Capital Receipts in government Budget – definition, types, examples class 12

looking for what is capital receipts in government budget. Its definition, types, and examples as per the class 12 syllabus.

This topic is concerned with the government budget chapter of Macroeconomics.

Capital receipts are one of the components of a Capital Budget or Budget Expenditures.

What is Capital Receipts (Class 12)

When the government receives money by raising loans or from the sale of assets. Such receipts are termed Capital Receipts.

Definition of Capital Receipts (Class 12)

Raising of funds by the government either by incurring liability or by disposing of assets held by it is treated as capital receipt.

S.K Aggarwal

Capital receipts refer to those receipts which either create a liability or cause a reduction in the assets of the government.

Sandeep Garg

Capital receipts are those money receipts of the government which either create a liability for the government or causes a reduction in its assets.

T.R Jain

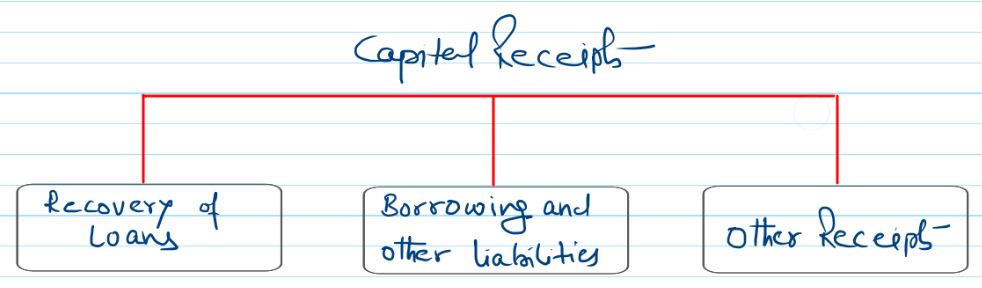

What are the types of Capital Receipts (Class 12)

In India, capital receipts of the government budget are often classified as under:-

Recovery of Loans:-

The central government grant loans to state governments, union territory governments,s, and other parties. When government recovers these loans from it debtors it is treated as capital receipts. It leads to a reduction in the financial assets of the government.

Borrowing and other liabilities:-

It includes the borrowing of the government from various sources such as the general public, central bank, and foreign governments and bodies.

Raising funds through borrowing leads to an increase in the liabilities of the government. It is a capital receipt.

Other Capital Receipts:-

It includes all sources other than recovery of loans and borrowing. Disinvestment is one other source of capital receipts.

When the government raises funds by selling its equity holding, it is called ‘disinvestment’.

| Topic | Chapters (Unit) |

| Syllabus | Syllabus of Government Budget and the Economy chapter Economics class 12 |

MCQs of Government Budget for class 12, CUET, CBSE, ISC and state Board

| 1. | MCQS of Government Budget class 12, CUET, CBSE, ISC |

| 2. | Assertion Reason MCQs of Government Budget class 12, CUET, CBSE, ISC |

| 3. | Matching Type MCQs of Government Budget class 12, CUET, CBSE, ISC |

| 4. | Case/situation Based MCQs of Government Budget class 12, CUET, CBSE, ISC |