[DK Goel] Q. 15, Q. 16 Bank Reconciliation Statements Solutions Class 11 CBSE (2025-26)

Solutions of Question number 15 and 16 of Chapter 16 Bank Reconciliation Statements DK Goel class 11 CBSE (2025-26)

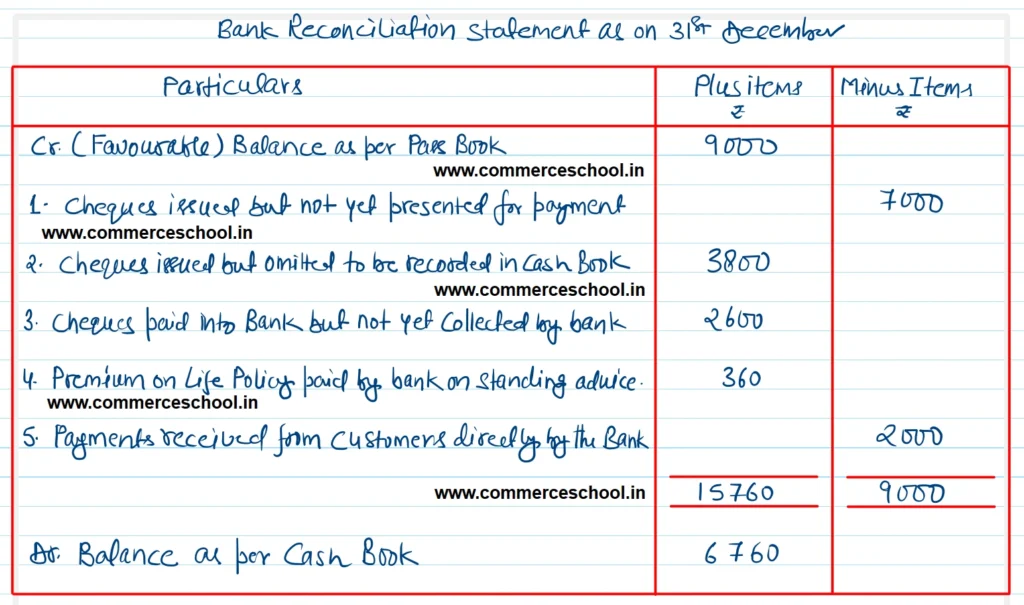

Q. 15. On 31st March, 2025 the Pass Book shows a credit balance of ₹ 9,000. Prepare a Bank Reconciliation Statement from the following particulars:-

| ₹ | ||

| 1 | Payments received from customers directly by the bank | 7,000 |

| 2 | Cheques issued but omitted to be recorded in the Cash Book | 3,800 |

| 3 | Cheques paid into bank but not yet collected by the bank | 2,600 |

| 4 | Premium on LIfe Policy paid by the bank on standing advice | 360 |

| 5 | Payments received from customers direct by the bank | 2,000 |

[Ans. Dr. Balance as per Cash Book ₹ 6,760.]

Solution:-

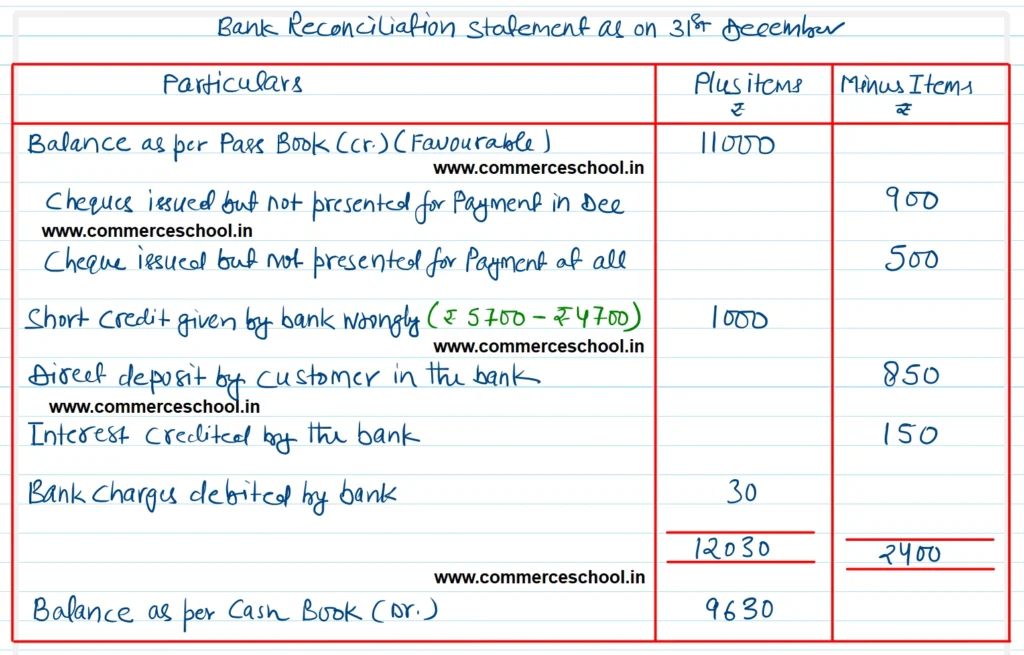

Q. 16. From the following particulars, prepare a Bank Reconciliation Statement of Sh. Yadav on 31st December 2024:-

Balance as per Pass Book on 31st December, 2024 is ₹ 11,000. Cheques for ₹ 6,200 were issued during the month of December but of these cheques for ₹ 900 were presented in the month of Janaury, 2025 and one cheque for ₹ 500 was not presented for payment. Cheque and cash amounting to ₹ 5,700 were deposited in bank during December but credit was given for ₹ 4,700 only. A customer had deposited ₹ 850 into the bank directly. The bank has credited the merchant for ₹ 150 as interest and has debited him for ₹ 30 as bank charges, for which there are no corresponding entries in Cash Book.

[Ans. Balance as per Cash Book, ₹ 9,630.]

Solution:-

Below is the list of all solutions