[CBSE] Q 28 Adjustments in Preparation of Financial Statement Solution TS Grewal Class 11 (2025-26)

Solution of Question number 28 of the Adjustments in Preparation of Financial Statements of TS Grewal Book class 11, 2025-26?

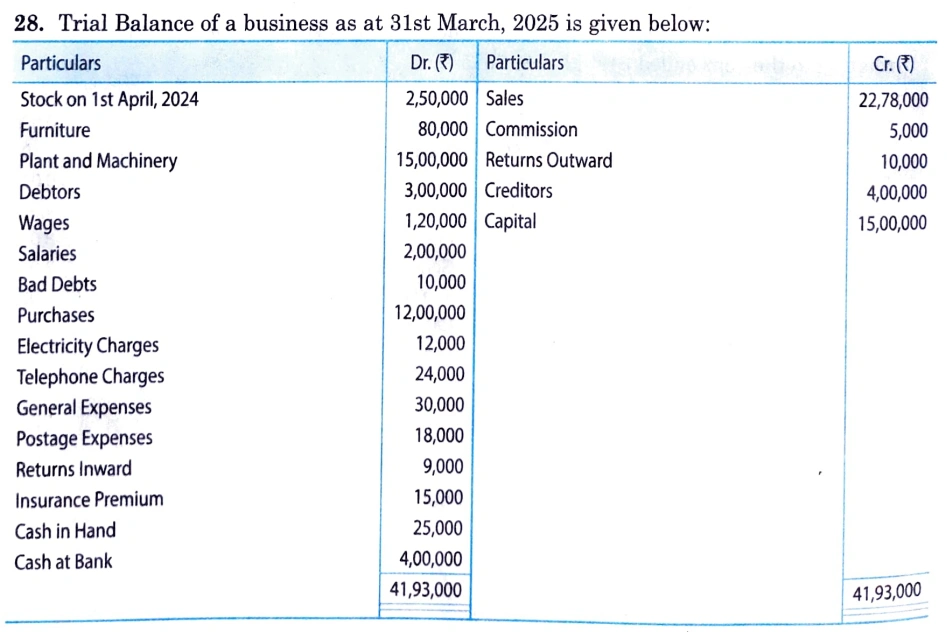

Trial Balance of a business as at 31st March, 2025 is given below:

| Particulars | Dr. (₹) | Particulars | Cr. (₹) |

| Stock on 1st April, 2024 | 2,50,000 | Sales | 22,78,000 |

| Furniture | 80,000 | Commission | 5,000 |

| Plant and Machinery | 15,00,000 | Returns Outward | 10,000 |

| Debtors | 3,00,000 | Creditors | 4,00,000 |

| Wages | 1,20,000 | Capital | 15,00,000 |

| Salaries | 2,00,000 | ||

| Bad Debts | 10,000 | ||

| Purchases | 12,00,000 | ||

| Electricity Charges | 12,000 | ||

| Telephone Charges | 24,000 | ||

| General Expenses | 30,000 | ||

| Postage Expenses | 18,000 | ||

| Returns Inward | 9,000 | ||

| Insurance Premium | 15,000 | ||

| Cash in Hand | 25,000 | ||

| Cash at Bank | 4,00,000 | ||

| 41,93,000 | 41,93,000 |

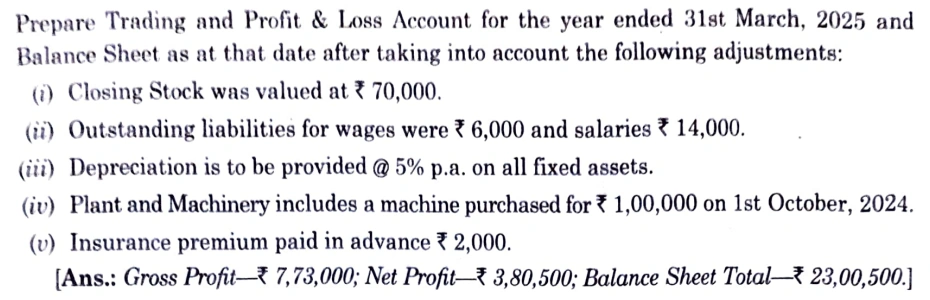

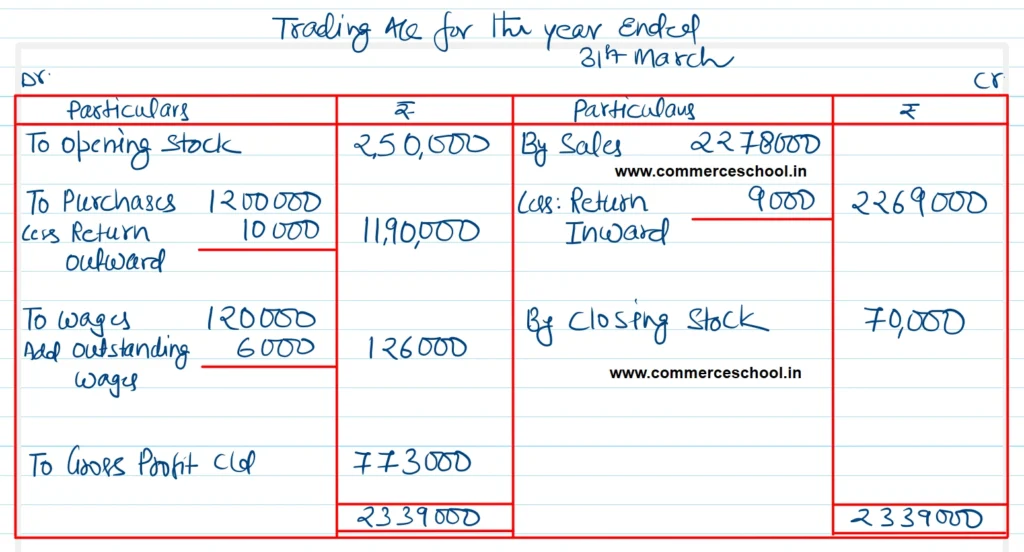

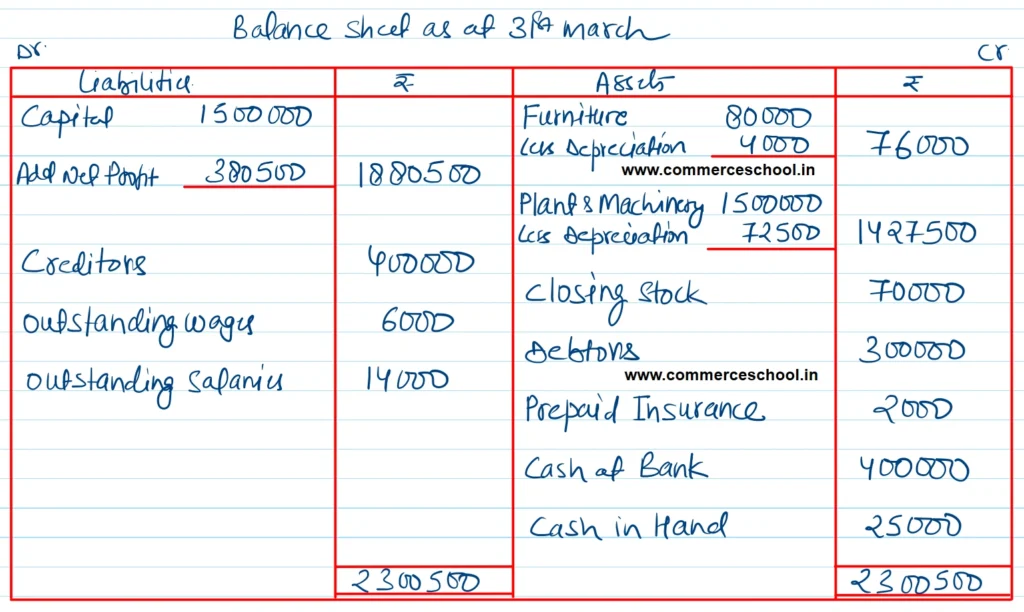

Prepare Trading and Profit & Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that after taking into account the following adjustments:

(i) Closing Stock was valued at ₹ 70,000.

(ii) Outstanding liabilities for wages were ₹ 6,000 and salaries ₹ 14,000.

(iii) Depreciation is to be provided @ 5% p.a. on all fixed assets.

(iv) Plant and Machinery includes a machine purchased for ₹ 1,00,000 on 1st October, 2024.

(v) Insurance premium paid in advance ₹ 2,000.

[Ans.: Gross Profit – ₹ 7,73,000; Net Profit – ₹ 3,80,500; Balance Sheet Total – ₹ 23,00,500.]

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |