[DK Goel] Q. 2 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 2 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

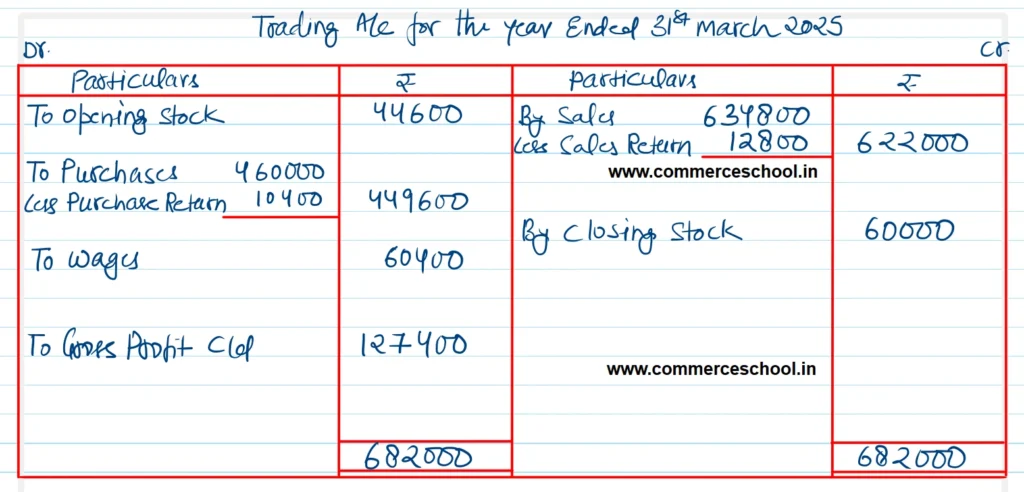

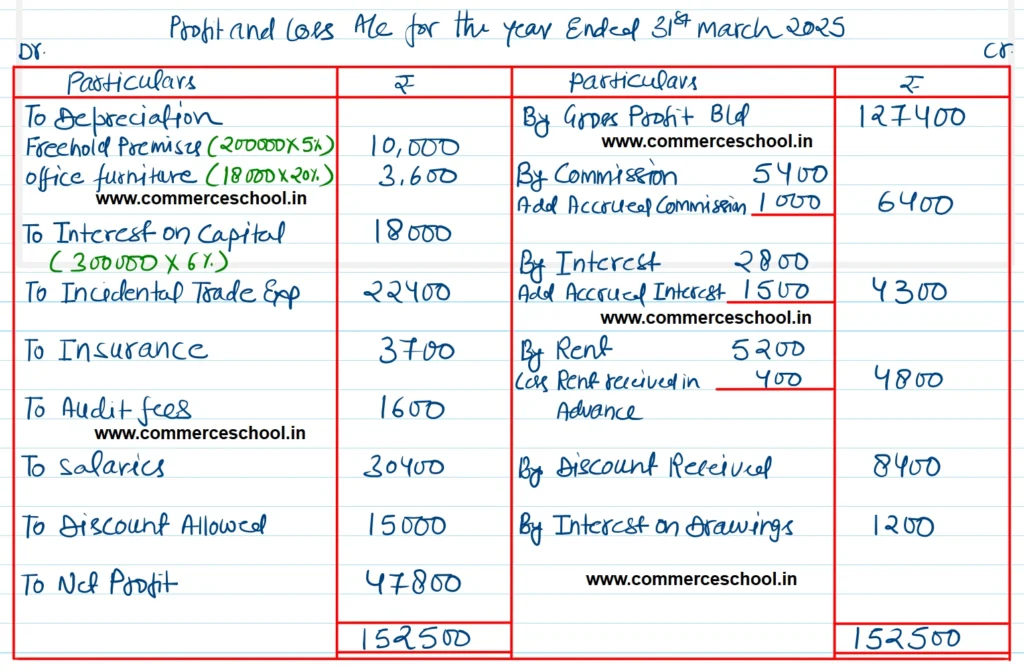

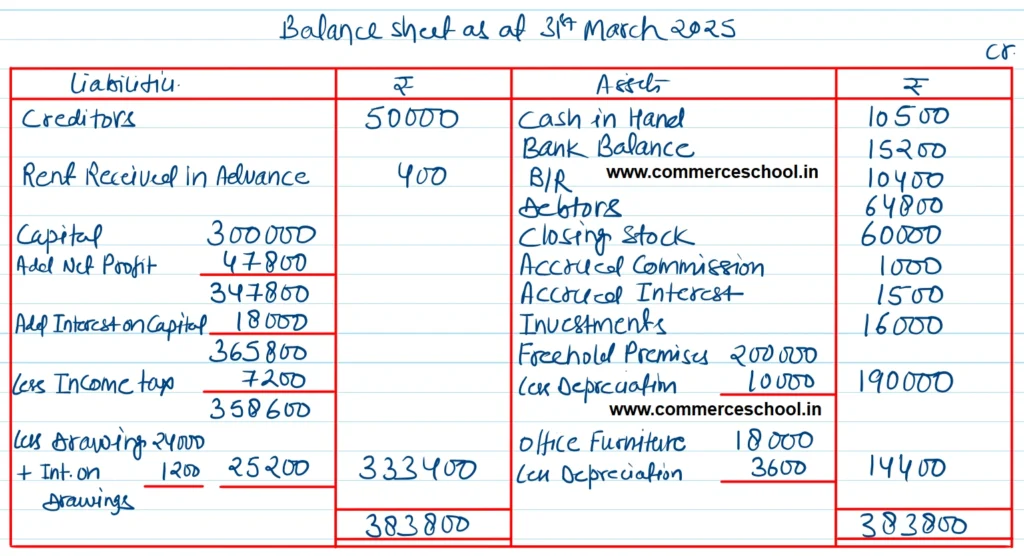

From the following Trial Balance of Rahim prepare Trading and Profit & Loss Account for the year ended 31st March, 2025 and Balance Sheet as at that date:-

| Particulars | Dr. (₹) | Cr. (₹) |

| Stock 1st April, 2024 | 44,600 | |

| Purchases and Purchases Return | 4,60,000 | 10,400 |

| Freehold Premises | 2,00,000 | |

| Incidental Trade Exp. | 22,400 | |

| Insurance | 3,700 | |

| Audit Fees | 1,600 | |

| Commission Received | 5,400 | |

| Interest | 2,800 | |

| Debtors and Creditors | 64,800 | 50,000 |

| Wages | 60,400 | |

| Salaries | 30,400 | |

| Capital | 3,00,000 | |

| Drawings | 24,000 | |

| Income-Tax | 7,200 | |

| Investments | 16,000 | |

| Discount allowed & Received | 15,000 | |

| Sales Return & Sales | 12,800 | |

| B/R | 10,400 | |

| Office Furniture | 18,000 | |

| Rent | 5,200 | |

| Cash in Hand | 10,500 | |

| Bank Balance | 15,200 | |

| 10,17,000 | 10,17,000 |

Adjustments:-

1. Stock at 31st March, 2025 is ₹ 60,000.

2. Write off 5% Depreciation on freehold premises and 20% on office furniture.

3. Commission earned but not received ₹ 1,000.

4. Interest earned ₹ 1,500.

5. ₹400 for rent has been received in advance.

6. Charge interest on Capital @ 6% and ₹ 1,200 on Drawings.

[Ans. G.P. ₹ 1,27,400; N.P. ₹ 47,800; Balance Sheet Total ₹ 3,83,800.]

Hint:- Income Tax is the ‘personal expenses’ of the Proprietor, as such it will be treated as Drawings.

Solution:-

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |