[CBSE] Q 21, Q 22 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 21 and 22 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

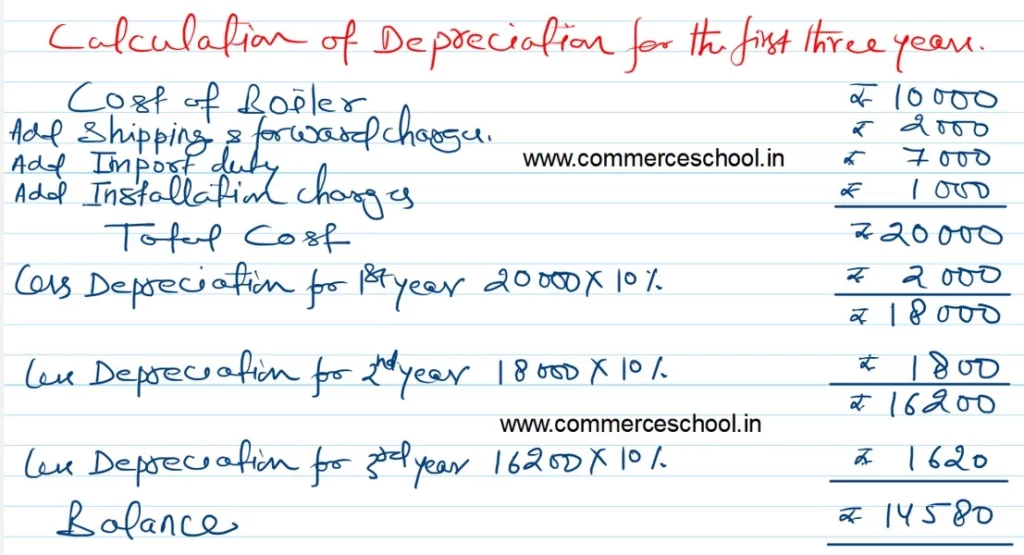

Q. 21. A boiler was purchased from abroad for ₹ 10,000. Shipping and forwarding charges ₹ 2,000, Import duty, ₹ 7,000 and expenses of installation amounted to ₹ 1,000.

Calculate the Depreciation for the first three years (separately for each year) @ 10% p.a. on Diminishing Balance Method.

[Balance after 3 years – ₹ 14,580.]

[Hint: Depreciation: 1st Year = ₹ 2,000; 2nd Year – ₹ 1,800; and 3rd Year = ₹ 1,620.]

Solution:-

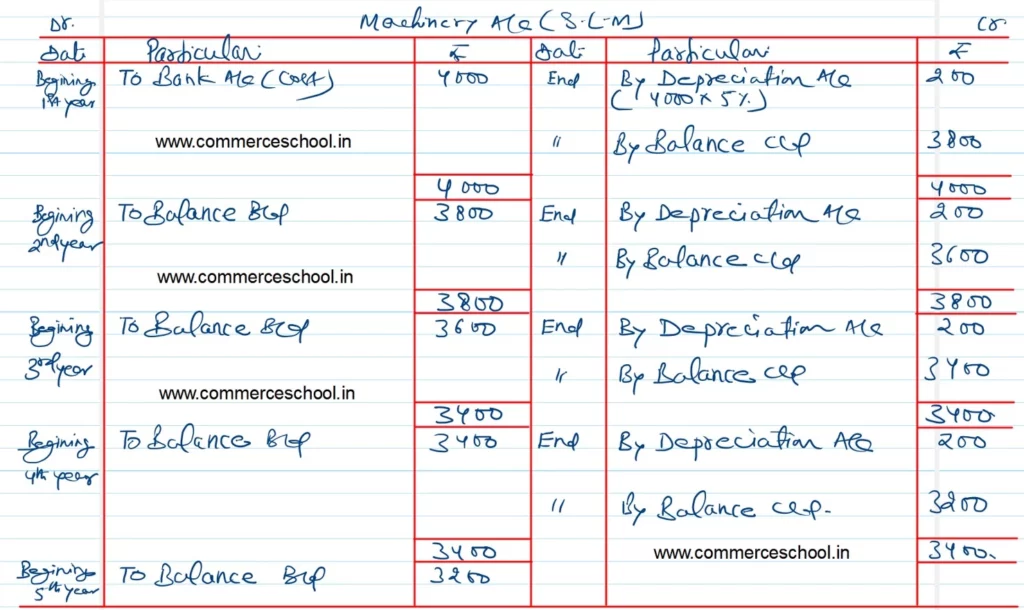

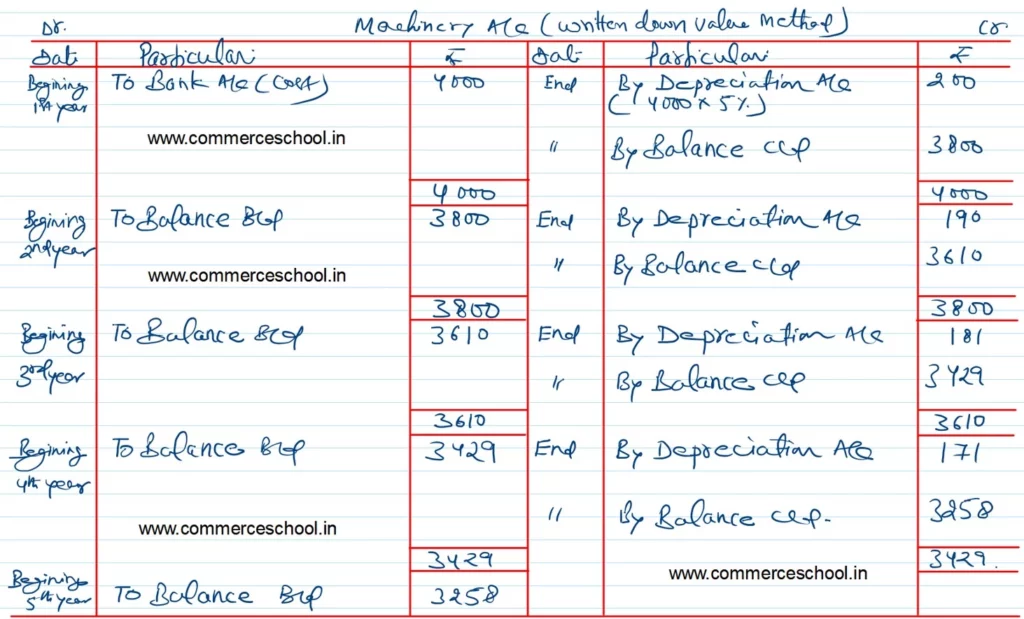

Q. 22. The original cost of furniture amounted to ₹ 4,000 and it is decided to write off 5% on the original cost as Depreciation at the end of each year.

Show the Ledger Account as it will appear during the first four years. Show also how the same account will appear if it was decided to write off 5% p.a. on the diminishing balance of the asset each year.

[Balance after 4th year: (a) on Original Cost Basis – ₹ 3,200; (b) On Diminishing Balance Basis – ₹ 3,258.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.