[CBSE] Q 122 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

[CBSE] Q 122 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

Rohit and Bal sharing profits in the ratio of 5 : 3 has the following Balance Sheet as at March 31, 2022:

Balance Sheet

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 1,00,000 | Goodwill | 1,50,000 |

| Bills Payable | 40,000 | Building | 1,70,000 |

| General Reserve | 1,40,000 | Plant | 1,35,000 |

| Capital Accounts: Rohit Bal | 4,00,000 2,00,000 | Furniture | 20,000 |

| Debtors | 1,65,000 | ||

| Bills Receivables | 75,000 | ||

| Stock | 1,10,000 | ||

| Bank | 55,000 | ||

| 8,80,000 | 8,80,000 |

On April 1st, 2022, they decided to admit Khosla into the partnership giving him 1/5th share. He brings in ₹ 2,50,000 as his share of capital. The partners decide to revalue the Assets as follows:

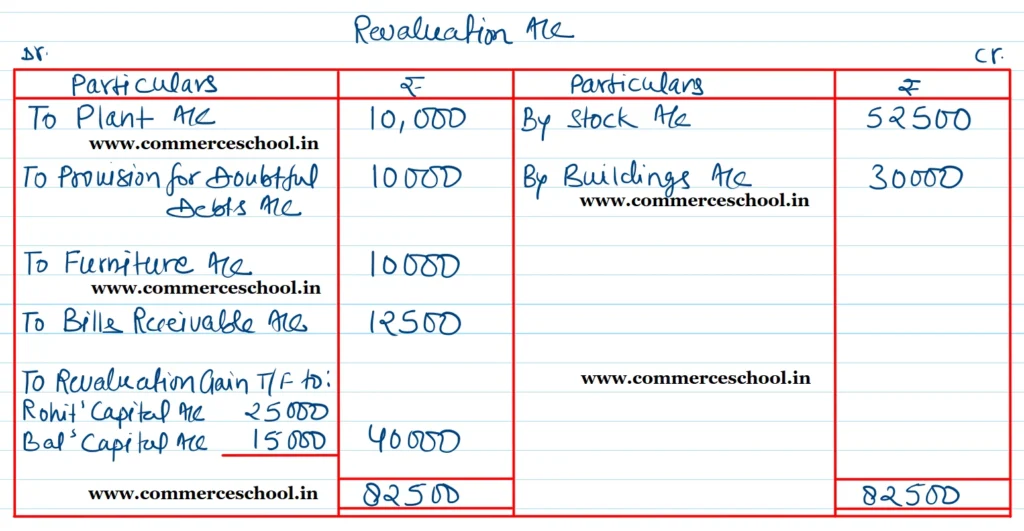

Goodwill ₹ 2,50,000; Plant ₹ 1,25,000; Debtors ₹ 1,55,000; Stock ₹ 1,62,500; Building ₹ 2,00,000; Furniture ₹ 10,000; Bills Receivable ₹ 62,500.

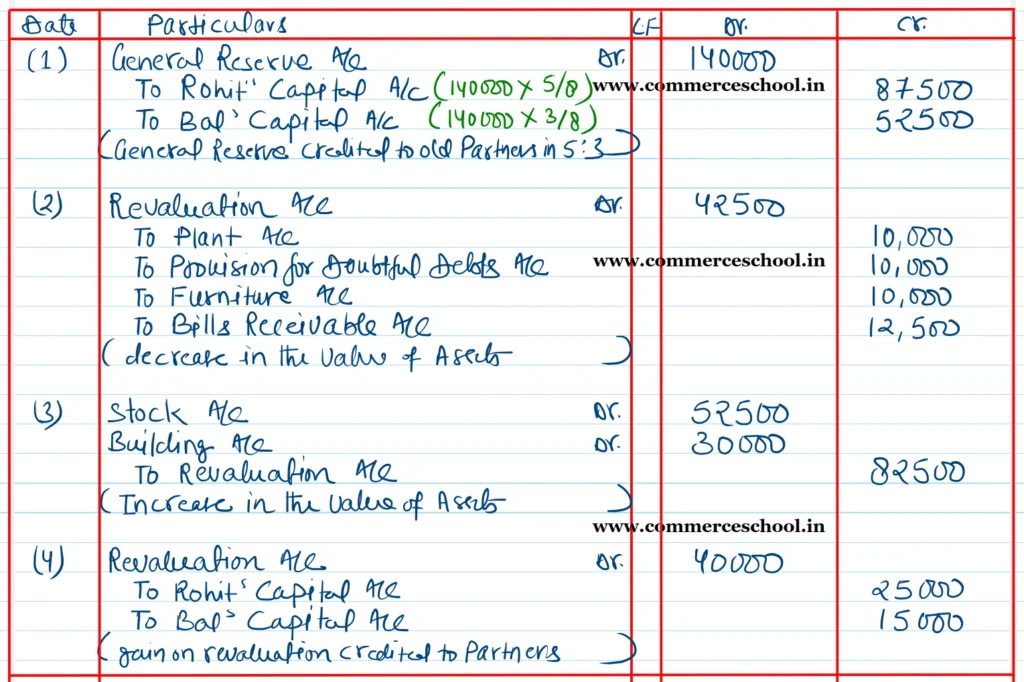

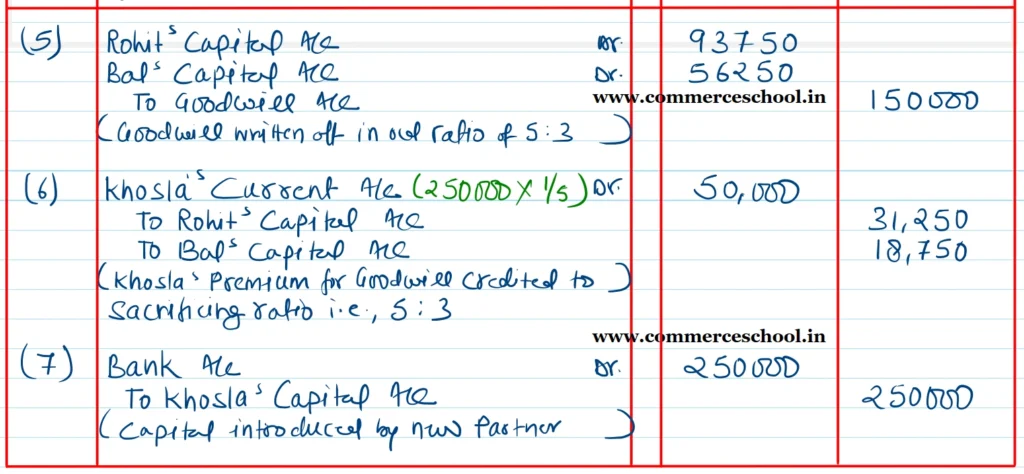

You are required to show the journal entries and prepare the Revaluation A/c.

[Ans. Gain on Revaluation ₹ 40,000.]

Solution:-

Note:-

(1) If the premium for goodwill brought in cash is not mentioned then it is assumed that the new partners do not bring a premium for goodwill in cash. Thus, it is adjusted through the new partner’s current Account.

(2) In the absence of any additional information, the sacrificing ratio is always equal to the old ratio, i.e., 5:3.