[CBSE] Q 1, Q 2 Solutions Financial Statements of Sole Proprietorship TS Grewal Class 11 (2025-26)

Solution of Question number 1 and 2 of the Financial Statements of Sole Proprietorship of TS Grewal Book class 11, 2025-26?

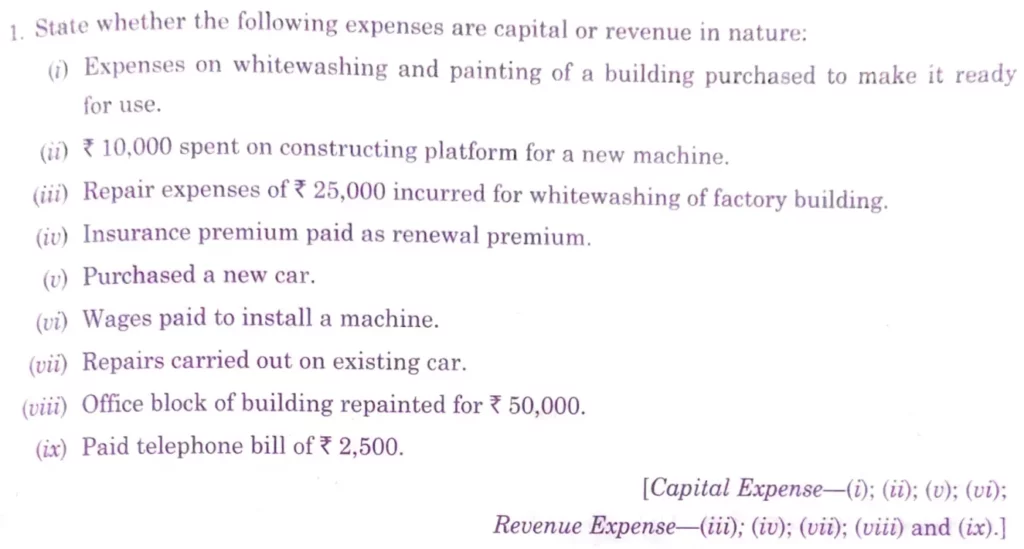

Q. 1. State whether the following expenses are capital or revenue in nature:

(i) Expenses on whitewhashing and painting of a building purchased to make it ready for use.

(ii) ₹ 10,000 spent on constructing platform for a new machine.

(iii) Repair expenses of ₹ 25,000 incurred for whitewashing of factory building.

(iv) Insurance premium paid as renewal premium.

(v) Purchased a new car.

(vi) GST paid on purchase of new machine.

(vii) Wages paid to install a machine.

(viii) Repairs carried out on existing car.

(ix) Office block of building repainted for ₹ 50,000.

(x) Paid telephone bill of ₹ 2,500.

[Capital Expense – (i), (ii), (v), (vi), (vii); Revenue Expense – (iii), (iv), (viii), (ix) and (x).]

Solution:-

I) Capital Expenses

Reason:- Expenses incurred on after purchasing an assets are included in the purchasing cost of the assets.

ii) Capital Expenses

Reason:- Expneses incurred on a new machine to make it usable is included in the purchasing cost of the assets.

iii) Revenue Expenses

Reason:- Expenses incurred in the maintenance of the old assets of the business are the Revenue Expenses.

iv) Revenue Expenses

Reason:- Insurance premium is the day to day expenses of the business.

v) Capital Expenses

Reason:- Expenditure incurred on purchasing a new assets are Capital expenses.

vi) Capital Expenses:-

Reason:- Expenditure incurred on purchasing a new assets are Capital expenses.

vii) Capital Expenses:-

Reason:- Expenditure incurred on a new machine to make it usable in business are included in the purchasing cost of the machine. thus installation charges of a new machine are Capital expenditures.

viii) Revenue Expenses:-

Reason:- Expenses incurred on maintenance of the existing assets are considered as day to day expenses of the business. Thus Repairs of existing car are Revenue Expenses.

ix) Revenue Expenses

Reason:- Expenses incurred on maintenance of the existing assets are considered as day-to-day expenses of the business. Thus expenses of repainted of office blocks are Revenue Expenses.

x) Telephone Bill:-

Reason:- Expenses on Telephone bill are day to day expenses of the business. Thus are Revenue Expenses.

Q. 2. From the following information, determine Gross Profit for the year ended 31st March, 2025:

| Opening Stock (1st April, 2022) Freight and Packing Sales | 50,000 20,000 3,80,000 | Goods purchased during the year Closing Stock (31st March, 2023) Packing Expenses on Sales | 2,80,000 60,000 12,000 |

[Gross Profit – ₹ 90,000.]

[Hint: ‘Packing Expenses on Sales’ are indirect Expenses]

Solution:-

Here is the list of all Solutions.

| S.N | Solutions |

| 1 | Question – 1, 2 |

| 2 | Question – 3, 4 |

| 3 | Question – 5, 6 |

| 4 | Question – 7, 8 |

| 5 | Question – 9, 10 |

| 6 | Question – 11, 12 |

| 7 | Question – 13, 14 |

| 8 | Question – 15, 16 |

| 9 | Question – 17, 18 |

| 10 | Question – 19, 20 |

| S.N | Solutions |

| 11 | Question – 21, 22 |

| 12 | Question – 23, 24 |

| 13 | Question – 25, 26 |

| 14 | Question – 27, 28 |

| 15 | Question – 29, 30 |