[CBSE] Q 3, Q 4 Accounts for Incomplete Records Solutions (2025-26)

Solution of Question number 3 and 4 Accounts for Incomplete Records (Single Entry System) CBSE Board (2025-26)

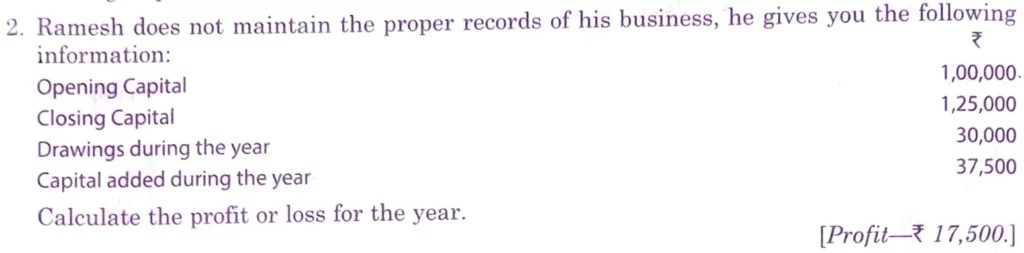

Q. 3. Ramesh does not maintain the proper records of his business, he gives you the following information:

| Particulars | ₹ |

| Opening Capital | 1,00,000 |

| Closing Capital | 1,25,000 |

| Drawings during the year | 30,000 |

| Capital added during the year | 37,500 |

Calculate the profit or loss for the year.

[Profit = ₹ 17,500.]

Solution:-

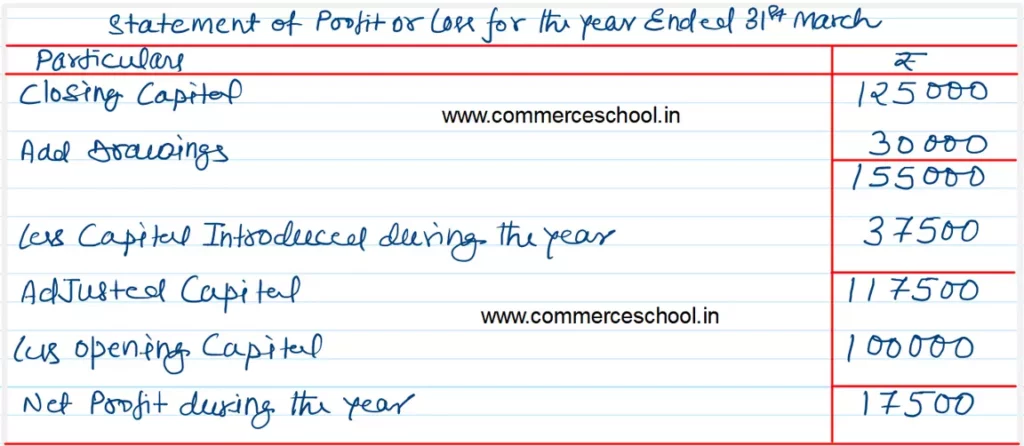

Q. 4. Capital of Pankaj Gupta in the beginning of the year was ₹ 70,000.

During the year his business earned a profit of ₹ 20,000, he withdrew ₹ 7,000 for his personal use. He sold ornaments of his wife for ₹ 20,000 and invested that amount into the business.

Find out his capital at the end of the year.

[Ans.: Capital at the end – ₹ 1,03,000.]

Solution:-

Following is the list