[CBSE] Q 27, Q 28 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 27 and 28 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

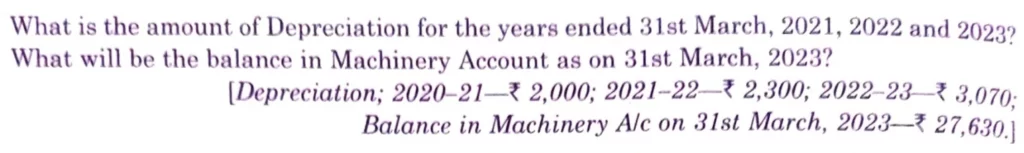

Q. 27. On 1st April, 2020, a machinery was purchased for ₹ 20,000.

On 1st October, 2021, another machine was purchased for ₹ 10,000 and on 1st April, 2022, one more machine was purchased for ₹ 5,000. The firm depreciates its machinery @ 10% p.a. on the Diminishing Balance Method.

What is the amount of Depreciation for the years ended 31st March, 2021, 2022 and 2023?

What will be the balance in Machinery Account as on 31st March, 2023?

[Depreciation; 2020 – 21 – ₹ 2,000; 2021 – 22 – ₹ 2,300; 2022 – 23 – ₹ 3,070; Balance in Machinery A/c on 31st March, 2023 – ₹ 27,630.]

Solution:-

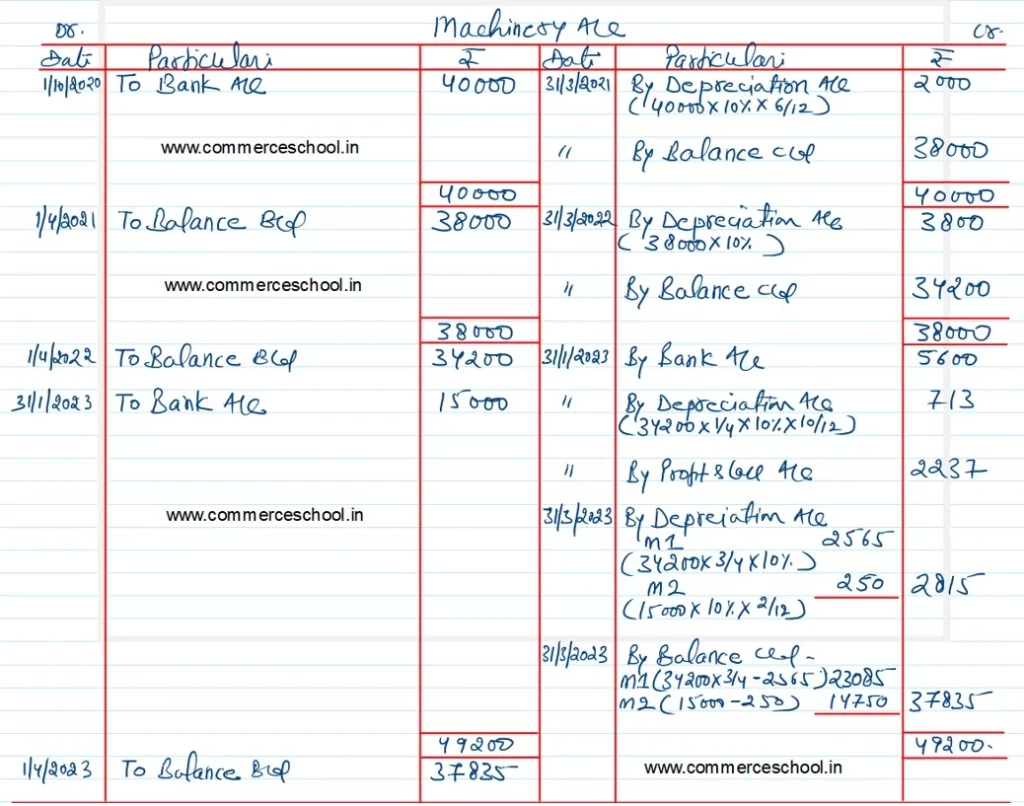

Q. 28. Gurman & Co. purchased machinery for ₹ 40,000 on 1st October, 2020.

Depreciation is provided @ 10% p.a. on the Diminishing Balance. On 31st January, 2023, one-fourth of the machinery was found unsuitable and disposed off for ₹ 5,600. On the same date new machinery at a cost of ₹ 15,000 was purchased. Write up the Machinery Account for the years ended 31st March, 2021, 2022 and 2023. Accounts are closed on 31st March each year.

[Loss on Sale of Machinery – ₹ 2,237; Balance in Machinery A/c – ₹ 37,835.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.