[DK Goel] Q. 35 Financial Statements (with Adjustments) Solutions Class 11 CBSE (2025-26)

Solutions of Question number 35 of Chapter 20 Financial Statements (with Adjustments) DK Goel class 11 CBSE (2025-26)

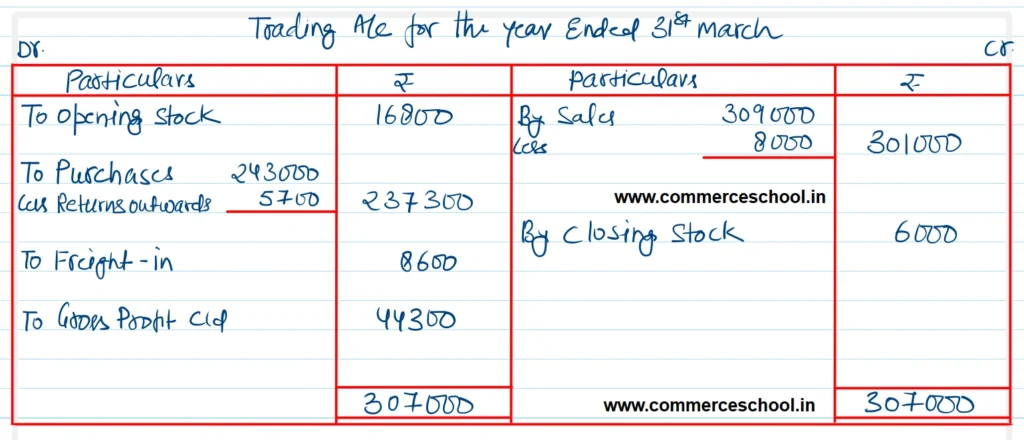

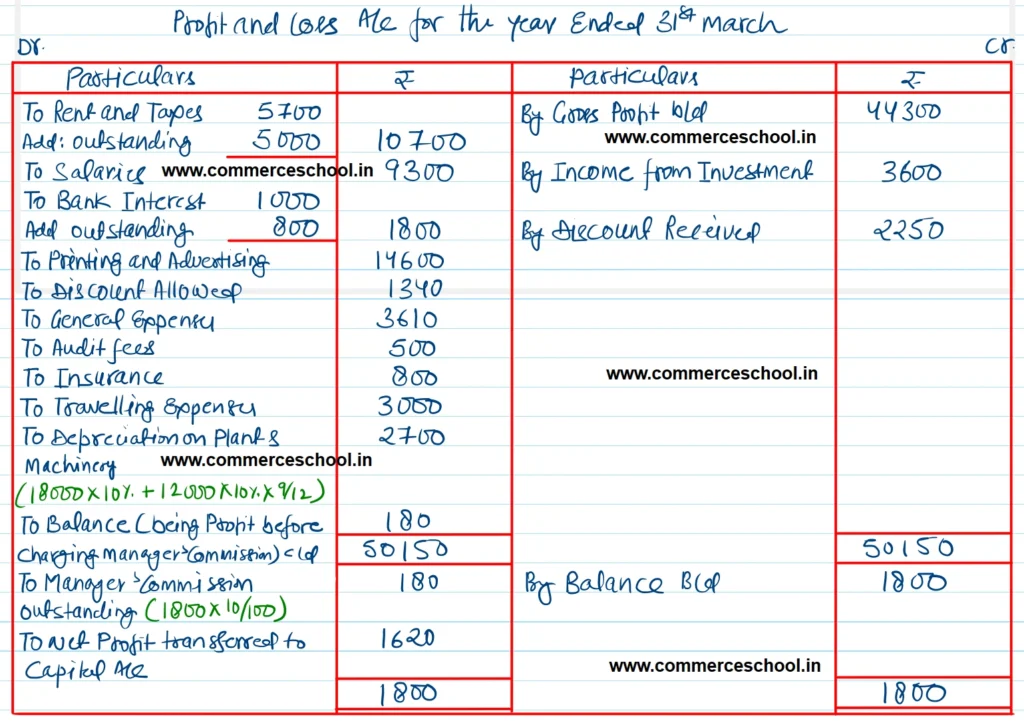

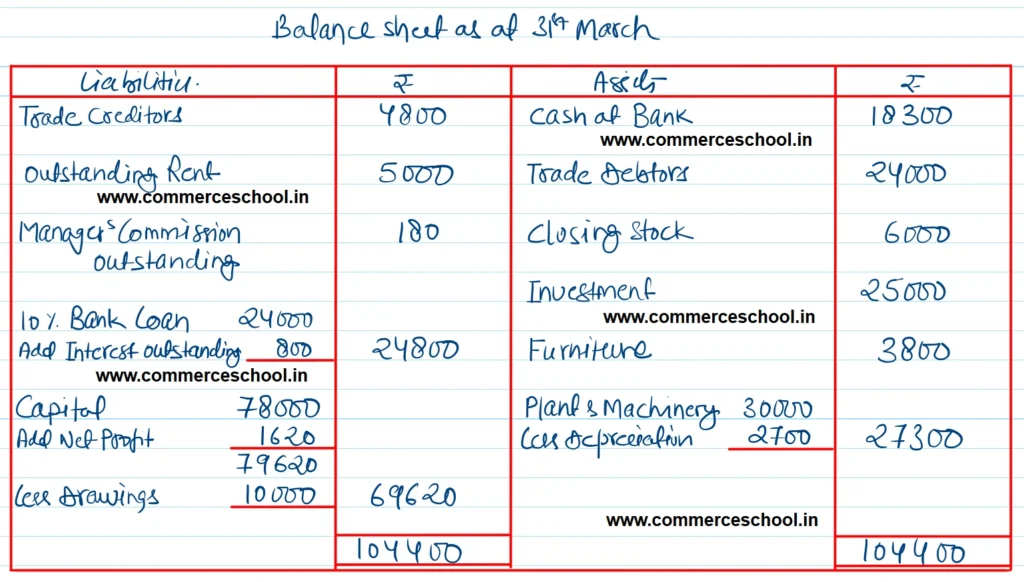

From the following information prepare financial Statements of M/s Raj & Bros for the year ending March 31, 2020.

| Dr. Bal (₹) | Cr. Bal (₹) | ||

| Stock (1-4-2019) | 16,800 | Capital | 78,000 |

| Sales Returns | 8,000 | Sales | 3,09,000 |

| Purchases | 2,43,000 | Returns Outward | 5,700 |

| Freight-in | 8,600 | Trade Creditors | 4,800 |

| Rent and Taxes | 5,700 | 10% Bank Loan (1-7-2019) | 24,000 |

| Salaries | 9,300 | Income from Investment | 3,600 |

| Trade Debtors | 24,000 | Discount Received | 2,250 |

| Bank Interest | 1,000 | ||

| Printing and Advertising | 14,600 | ||

| Cash at Bank | 18,300 | ||

| Discount Allowed | 1,340 | ||

| Investment | 25,000 | ||

| Furniture | 3,800 | ||

| General Expenses | 3,610 | ||

| Audit Fees | 500 | ||

| Insuarnce | 800 | ||

| Travelling Expenses | 3,000 | ||

| Plant & Machinery | 30,000 | ||

| Drawings | 10,000 | ||

| 4,27,350 | 4,27,350 |

Additional Information:

(i) Depreication on Plant and Machinery @ 10% p.a., a Machine has been purchased on July 01, 2019 for ₹ 12,000.

(ii) The manager is entitled to a commission of 10% of the net profit before charging such commission.

(iii) Closing stock in trade is valued at ₹ 6,000 (Cost); ₹ 6,200 (Realisable Value).

(iv) Rent Outstanding ₹ 5,000.

[Ans. Gross Profit ₹ 44,300; Net Profit ₹ 1,620; Balance Sheet Total ₹ 1,04,400.]

Solution:-

Note:-

The interest on a bank loan of ₹24,000 at 10% per annum for 9 months amounts to ₹1,800. The Trial Balance, however, shows that only ₹1,000 has been paid. Therefore, the remaining ₹800 represents

Outstanding interest

Loan amount = ₹24,000

Interest @ 10% p.a. for 9 months = ₹1,800

Interest paid = ₹1,000

Interest outstanding = ₹800

Below is the list of all solutions

| S.N | Solutions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Solutions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Solutions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Solutions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |