[CBSE] DK Goel Q. 35 Change in Profit Sharing Ratio Solutions Class 12 (2024-25)

Solution of Question 35 of Change in Profit sharing ratio DK Goel Class 12 CBSE (2024-25)

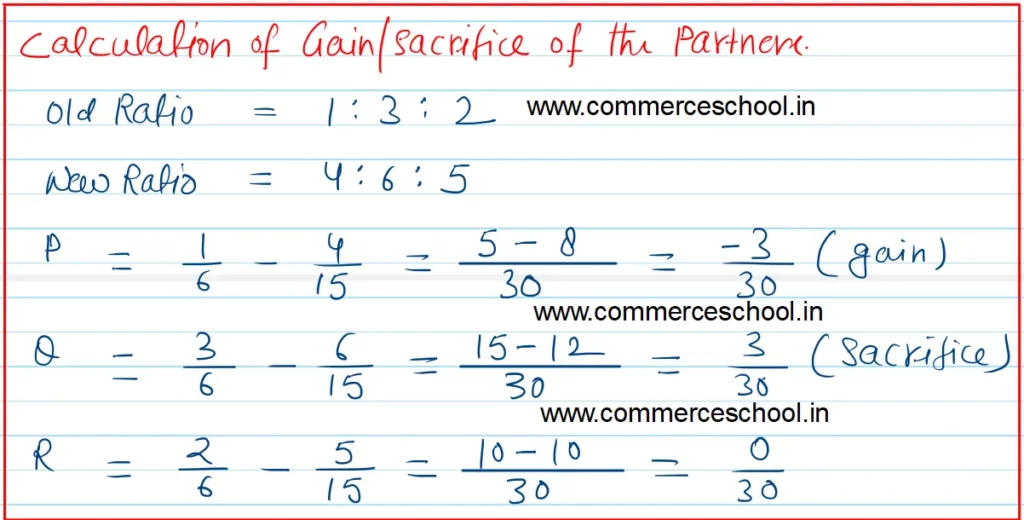

P, Q and R were partners sharing profits in the ratio of 1 : 3 : 2. Following was their Balance Sheet as at 31st March, 2022:

| Liabilities | ₹ | Assets | ₹ |

| Sundry Creditors | 2,80,000 | Land and Building | 5,00,000 |

| Outstanding Expenses | 15,000 | Investments (Market Value ₹ 1,10,000) | 1,25,000 |

| Workmen Compensation Reserve | 60,000 | Stock | 2,20,000 |

| Investment Fluctuation Reserve | 45,000 | Sundry Debtors | 3,20,000 |

| Capital Accounts: P Q R | 2,00,000 5,00,000 3,00,000 | Bank Balance | 1,60,000 |

| Advertisement Suspense | 75,000 | ||

| 14,00,000 | 14,00,000 |

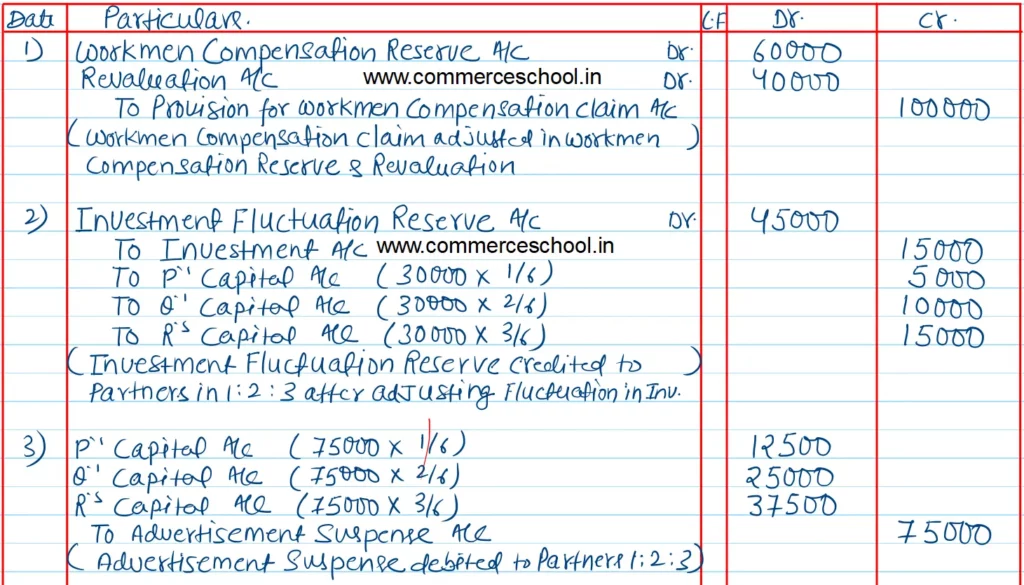

On 1st April, 2022 they decided to share future profits in the ratio of 4 : 6 : 5. It was agreed that:

(I) Claim for Workmen’s Compensation has been estimated at ₹ 1,00,000.

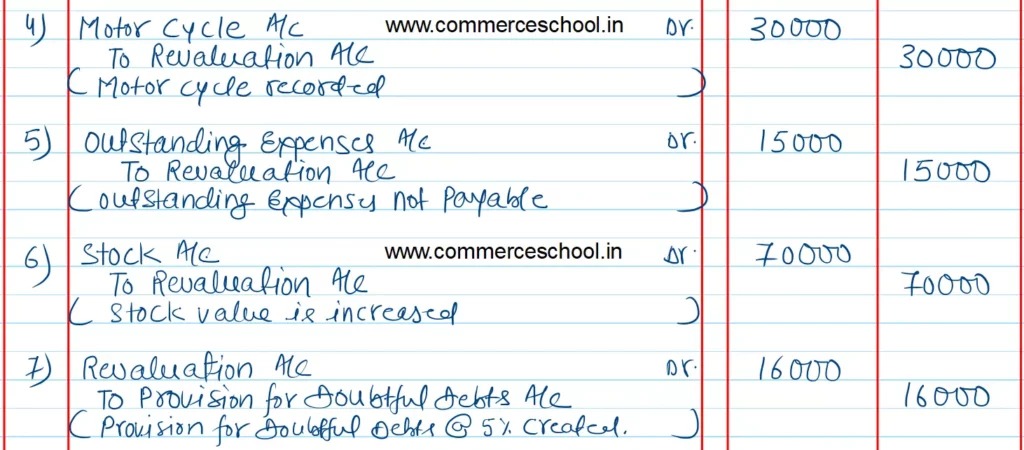

(ii) A motorcycle valued at ₹ 30,000 was unrecorded and is now to be recorded in the books.

(iii) Outstanding expenses were not payable any more.

(iv) Value of stock be increased to ₹ 2,90,000.

(v) A provision for doubtful debts be created @ 5% on Sundry Debtors.

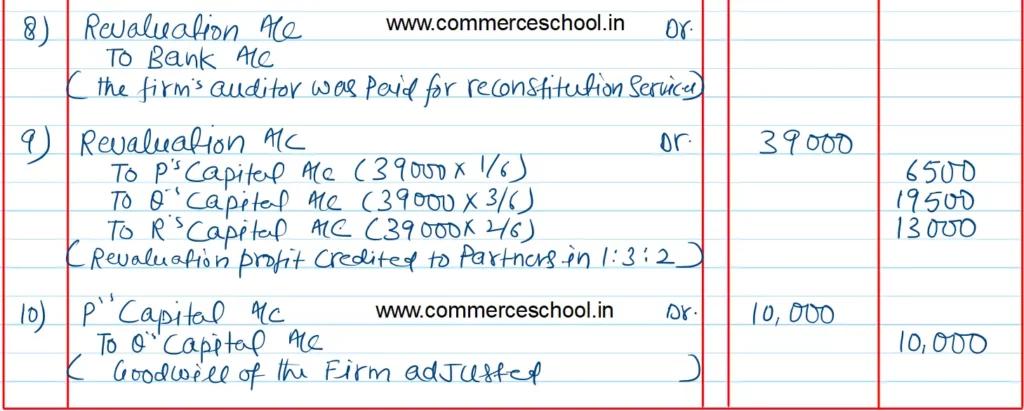

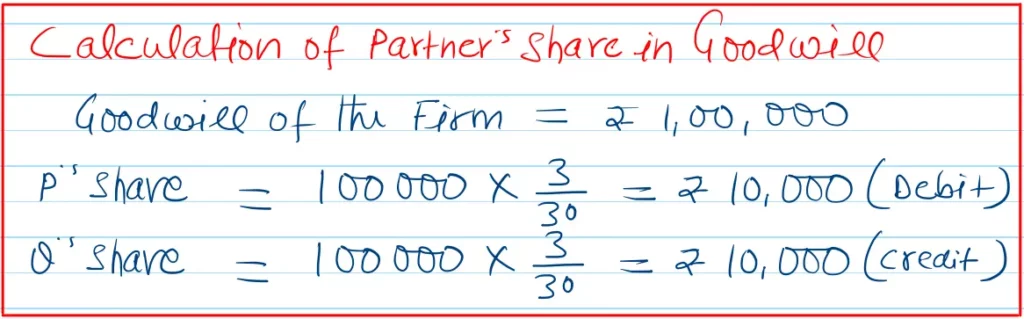

(vi) Goodwill is valued at ₹ 1,00,000.

(vii) The work for reconstitution was assigned to firm’s auditors. They were paid ₹ 20,000 for this work.

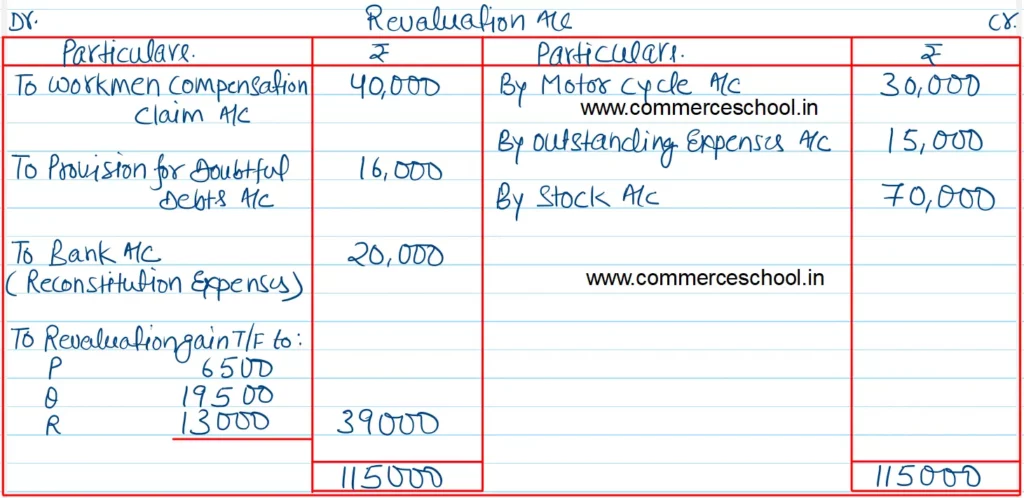

Pass journal entries and prepare Revaluation Account.

[Ans. Gain on Revaluation ₹ 39,000.]

Solution:-

Working Notes:-

Here are the solutions of Change in Profit Sharing ratio chapter of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |