[CBSE] Q 13, Q 14 Accounts for Incomplete Records Solutions (2025-26)

Solution of Question number 13 and 14 Accounts for Incomplete Records (Single Entry System) CBSE Board (2025-26)

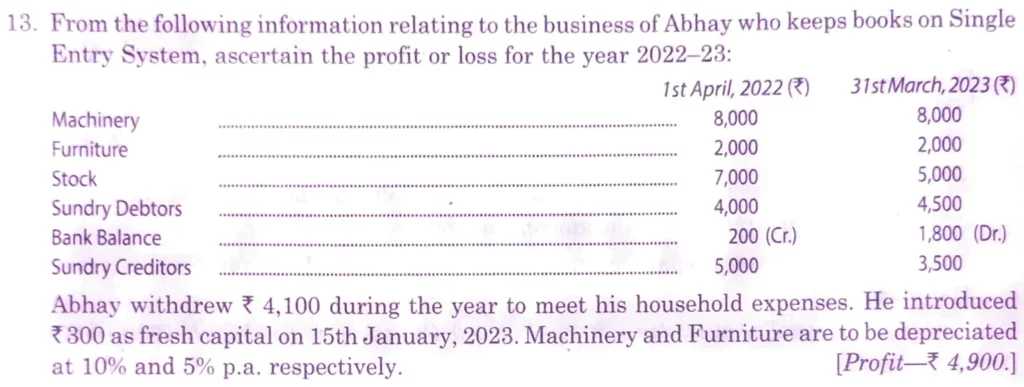

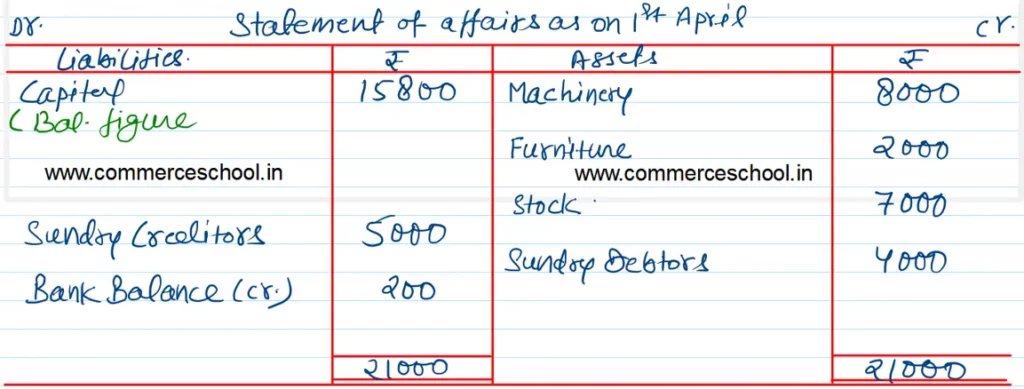

Q. 13. From the following information relating to the business of Abhay who keeps books on Single Entry System, ascertain the profit or loss for the year 2024-25:

| 1st April, 2022 (₹) | 31st March, 2023 (₹) | |

| Machinery | 8,000 | 8,000 |

| Furniture | 2,000 | 2,000 |

| Stock | 7,000 | 5,000 |

| Sundry Debtors | 4,000 | 4,500 |

| Bank Balance | 200 (Cr.) | 1,800 (Dr.) |

| Sundry Creditors | 5,000 | 3,500 |

Abhay withdrew ₹ 4,100 during the year to meet his household expenses. He introduced ₹ 300 as fresh capital on 15th January 2023. Machinery and Furniture are to be depreciated at 10% and 5% p.a. respectively.

[Profit – ₹ 4,900.]

Solution:-

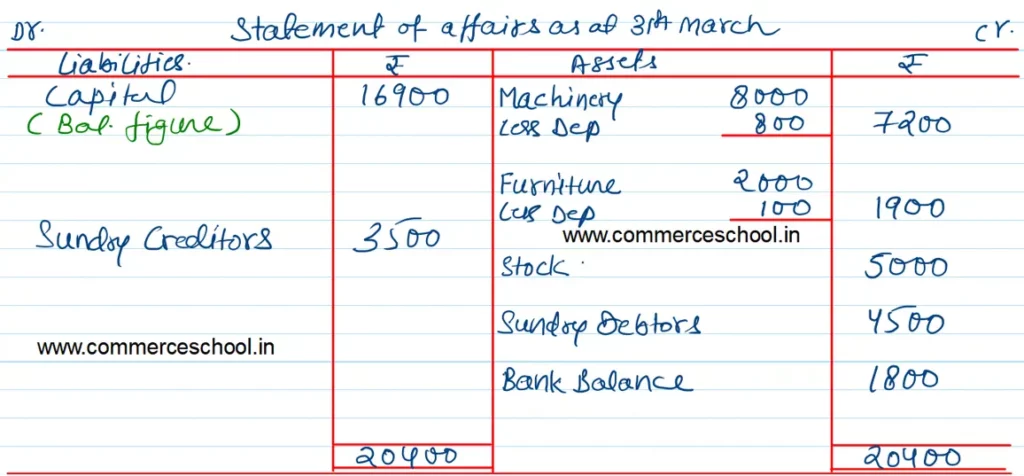

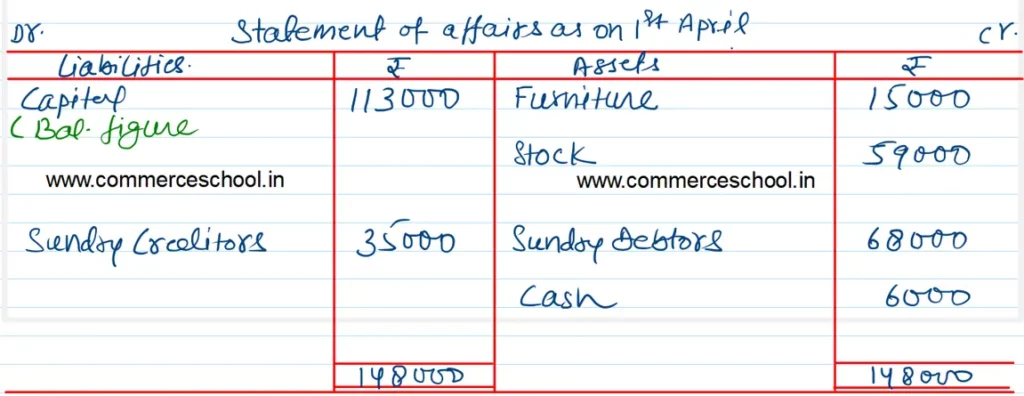

Q. 14. Following information is supplied to you by a shopkeeper:

| 1st April, 2022 (₹) | 31st March, 2023 (₹) | |

| Cash | 6,000 | 7,000 |

| Sundry Debtors | 68,000 | 64,000 |

| Stock | 59,000 | 87,000 |

| Furniture | 15,000 | 13,500 |

| Sundry Creditors | 35,000 | 29,000 |

During the year, he withdrew ₹ 2,500 per month for domestic purposes. He also borrowed frofm a friend at 9% a sum of ₹ 20,000 on 1st October, 2022. He has not yet paid the interest. A provision of 5% on debtors for doubtful debts is to be made.

Ascertain the profit or loss made by him during the period.

[Profit earned during the year – ₹ 35,400.]

Solution:-

Following is the list