[CBSE] Q 1, Q 2 Accounts for Incomplete Records Solutions (2025-26)

Solution of Question number 1 and 2 Accounts for Incomplete Records (Single Entry System) CBSE Board (2025-26)

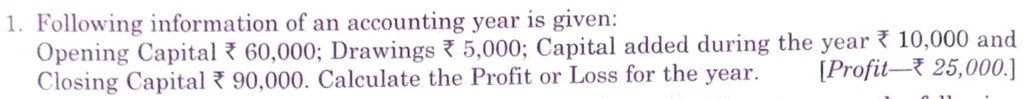

Q. 1 Following information of an accounting year is given:

Opening Capital ₹ 60,000; Drawings ₹ 5,000; Capital added during the year ₹ 10,000 and Closing Capital ₹ 90,000. Calculate the Profit or Loss for the year.

[Profit – ₹ 25,000.]

Solution:-

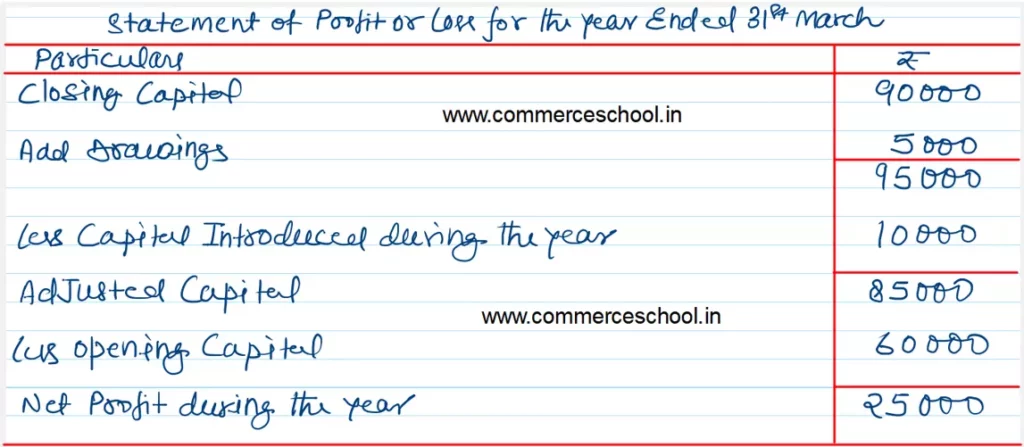

Q. 2 Pankaj maintains his books of account on Single Entry System. He provides following information from his books.

Find out additional capital introduced in the business during the year 2022-23.

Opening Capital – ₹ 1,30,000

Drawings during the year – ₹ 50,000

Closing Capital – ₹ 2,00,000

Profit made during the year – ₹ 1,00,000.

[Additional Capital – ₹ 20,000.]

Solution:-

Following is the list