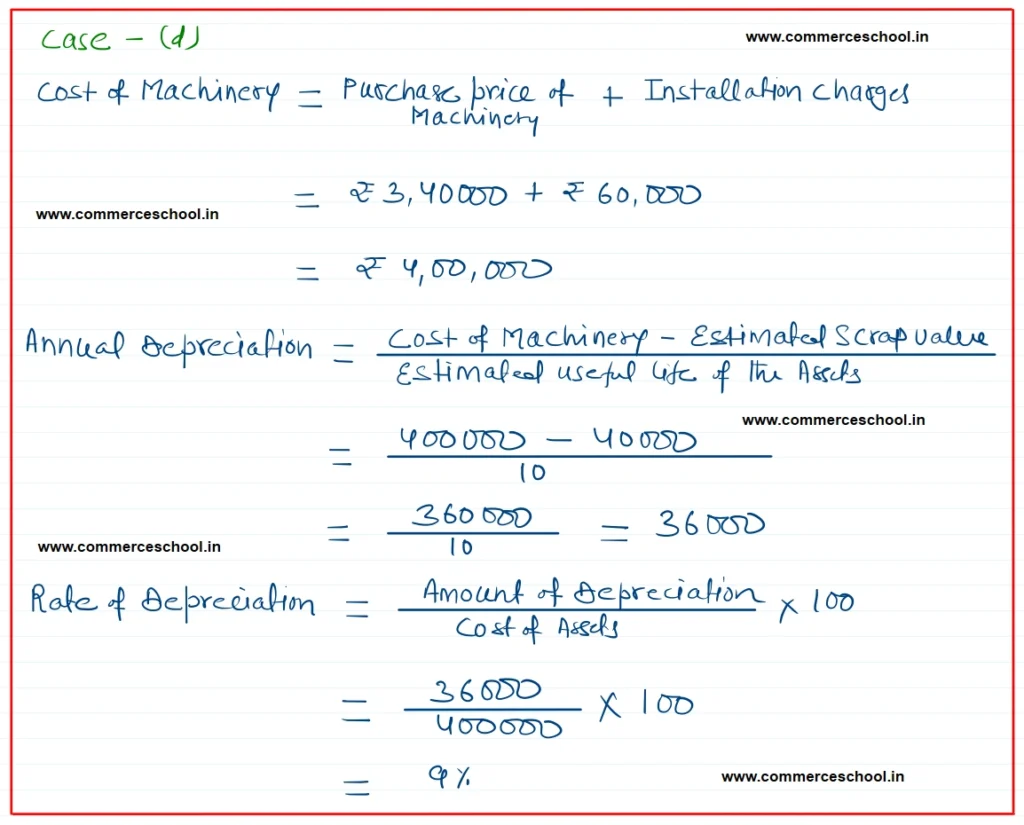

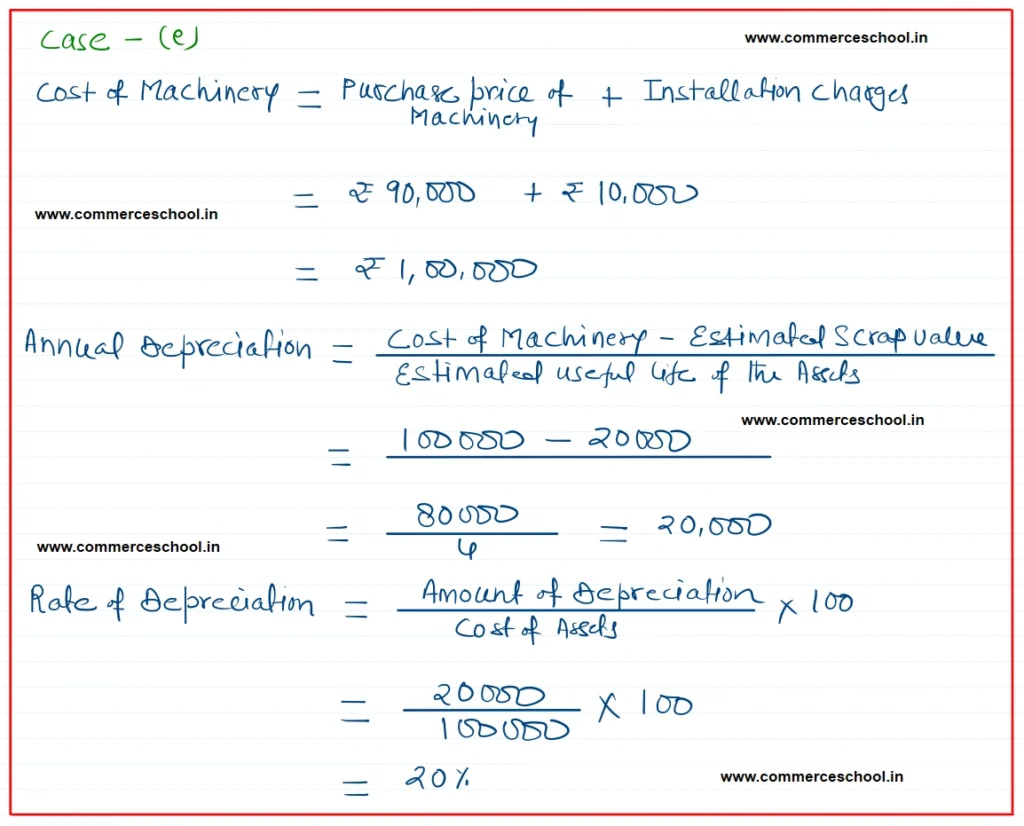

| Case | Purchase Price of Machinery (₹) | Installation Charges (₹) | Estimated Scrap Value (₹) | Estimated Useful Life (in Years) |

| (a) (b) (c) (d) (e) | 1,80,000 4,75,000 90,000 3,40,000 90,000 | 20,000 25,000 10,000 60,000 10,000 | 10,000 50,000 20,000 40,000 20,000 | 5 5 10 10 4 |

| Case (a) | Case (b) | Case (c) | Case (d) | Case (e) | |

| Annual Depreciation( ₹ ) | 38,000 | 90,000 | 8,000 | 36,000 | 20,000 |

| Rate Depreciation (%) | 19 | 18 | 8 | 9 | 20 |

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.