[CBSE] Q 35 Depreciation Solutions TS Grewal Class 11 (2025-26)

Solution of Question number 33 of the Depreciation chapter TS Grewal Class 11 CBSE Board for 2025-26 Session.

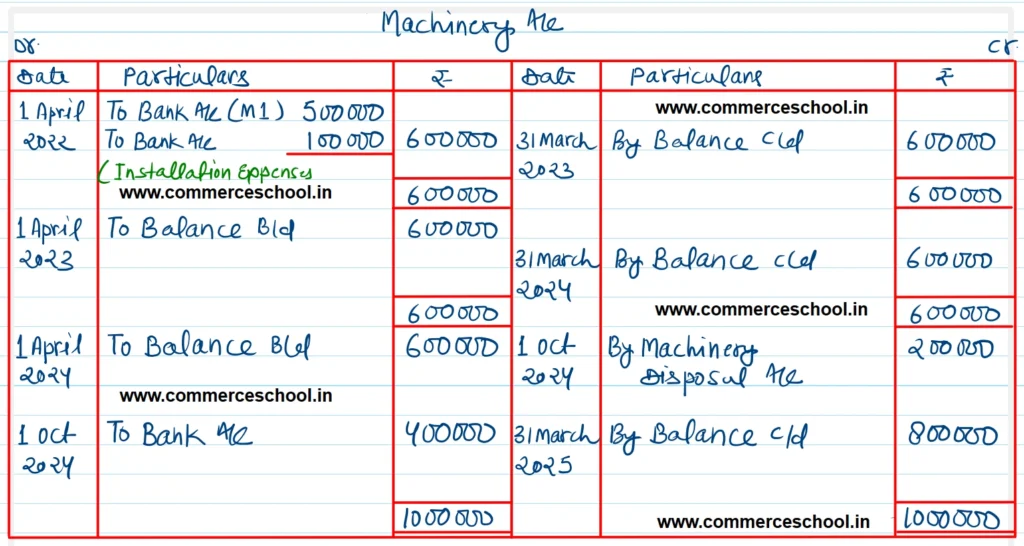

Q. 35. On 1st April, 2022, Jai purchased machinery for ₹ 5,00,000 and spent ₹ 1,00,000 on its installation.

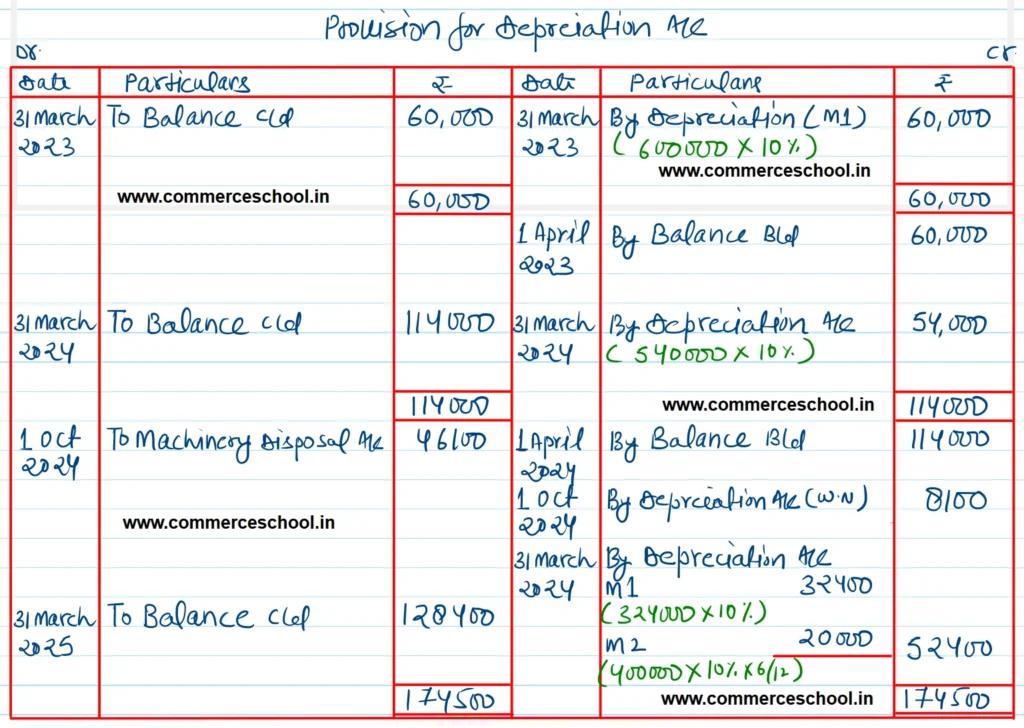

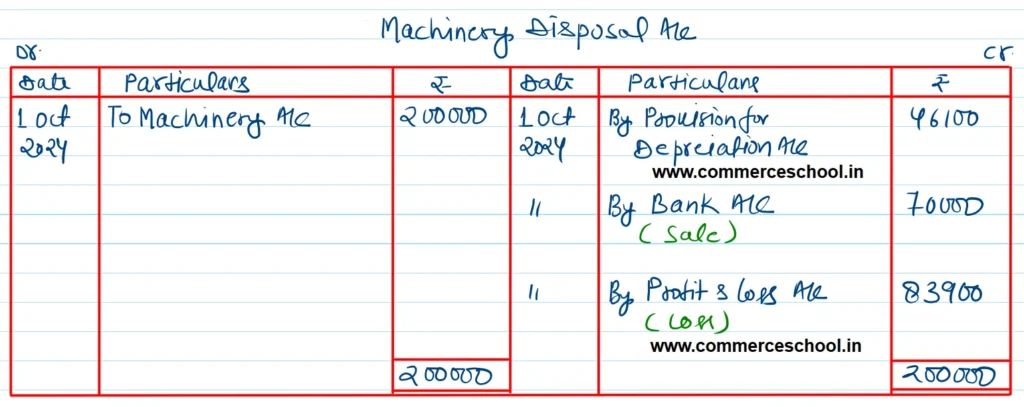

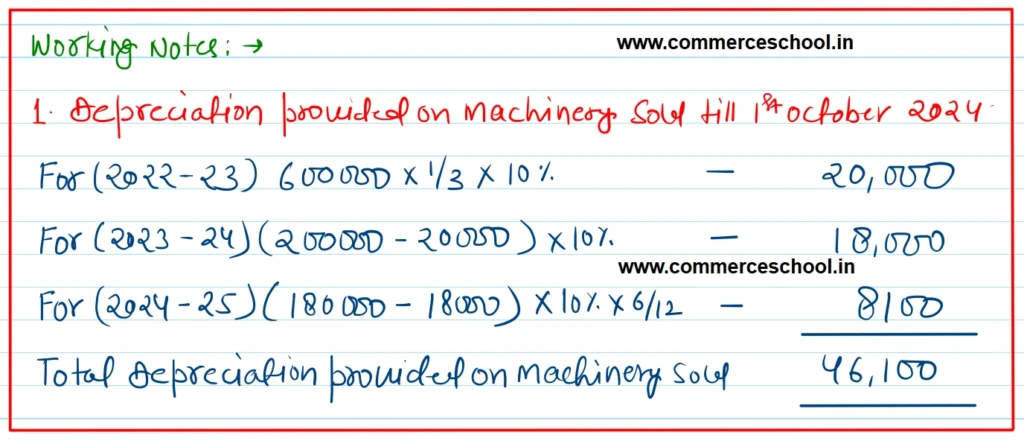

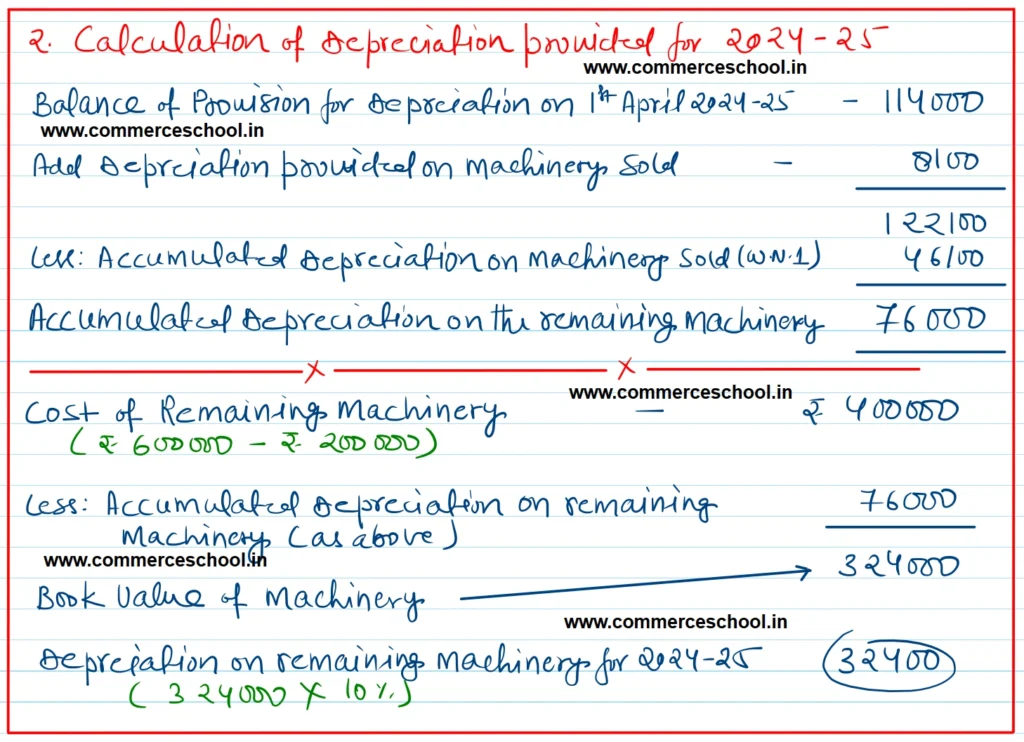

On 1st October, 2024, 1/3rd of machinery purchased on 1st April, 2022 was sold for ₹ 70,000 and a new machinery at the cost of ₹ 4,00,000 was purchased on the same date. The company has adopted the written down value method of providing depreciation @ 10% p.a. on the machinery.

You are required to show: (i) Machinery Account; (ii) Machinery Disposal Account, and (iii) Provision for Depreciation Account for the period of three accounting years ended 31st March, 2025.

[Ans.: Loss on Sale of Machine – ₹ 83,900; Balance of Machinery A/c (31st March, 2025) – ₹ 8,00,000; Balance of Provision for Depreciation A/c (31st March, 2025) – ₹ 1,28,400.]

Solution:-

Following is the list of all solutions of the depreciation chapter of ts Grewal CBSE for the (2025-26) session.

please add answers also