[CBSE] Q 141 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

The solution of Question number 141 of Admission of a Partner chapter 3 of DK Goel Class 12 CBSE (2024-25)

Chander and Damini were partners in a firm sharing profits and losses equally. On 31st March, 2017 their Balance Sheet was as follows:

Balance Sheet of Chander and Damini as at 31.3.2017

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 1,04,000 | Cash at Bank | 30,000 |

| Capitals: Chander Damini | 2,50,000 2,16,000 | Bills Receivable | 45,000 |

| Debtors | 75,000 | ||

| Furniture | 1,10,000 | ||

| Land and Building | 3,10,000 | ||

| 5,70,000 | 5,70,000 |

On 1.4.2017, they admitted Elina as a new partner for 1/3rd share in the profits on the following conditions:

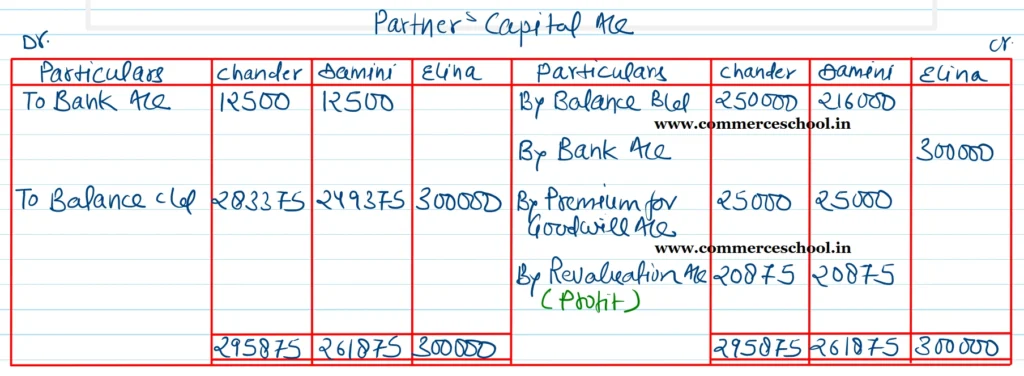

(i) Elina will bring ₹ 3,00,000 as her capitl and ₹ 50,000 as her share of goodwill premium, half of which will be withdrawn by Chander and Damini.

(ii) Debtors to the extent of ₹ 5,000 were unrecorded.

(iii) Furniture will be reduced by 10% and 5% provision for bad and doutful debts will be created on bills receivables and debtors.

(iv) Value of land and Building will be appreciated by 20%.

(v) There being a claim against the firm for damages, a liability to the extent of ₹ 8,000 will be created for the same.

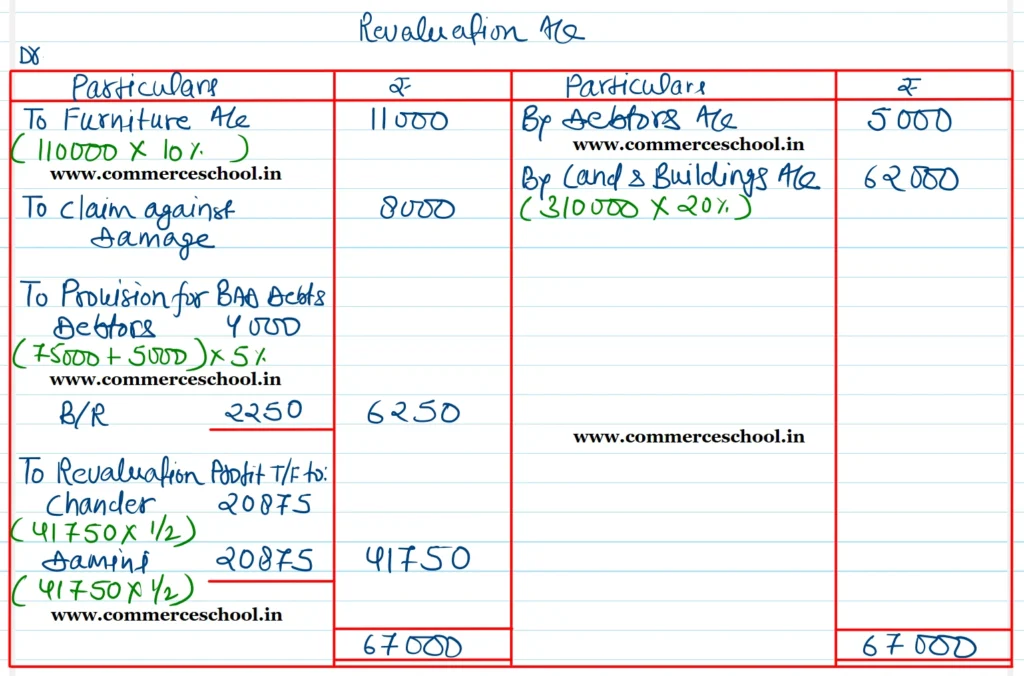

Prepare Revaluation Account and Partner’s Capital Accounts:

[Ans. Gain on Revaluation ₹ 41,750; Capital Accounts : Chander ₹ 2,83,375; Damini ₹ 2,49,375 and Elina ₹ 3,00,000.]

Solution:-

Note:-

In the absense of any additional information, the sacrificing ratio is always equal to the old ratio.