Q. 26 solution of Retirement of Partner Chapter TS Grewal Book Class 12 2021-22

Are you looking for the solution of Question number 26 of the Retirement of Partner Chapter of TS Grewal Book 2021-22 Edition for the 2021-22 session?

Question number 26 of the Retirement of Partner chapter is a practical one.

Solution of Question Number 26 of Retirement of Partner Chapter of TS Grewal Book 2021-22 Class 12

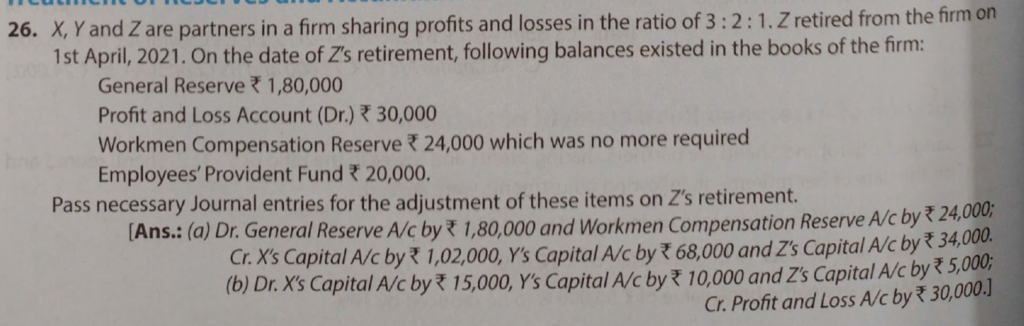

Question – 26

X, Y, and Z are partners in firm sharing profits and losses in the ratio of 3:2:1. Z retired from the firm on 1st April 2020. On the date of Z’s retirement, the following balances existed in the books of the firm.:

General Reserve ₹ 1,80,000

Profit and Loss Account (Dr) ₹ 30,000

Workmen Compensation Reserve ₹ 24,000 which was no more required

Employee’s Provident Fund ₹ 20,000

Pass necessary Journal entries for the adjustment of these items on Z’s retirement.

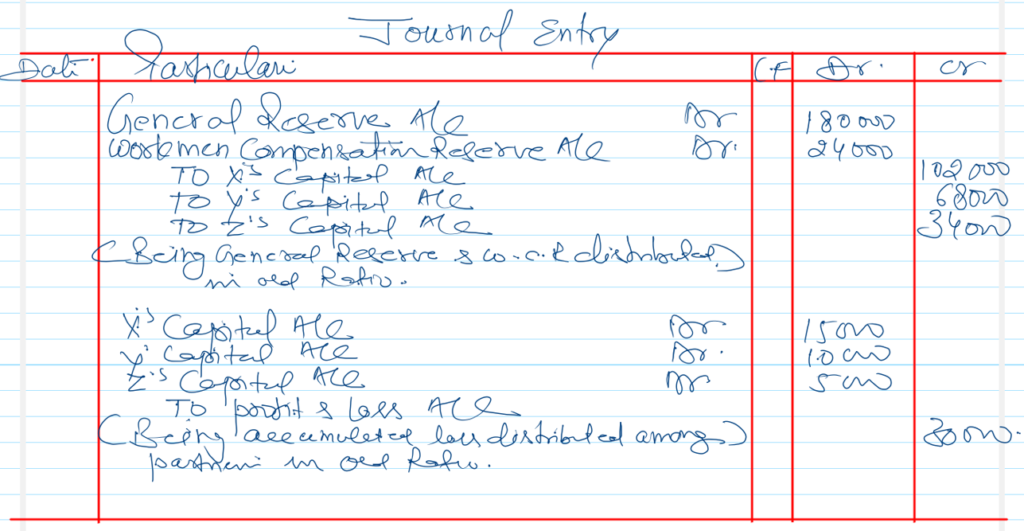

Solution:-

| S.N | Admission of Partner |

| 1. | Question – 1 |

| 2. | Question – 2 |

| 3. | Question – 3 |

| 4. | Question – 4 |

| 5. | Question – 5 |

| 6. | Question – 6 |

| 7. | Question – 7 |

| 8. | Question – 8 |

| 9. | Question – 9 |

| 10. | Question – 10 |

| S.N | Admission of Partner |

| 11. | Question – 11 |

| 12. | Question – 12 |

| 13. | Question – 13 |

| 14. | Question – 14 |

| 15. | Question – 15 |

| 16. | Question – 16 |

| 17. | Question – 17 |

| 18. | Question – 18 |

| 19. | Question – 19 |

| 20. | Question – 20 |

| S.N | Admission of Partner |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Admission of Partner |

| 31. | Question – 31 |

| 32. | Question – 32 |

| 33. | Question – 33 |

| 34. | Question – 34 |

| 35. | Question – 35 |

| 36. | Question – 36 |

| 37. | Question – 37 |

| 38. | Question – 38 |

| 39. | Question – 39 |

| 40. | Question – 40 |