[CBSE] Q 7, Q 8 Accounts for Incomplete Records Solutions (2025-26)

Solution of Question number 7 and 8 Accounts for Incomplete Records (Single Entry System) CBSE Board (2025-26)

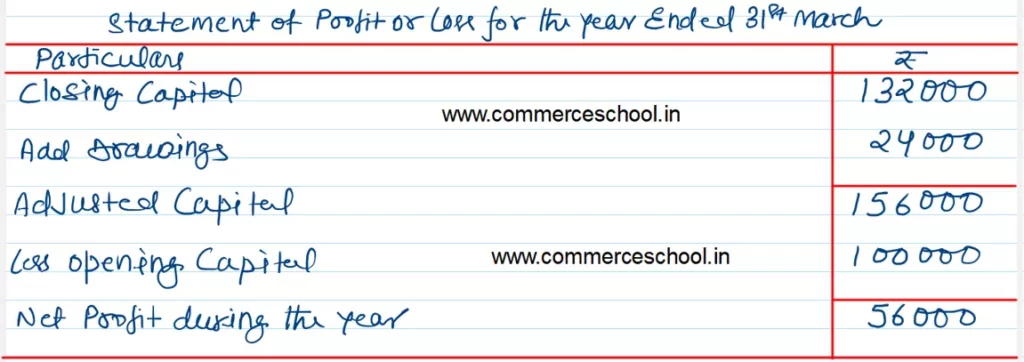

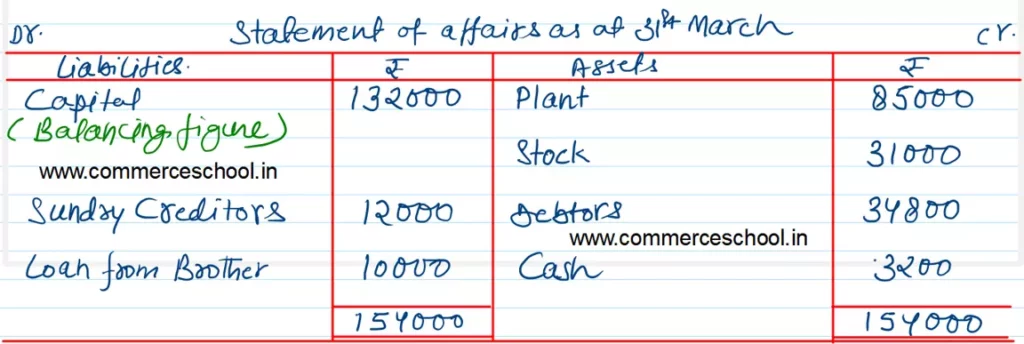

Q. 7. Krishan started his business on 1st April, 2024 with a Capital of ₹ 1,00,000. On 31st March, 2025, his assets were:

| Cash | 3,200 |

| Stock | 34,800 |

| Debtors | 31,000 |

| Plant | 85,000 |

He owed ₹ 12,000 to sundry creditors and ₹ 10,000 to his brother on that date. He withdrew ₹ 2,000 per month for his personal expenses. Ascertain his profit.

[Profit earned – ₹ 56,000.]

Solution:-

Q. 8. Muneesh maintains his books on Single Entry System and from them and the particulars supplied, the following figures were gathered together on 31st March, 2025:

Book Debts ₹ 10,000; Cash in Hand ₹ 510; Stock-in-Trade (estimated) ₹ 6,000; Furniture and Fittings ₹ 1,200; Trade Creditors ₹ 4,000; Bank Overdraft ₹ 1,000. Muneesh stated that he started business on 1st April, 2022 with cash ₹ 6,000 paid into bank but stocks valued at ₹ 4,000. During the year he estimated his drawings to be ₹ 2,400. You are required to prepare the Statement, showing the profit for the year, after writing off 10% for Depreciation on Furniture and Fittings.

[Profit – ₹ 4,990.]

Solution:-

Following is the list