[CBSE] Q 11, Q 12 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 11 and 12 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

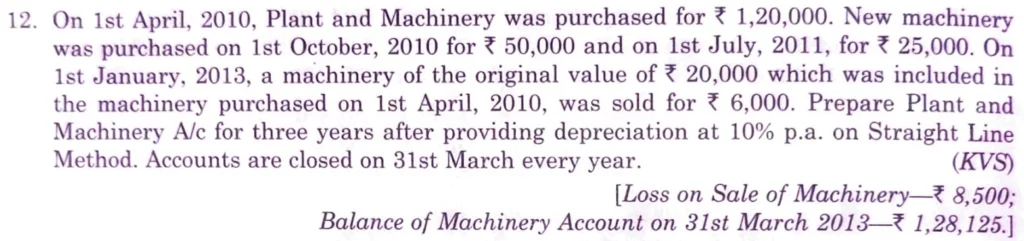

Q. 11. On 1st April, 2019, Gurman Toys purchased a machine for ₹ 2,40,000 and spent ₹ 10,000 on its erection.

On 1st October, 2019, an additional machinery costing ₹ 1,00,000 was purchased. On 1st October, 2021 the machine purchased on 1st April, 2019 was sold for ₹ 1,43,000 and on the same date, a new machine was purchased at a cost of ₹ 2,00,000.

Show the Machinery Account for the first four financinal years after charging Depreciation at 5% p.a. by the Straight Line Method.

[Loss on Sale of Machinery – ₹ 75,750; Balance of Machinery A/c on 1st April, 2023 – ₹ 2,67,500.]

Solution:-

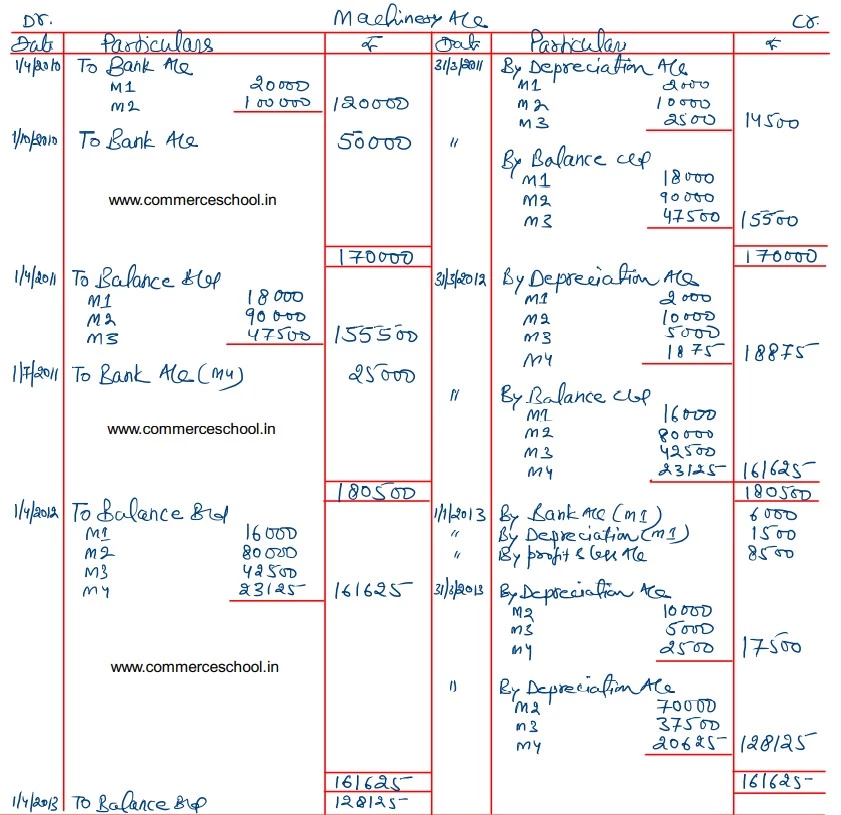

Q. 12. On 1st April, 2010, Plant and Machinery was purchased for ₹ 1,20,000.

New Machinery was purchased on 1st October, 2010 for ₹ 50,000 and on 1st July, 2011, for ₹ 25,000. On 1st January, 2013, a machinery of the original value of ₹ 20,000 which was included in the machinery purchased on 1st April, 2010, was sold for ₹ 6,000. Prepare Plant and Machinery A/c for three years after providing depreciation at 10% p.a. on Straight Line Method. Account are closed on 31st March every year.

[Loss on Sale of Machinery – ₹ 8,500; Balance of Machinery Account on 31st March 2013, – ₹ 1,28,125.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.