[CBSE] Q 131 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

[CBSE] Q 131 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

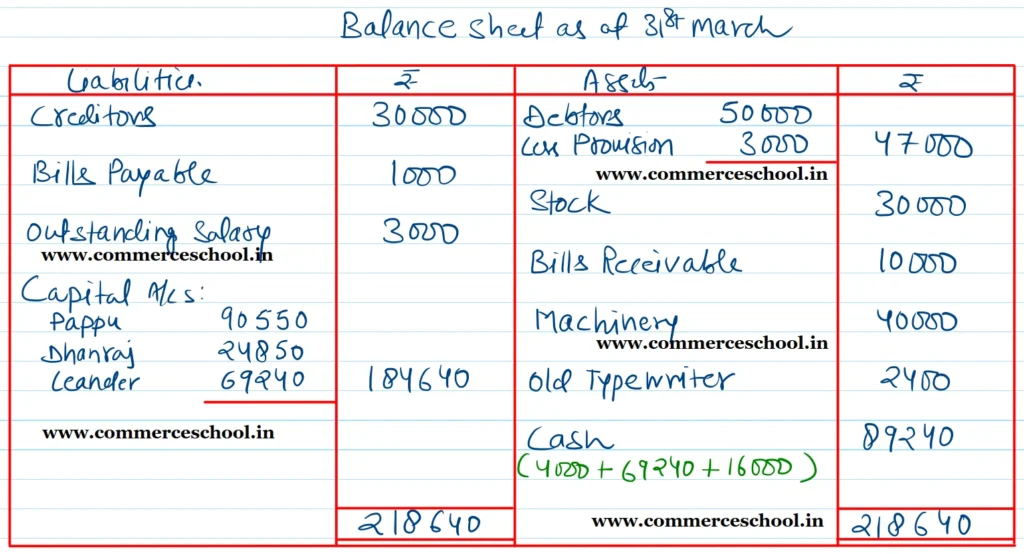

Pappu and Dhanraj were partners in a firm sharing profits in the ratio of 3 : 1. Their Balance Sheet as at 31.3.2023 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 30,000 | Debtors 50,000 Less: Provision 5,000 | 45,000 |

| Bills Payable | 1,000 | Stock | 30,000 |

| Reserve Fund | 16,000 | Bills Receivable | 10,000 |

| Outstanding Salary | 3,000 | Patents | 1,000 |

| Capitals: Pappu Dhanraj | 60,000 20,000 | Machinery | 40,000 |

| Cash | 4,000 | ||

| 1,30,000 | 1,30,000 |

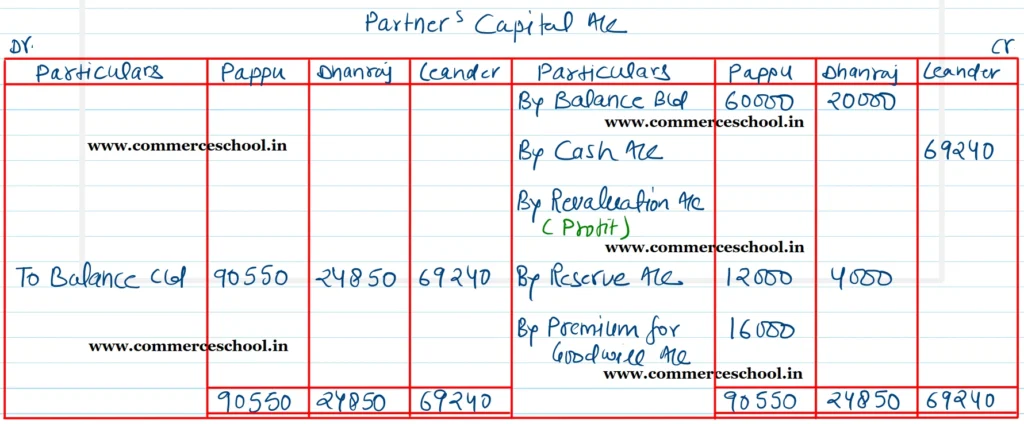

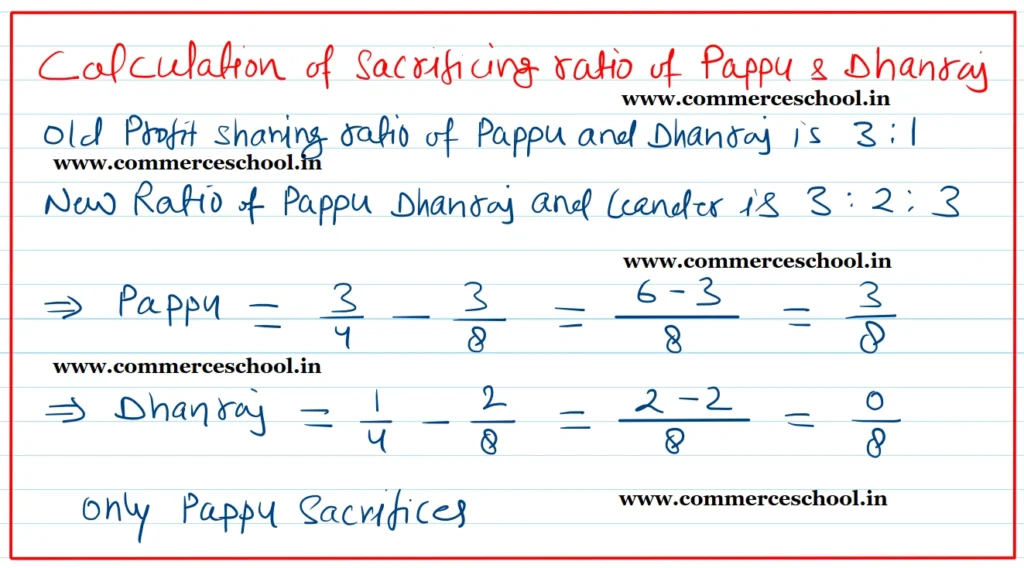

They admitted Leander as a new partner on 1st April, 2023. New Profit sharing ratio is agreed as 3 : 2 : 3. Leander brings in proportionate capital after the following adjustments:

(i) Leander brings ₹ 16,000 as his share of goodwill.

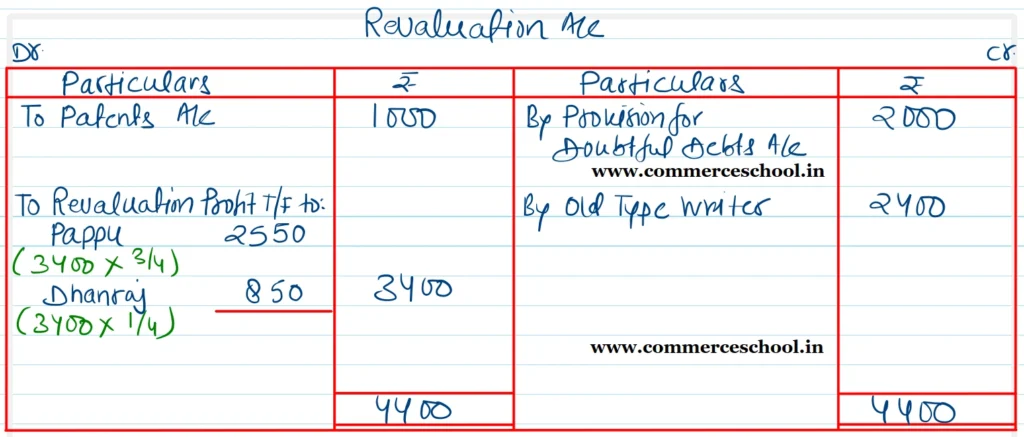

(ii) Provision for doubtful debts is to be reduced by ₹ 2,000.

(iii) There is an old typewriter valued at ₹ 2,400. It does not appear in the books of the firm. It is now to be recorded.

(iv) Patents are valueless.

Prepare Revaluation Account, Capital Accounts and the Opening Balance Sheet of Pappu, Dhanraj and Leander.

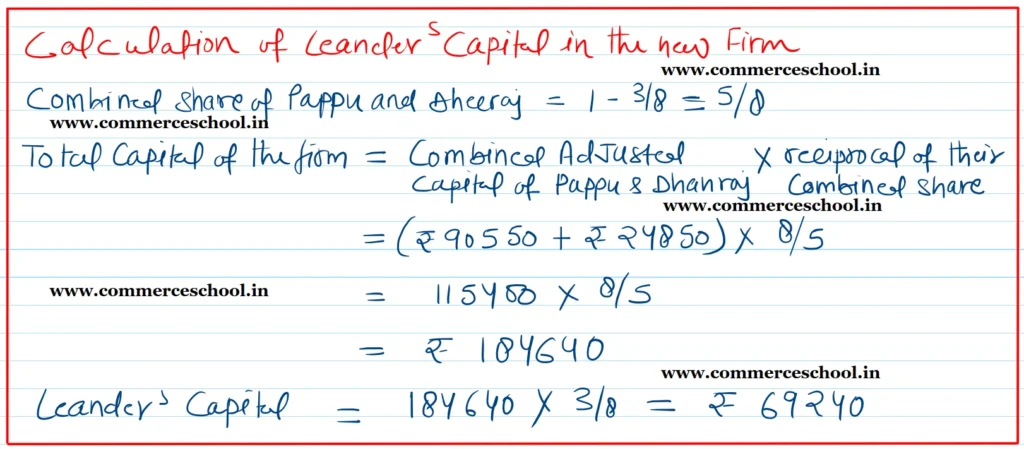

[Ans. Gain on Revaluation ₹ 3,400; Balances of Capital Accounts, Pappu ₹ 90,550; Dhanraj ₹ 24,850 and Leander ₹ 69,240. Total of B/S ₹ 2,18,640.]

Solution:-