Q. 13 solution of Dissolution of Partnership Firm Chapter TS Grewal Book Class 12 2021-22

Are you looking for the solution of Question number 13 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2021-22 Edition for the 2021-22 session?

Question number 13 of the Dissolution of Partnership Firm chapter is a practical one.

Solution of Question Number 13 of Dissolution of Partnership Firm Chapter of TS Grewal Book 2021-22 Class 12

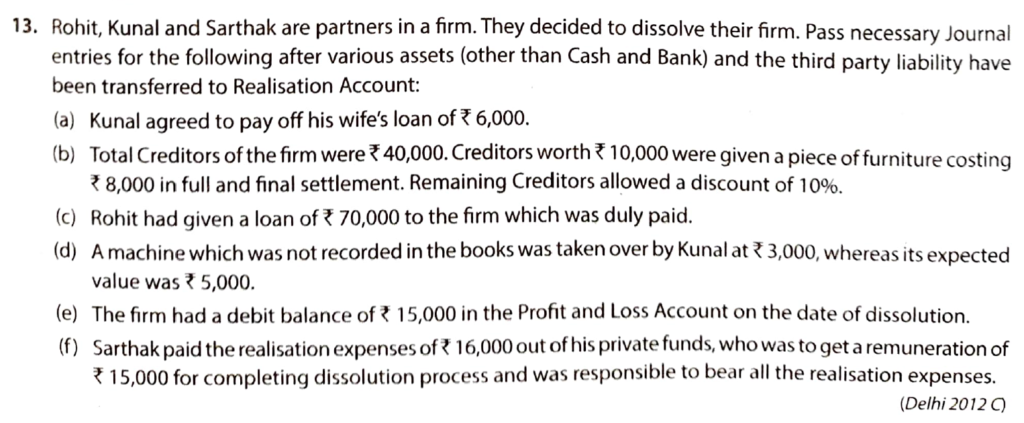

Question – 13

Rohit, Kunal and Sarthak are partners in a firm. They decided to dissolve their firm. Pass necessary Journal entries for the following after various assets (other than Cash and Bank) and the third party liabilities have been transferred to Realisation Account:

a) Kunal agreed to pay off his wife’s loan of ₹6,000.

b) Total Creditors of the firm were ₹40,000. Creditors worth ₹10,000 were given a piece of furniture costing ₹8,000 in full and final settlement. Remaining creditors allowed a discount of 10%

c) Rohit had given a loan of ₹70,000 to the firm which was duly paid.

d) A machine that was not recorded in the book was taken over by Kunal at ₹3,000. Whereas its expected value was ₹5,000.

e) The firm had a debit balance of ₹15,000 in the profit and loss Account on the date of dissolution.

f) Sarthak paid the realisation expenses of ₹16,000 out of his private funds, who was to get a remuneration of ₹15,000 for completing the dissolution process and was responsible to bear all the realisation expenses.

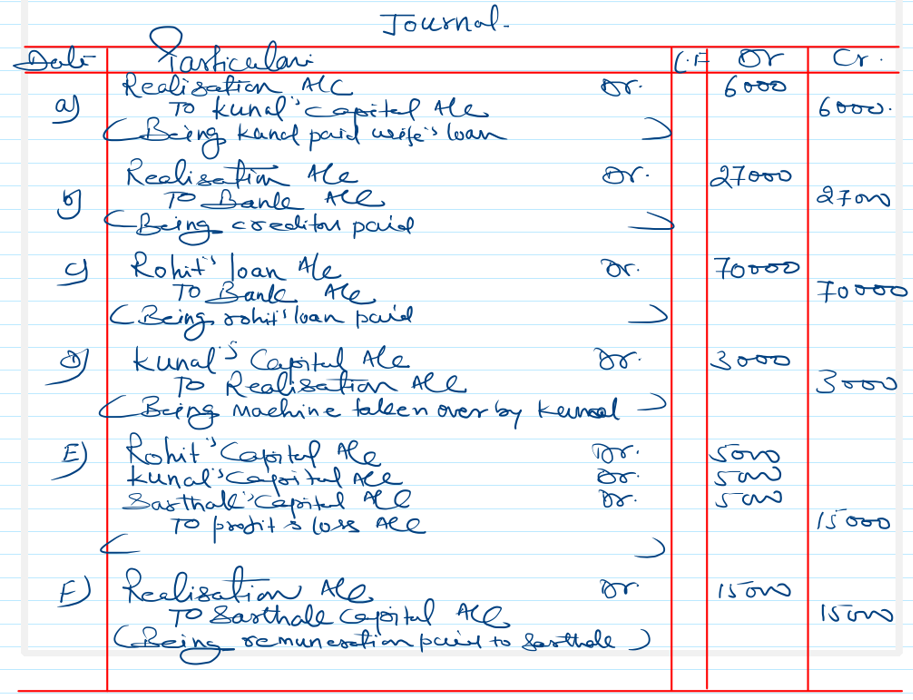

Solution:-

Here is the list of solutions

| S.N | Link to Solution |

| 1. | Question – 1 |

| 2. | Question – 2 |

| 3. | Question – 3 |

| 4. | Question – 4 |

| 5. | Question – 5 |

| 6. | Question – 6 |

| 7. | Question – 7 |

| 8. | Question – 8 |

| 9. | Question – 9 |

| 10. | Question – 10 |

| S.N | Link to Solution |

| 11. | Question – 11 |

| 12. | Question – 12 |

| 13. | Question – 13 |

| 14. | Question – 14 |

| 15. | Question – 15 |

| 16. | Question – 16 |

| 17. | Question – 17 |

| 18. | Question – 18 |

| 19. | Question – 19 |

| 20. | Question – 20 |

| S.N | Link to Solution |

| 21. | Question – 21 |

| 22. | Question – 22 |

| 23. | Question – 23 |

| 24. | Question – 24 |

| 25. | Question – 25 |

| 26. | Question – 26 |

| 27. | Question – 27 |

| 28. | Question – 28 |

| 29. | Question – 29 |

| 30. | Question – 30 |

| S.N | Link to Solution |

| 31. | Question – 31 |

| 32. | Question – 32 |

| 33. | Question – 33 |

| 34. | Question – 34 |

| 35. | Question – 35 |

| 36. | Question – 36 |

| 37. | Question – 37 |

| 38. | Question – 38 |

| 39. | Question – 39 |

| 40. | Question – 40 |