[CBSE] Q 13 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 13 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Following is the Balance Sheet of Ramji Lal and Panna Lal as at 31st March, 2024:

| Liabilities | ₹ | Assets | ₹ |

| Capitals: Ramji Lal Panna Lal | 16,000 10,000 | Goodwill | 4,000 |

| Reserves | 3,600 | Machinery | 6,000 |

| Workmen Compensation Reserve | 2,000 | Plant | 12,800 |

| Creditors | 5,400 | Debtors 10,800 Less: Provision 800 | 10,000 |

| Bills Payable | 2,600 | Bank | 6,800 |

| 39,600 | 39,600 |

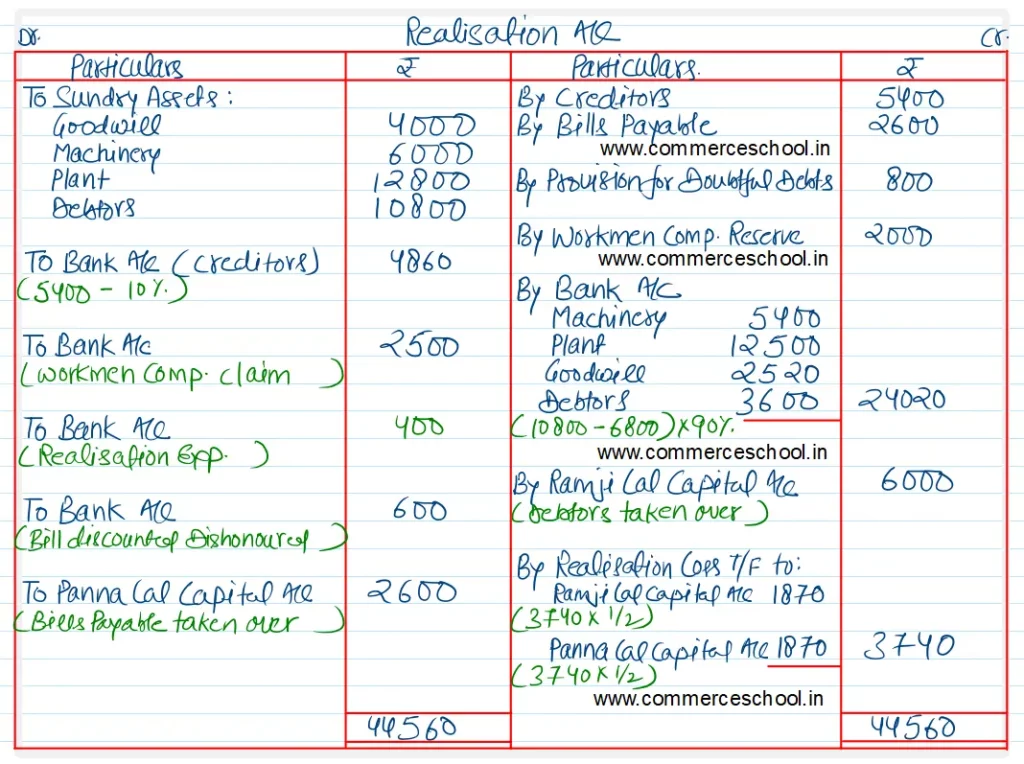

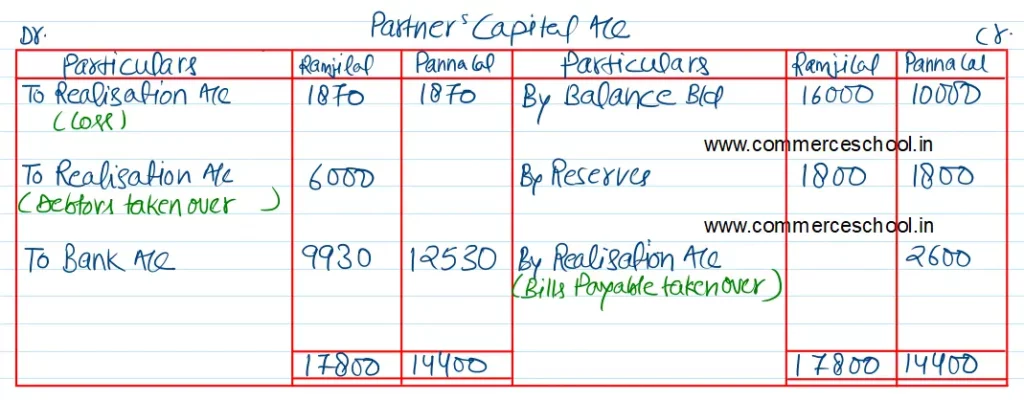

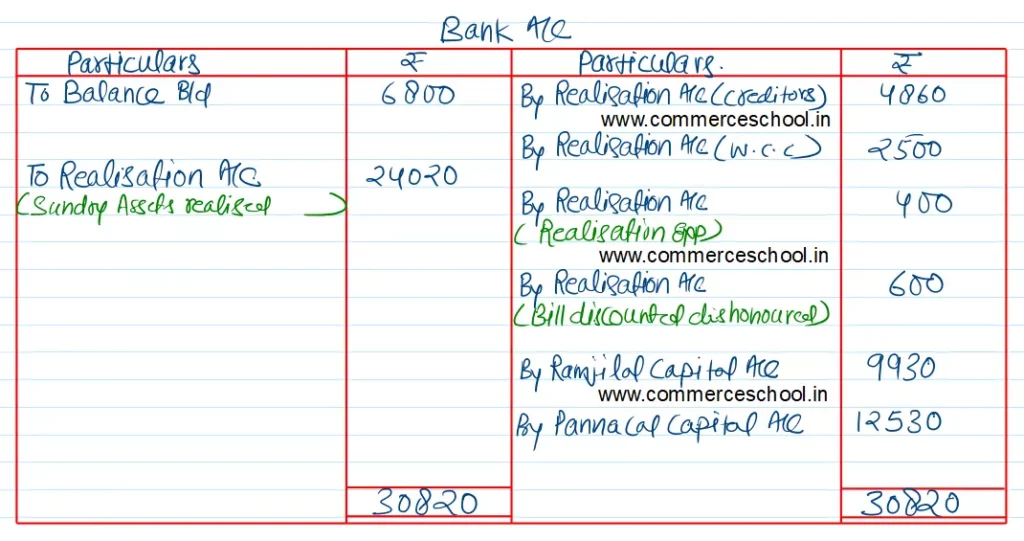

They decided to dissolve the firm. Assets are realised as follows:

(i) Machinery 10% less than book value; Plant ₹ 12,500 and Goodwill ₹ 2,520.

(ii) Ramji Lal is to take over Debtors amounting to ₹ 6,800 at ₹ 6,000, remaining Debtors were realised for 90% of the book value.

(iii) One bill of ₹ 600 under discount having been dishonoured had to be taken up by them.

(iv) The Bill payable of ₹ 2,600 to be assumed by Panna Lal at that figure.

(v) Creditors are paid off at a discount of 10%.

(vi) An amount of ₹ 2,500 had to be paid for Workmen Compensation.

(vii) The liquidation expenses amounted to ₹ 400.

You are required to show the Realisation Account, Capital Accounts and Bank Account.

[Ans. Loss on Realisation ₹ 3,740; Amount paid to Ramji Lal ₹ 9,930; Amount paid to Panna Lal ₹ 12,530; Bank Account Total ₹ 30,820.]

Hint: Entire amount of Workmen Compensation Reserve of ₹ 2,000 will be credited to Realisation Account.

Solution:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |