[CBSE] Q 17, Q 18 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 17 and 18 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

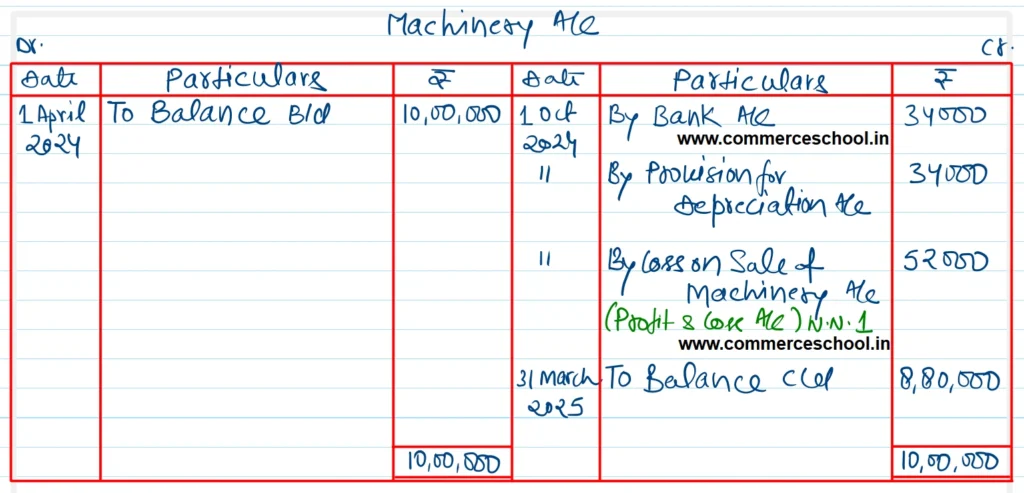

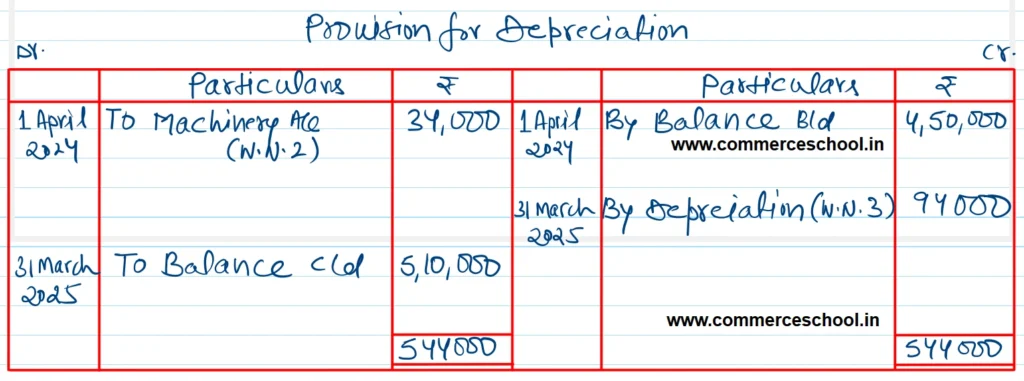

Q. 17. The following balances appeared in the books of Priyank Ltd. as on 1st April, 2024:

| ₹ | |

| Machinery A/c | 10,00,000 |

| Provision for Depreciation A/c | 4,50,000 |

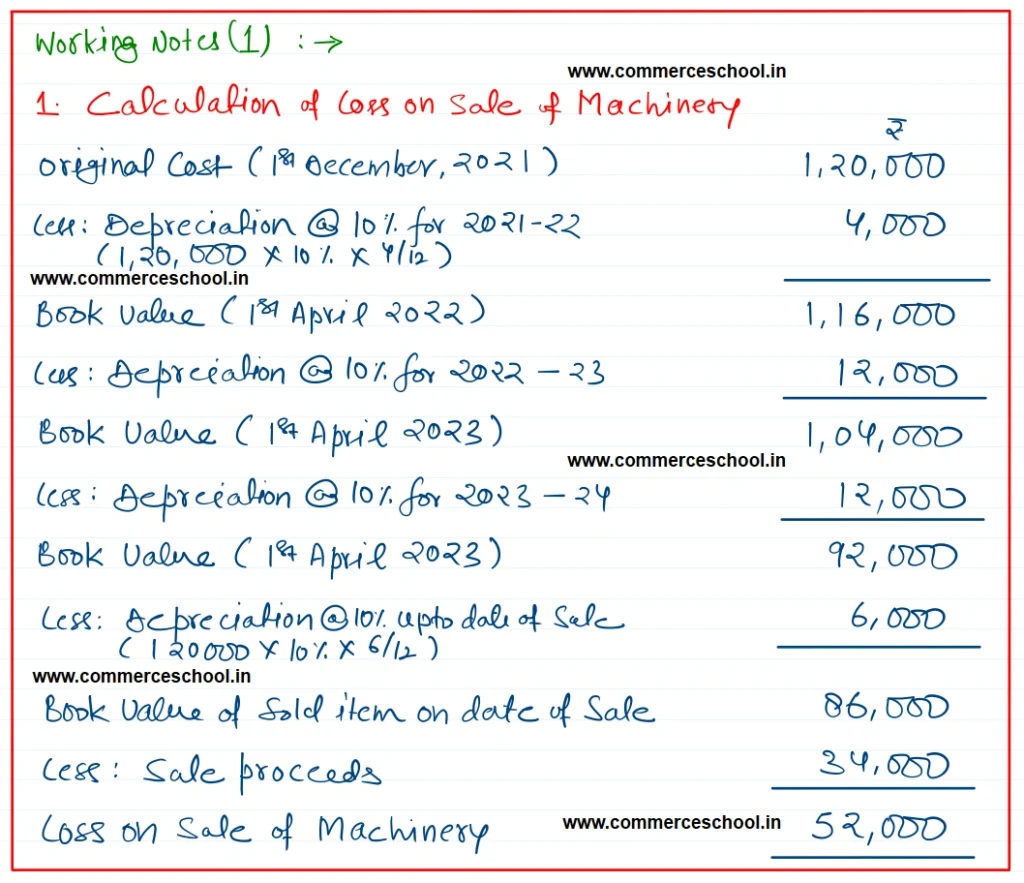

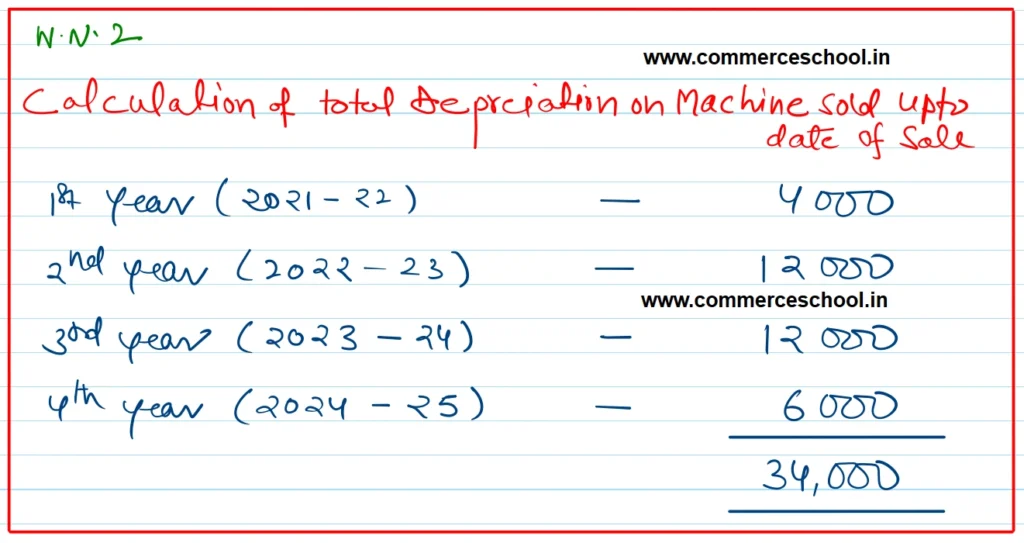

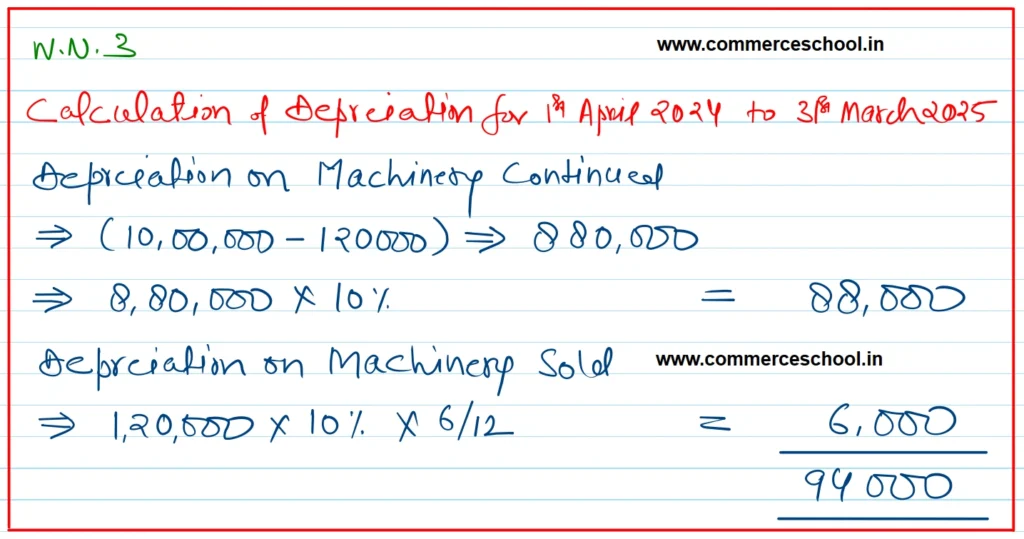

Depreciatoin is provided at 10% per annum on the original cost on 31st March every year. On 1st October, 2024, a machine which was purchased on 1st December, 2021 for ₹ 1,20,000 was sold for ₹ 34,000.

Prepare Machinery Account and Provision for Depreciation Account for the year 2024-25.

[Ans.: Loss on sale of Machinery – ₹ 52,000; Balance of Machinery A/c – ₹ 8,80,000; Balance of Provision for Depreciation A/c – ₹ 5,10,000.]

Solution:-

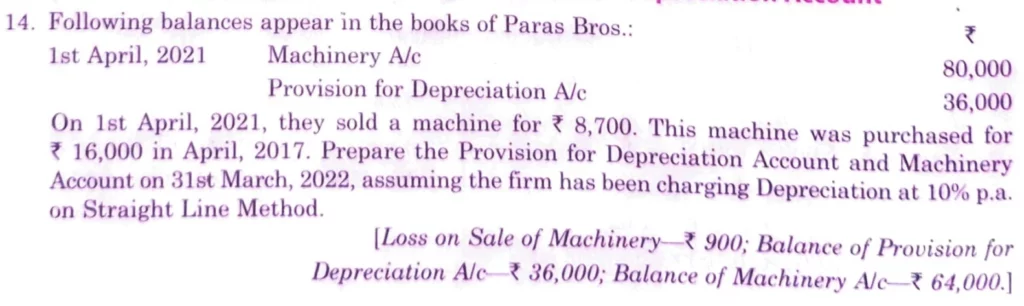

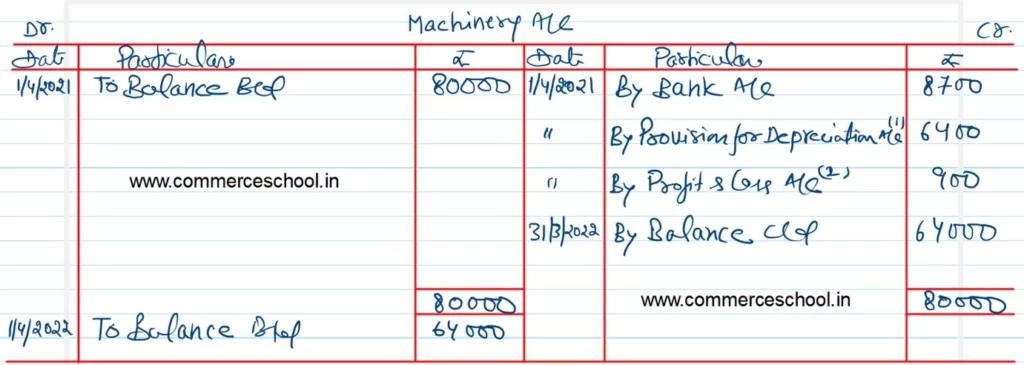

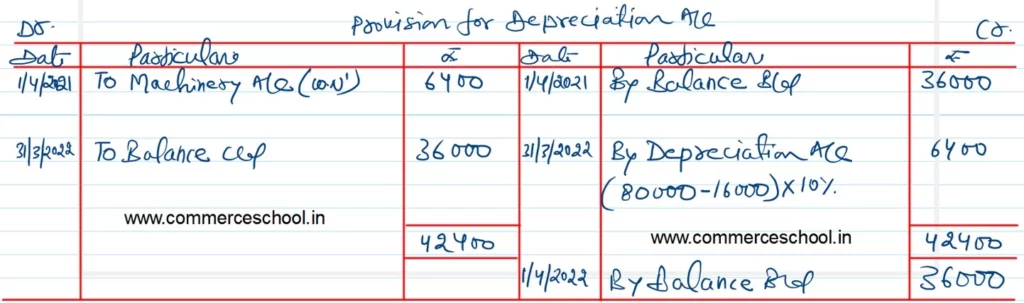

Q. 18. Following balances appear in the Book of Paras Bros:

| 1st April 2024 | Machinery A/c Provision for Depreciation A/c | 80,000 36,000 |

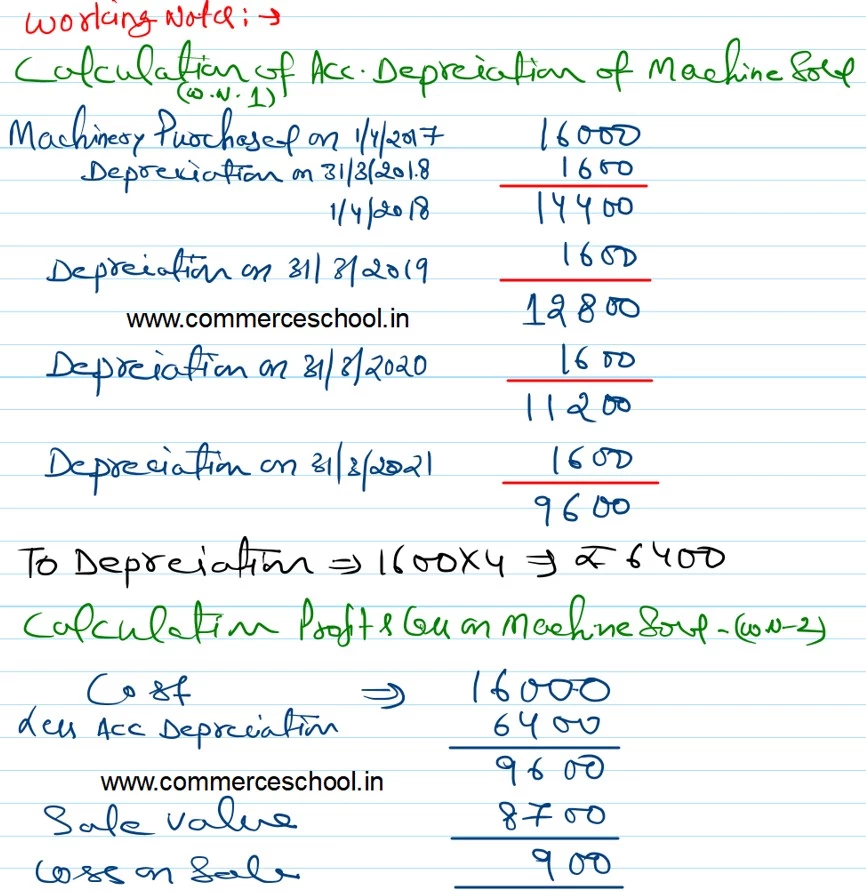

On 1st April, 2024, they decided to sell a machine for ₹ 8,700. This machine was purchased for ₹ 16,000 in April, 2020.

Prepare the Provision for Depreciation Account and Machinery Account on 31st March, 2025, assuming the firm has been charging Depreciation at 10% p.a. on Straight Line Method.

[Loss on Sale of Machinery – ₹ 900; Balance of Provision for Depreciation A/c – ₹ 36000; Balance of Machinery A/c – ₹ 64,000.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.

here is not a solution of question no.17