[CBSE] Q 12 Accounts for Incomplete Records Solutions (2023-24)

Solution of Question number 12 Accounts for Incomplete Records (Single Entry System) CBSE Board (2023-24)

Kuldeep, a general merchant, keeps his accounts on Single Entry System. He wants to know the results of his business on 31st March, 2023 and for that following information available:

| 1st April, 2022 (₹) | 31st March, 2023 (₹) | |

| Cash in Hand | 1,50,000 | 1,75,000 |

| Bank Balance | 7,50,000 | 8,00,000 |

| Furniture | 1,00,000 | 1,00,000 |

| Stock | 5,00,000 | 6,50,000 |

| Creditors | 3,50,000 | 4,00,000 |

| Debtors | 2,50,000 | 3,00,000 |

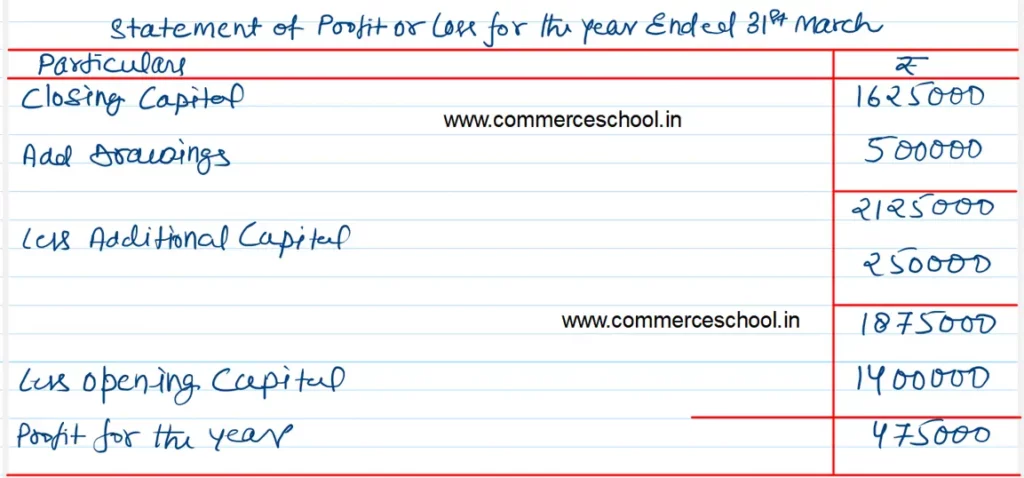

During the year, he had withdrawn ₹ 5,00,000 for his personal use and invested ₹ 2,50,000 as additional capital. Calculate his profits on 31st March 2023 and prepare the Statement of Affairs as on that date.

[Profit – ₹ 4,75,000.]

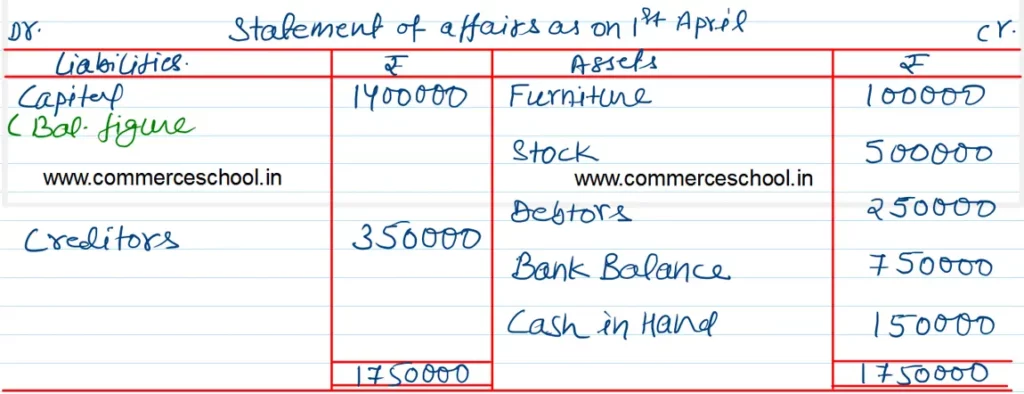

Solution:-

Following is the list

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |