[CBSE] Q 123 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

[CBSE] Q 123 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

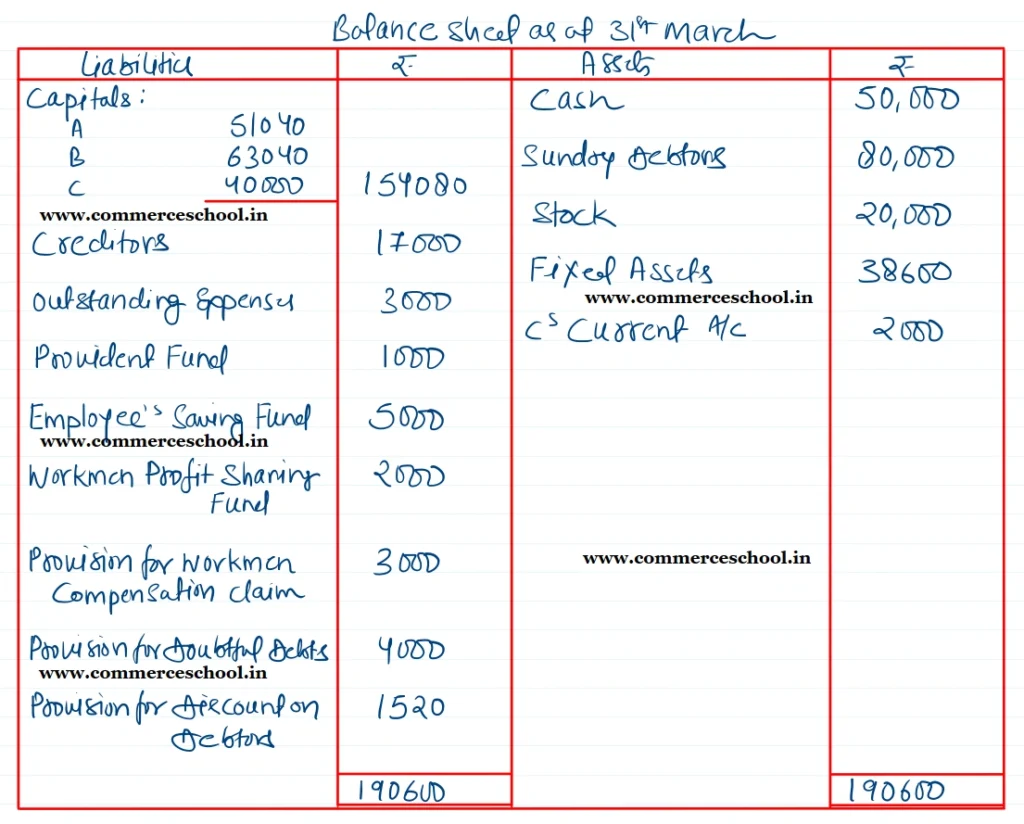

A and B are partners in a firm. Their Balance Sheet as at 31st March, 2022 was as follows:

| Liabilities | ₹ | Assets | ₹ |

| Capital: A B | 50,000 60,000 | Cash | 10,000 |

| Creditors | 15,000 | Sundry Debtors | 80,000 |

| Outstanding Exp. | 3,000 | Stock | 20,000 |

| Insurance Fund | 7,000 | Fixed Assets | 38,600 |

| Provident Fund | 1,000 | P & L A/c | 4,000 |

| Employees Saving Fund | 5,000 | ||

| Workmen Profit Sharing Fund | 2,000 | ||

| Workmen Compensation Reserve | 5,600 | ||

| Provision for Doubtful Debts | 4,000 | ||

| 1,52,600 | 1,52,600 |

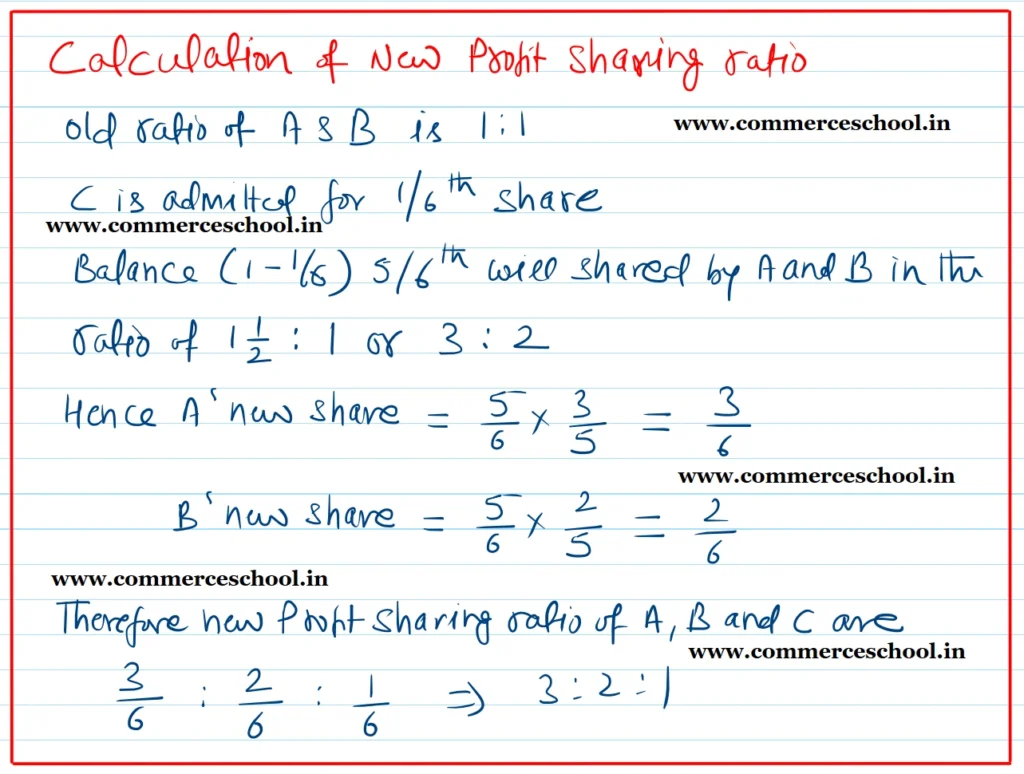

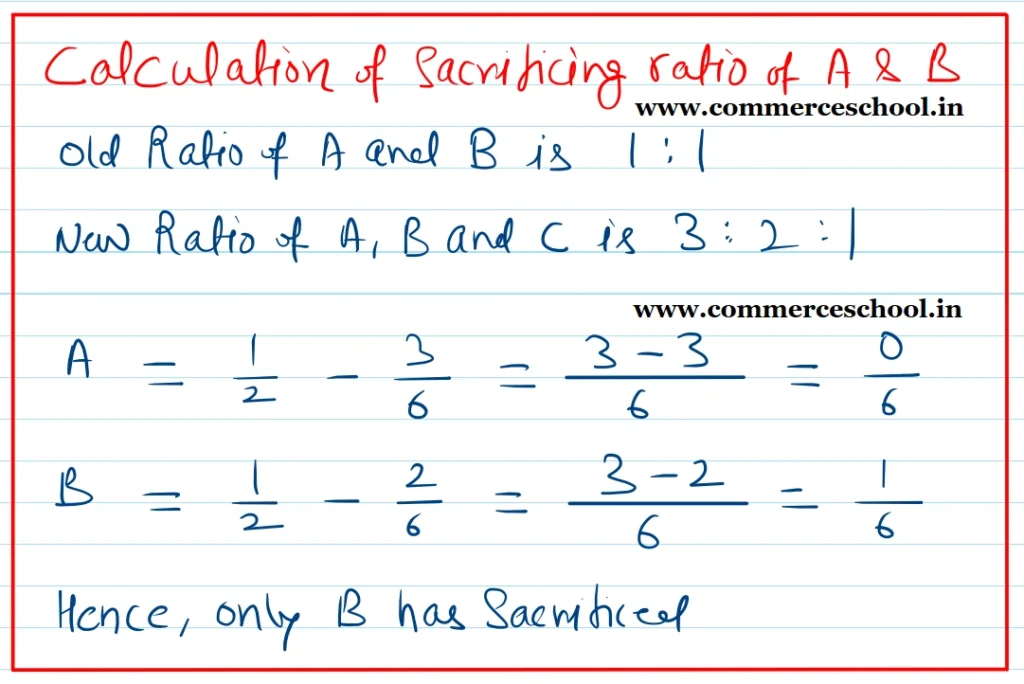

C was taken into partnership as from 1.4.2022 on following terms for 1/6 share:

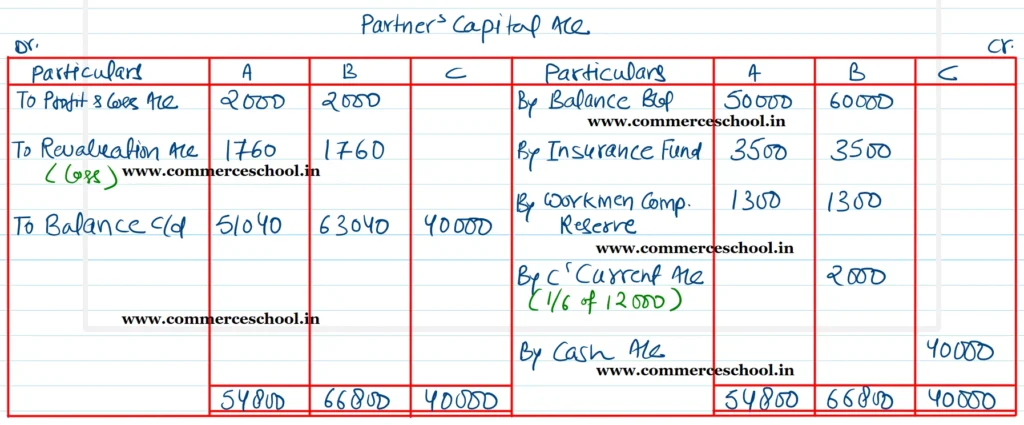

(1) C will bring ₹ 40,000 as his capital.

(2) Goodwill is valued at ₹ 12,000 and admitting partner is unable to bring his share of goodwill in cash.

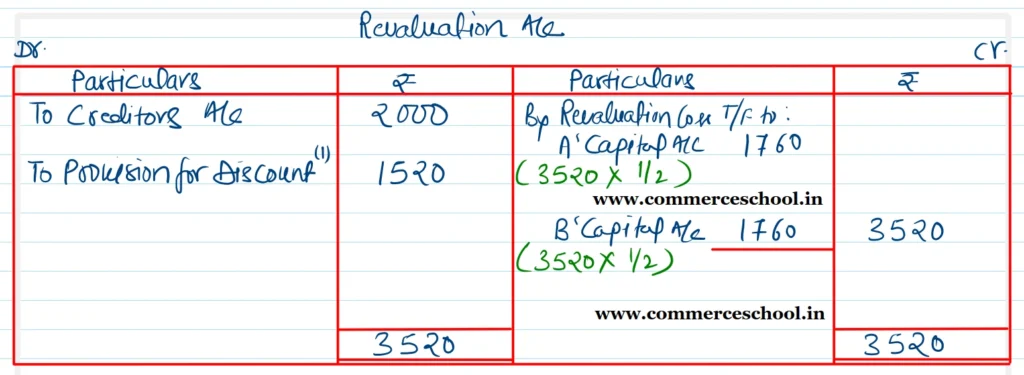

(3) Claim on account of Workmen’s Compensation is ₹ 3,000.

(4) Creditors are to be paid ₹ 2,000 more

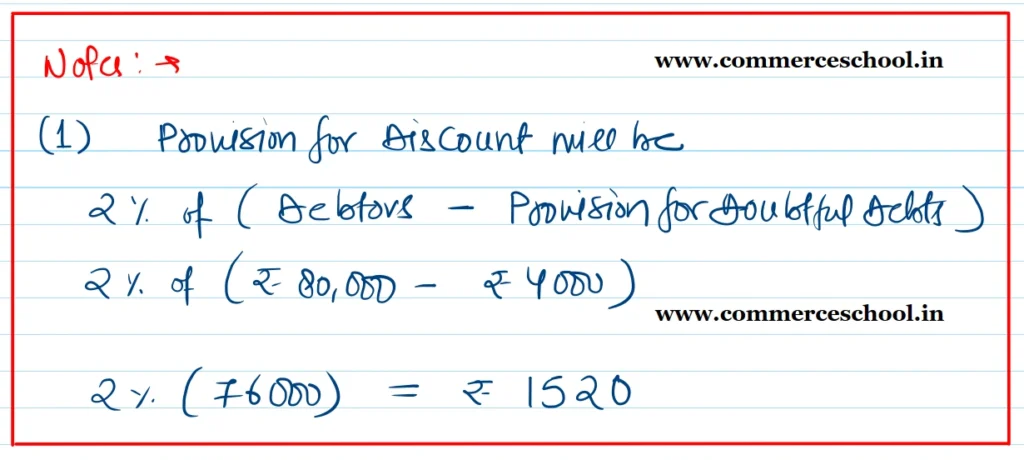

(5) 2% Provision for Discount on Debtors is required.

(6) The share of A, in the new firm will be 11/2 times of B.

Prepare Revaluation A/c, Capital Accounts and Balance Sheet.

Solution:-