Capital Expenditure in Government Budget – definition, types examples class 12

Looking for what is capital expenditure in Government budget chapter macroeconomics, Its definition, types, and examples, as per the class 12 syllabus.

capital Expenditures are one of the components of a Capital Budget or Budget Expenditures.

What is Capital Expenditure (Class 12)

There are expenditures of the government which result in the creation of physical or financial assets or reduction in financial liabilities.

Definition of Capital Expenditure (Class 12)

Following are the various definition given in reference books.

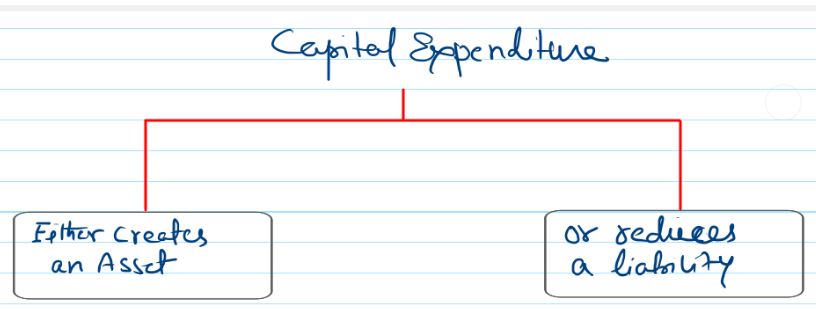

Capital expenditure is that which leads to creation of assets or lead to reduction in liabilities.

S.K Aggarwal

Capital expenditure refers to the estimated expenditure of the government is a fiscal year that creates assets or causes a reduction in liabilities.

T.R Jain

Capital Expenditure refers to the expenditure which either creates an assets or causes a reduction in the liabilities of the government.

Sandeep Garg

Types of Capital Expenditure

Capital expenditure can be categorized into two parts.

Planned Capital Expenditure

Non-planned Capital Expenditure

Examples of Capital Expenditure (Class 12)

- Expenditure on the acquisition of land, building, machinery, equipment, investment in shares by government.

- loans and advances by the central government to state and union territory governments, PSUs and other parties.

- repayment of liabilites.

| Topic | Chapters (Unit) |

| Syllabus | Syllabus of Government Budget and the Economy chapter Economics class 12 |

MCQs of Government Budget for class 12, CUET, CBSE, ISC and state Board

| 1. | MCQS of Government Budget class 12, CUET, CBSE, ISC |

| 2. | Assertion Reason MCQs of Government Budget class 12, CUET, CBSE, ISC |

| 3. | Matching Type MCQs of Government Budget class 12, CUET, CBSE, ISC |

| 4. | Case/situation Based MCQs of Government Budget class 12, CUET, CBSE, ISC |