[DK Goel] Q. 23 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 23 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

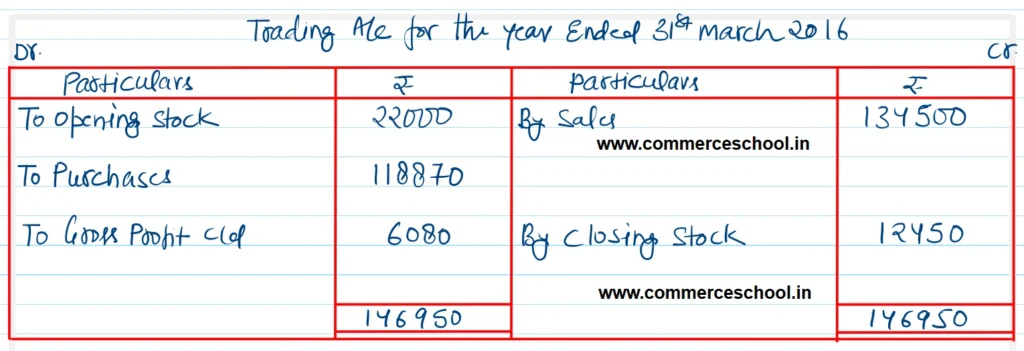

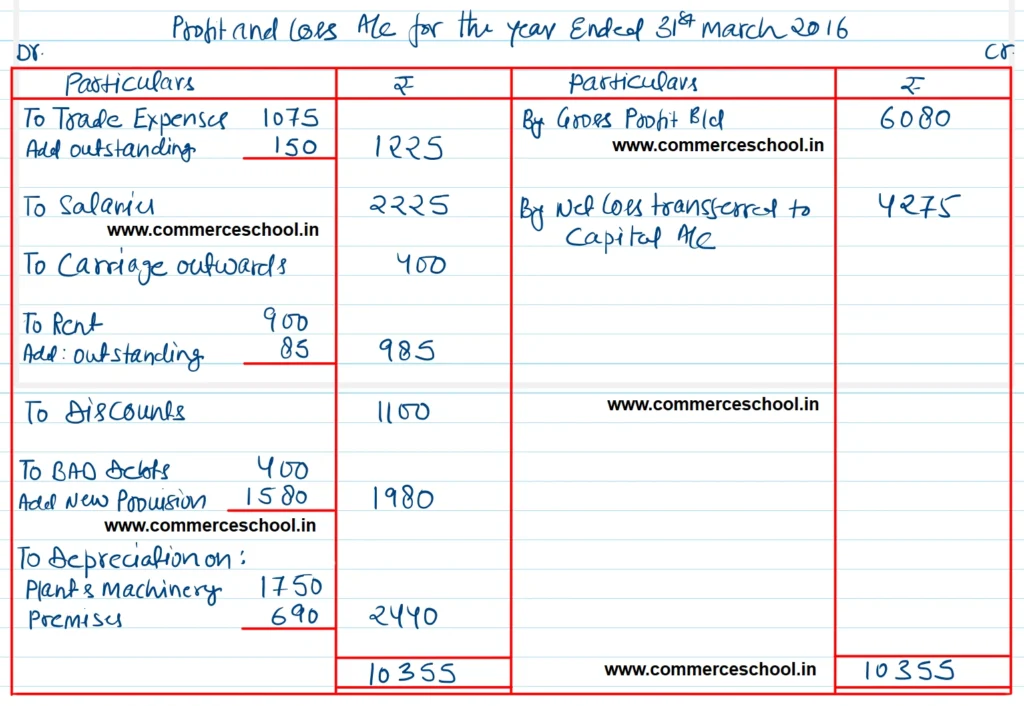

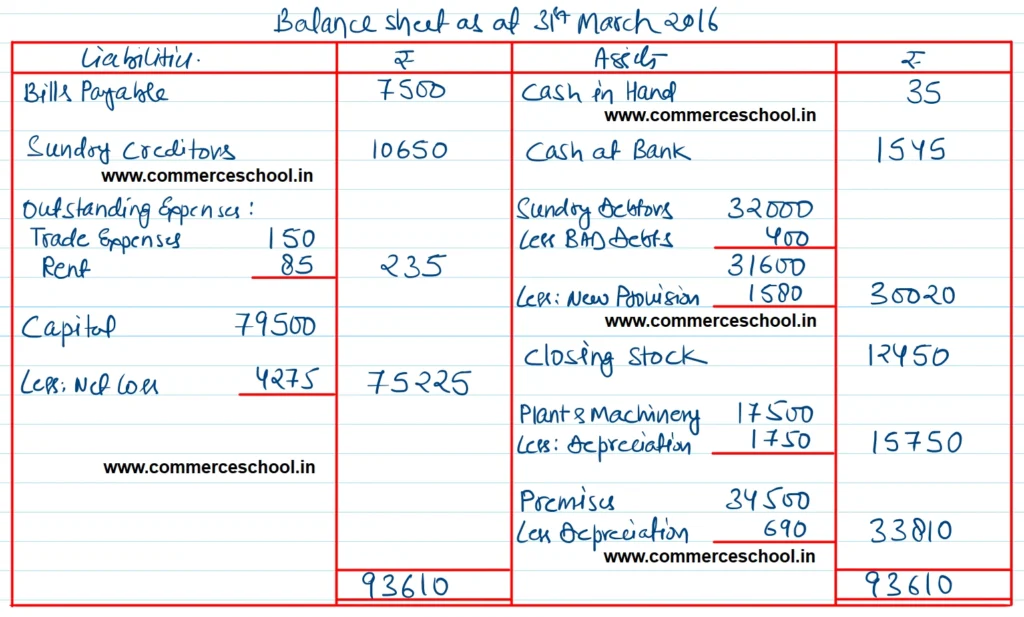

From the following Trial Balance and other information prepare Trading and Profit and Loss Account for the year ended 31st March 2016 and Balance Sheet as at that date.

| Heads of Accounts | Debit (₹) | Credit (₹) |

| Sundry Debtors | 32,000 | |

| Stock (1st April 2015) | 22,000 | |

| Cash in Hand | 35 | |

| Cash at Bank | 1,545 | |

| Plant and Machinery | 17,500 | |

| Sundry Creditors | 10,650 | |

| Trade Expenses | 1,075 | |

| Sales | 1,34,500 | |

| Salaries | 2,225 | |

| Carriage Outwards | 400 | |

| Rent | 900 | |

| Bills Payable | 7,500 | |

| Purchases | 1,18,870 | |

| Discounts | 1,100 | |

| Premises | 34,500 | |

| Capital (1st April 2015) | 79,500 | |

| 2,32,150 | 2,32,150 |

Additional Information: Stock on 31st March 2016 was ₹ 12,450. Rent was unpaid to the extent of ₹ 85 and ₹ 150 were outstanding for Trade Expenses. ₹ 400 are to be written off as bad debts out of the above debtors, and 5% is to be provided for doubtful debts. Depreciate plant and machinery 10% and premises by 2%. Manager is entitled a commission of 5% on net profit after charging his commission.

[Ans. Gross Profit ₹ 6,080; Net Loss ₹ 4,275; Balance Sheet Total ₹ 93,610.]

Solution:-

Hint: Manager will not be entitled for any commission since there is net loss in the question.

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |