[CBSE] Q 132 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

[CBSE] Q 132 DK Goel Admission of a Partner Solutions Class 12 (2024-25)

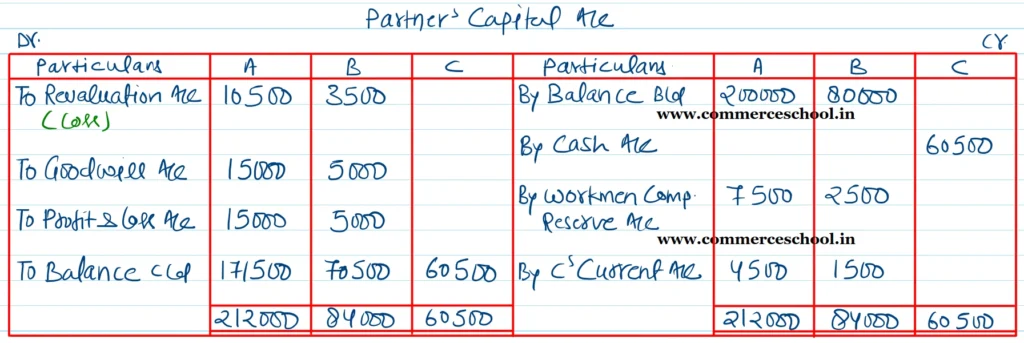

A and B are partners in a firm sharing profit and losses in the ratio of 3 : 1. On 1st April, 2022 their position was as given below:

| Liabilities | ₹ | Assets | ₹ |

| Capital Accounts: A B | 2,00,000 80,000 | Goodwill | 20,000 |

| Sundry Creditors | 70,000 | Plant | 1,00,000 |

| Workmen Compensation Reserve | 10,000 | Patents | 10,000 |

| Stock | 1,42,000 | ||

| Sundry Debtors | 50,000 | ||

| Cash | 18,000 | ||

| Profit & Loss Account | 20,000 | ||

| 3,60,000 | 3,60,000 |

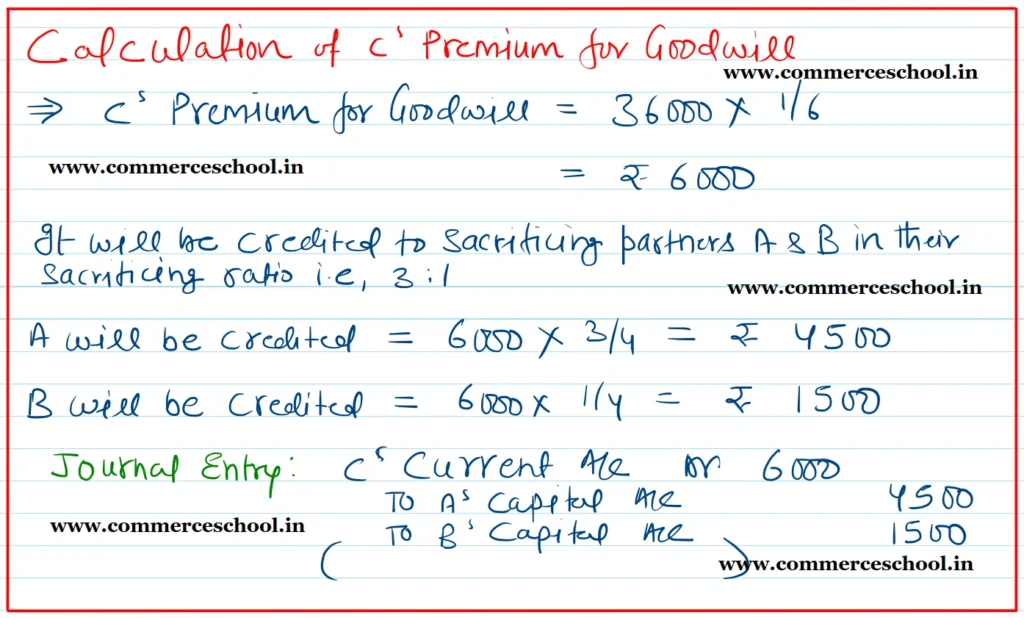

They admit C into partnership with 1/6th share in profits upon the following terms:

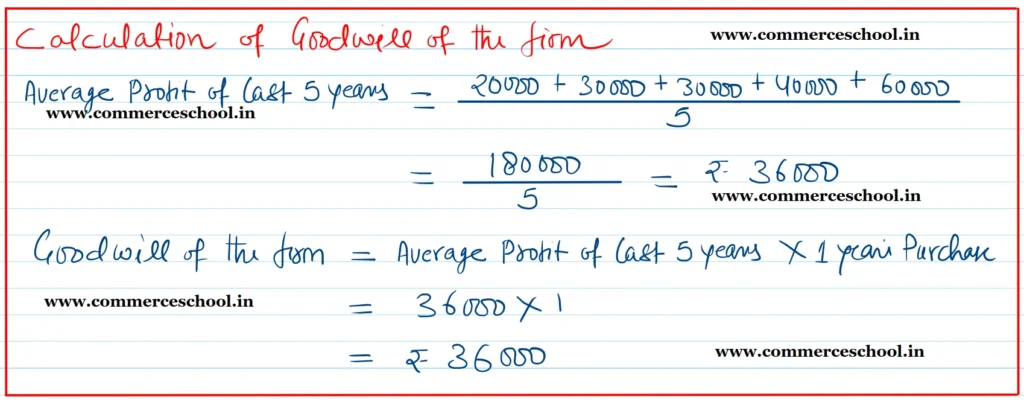

(1) Goodwill is to be valued at one year’s purchase of the five year’s average profits which were ₹ 20,000; ₹ 30,000; ₹ 30,000; ₹ 40,000 and ₹ 60,000 respectively.

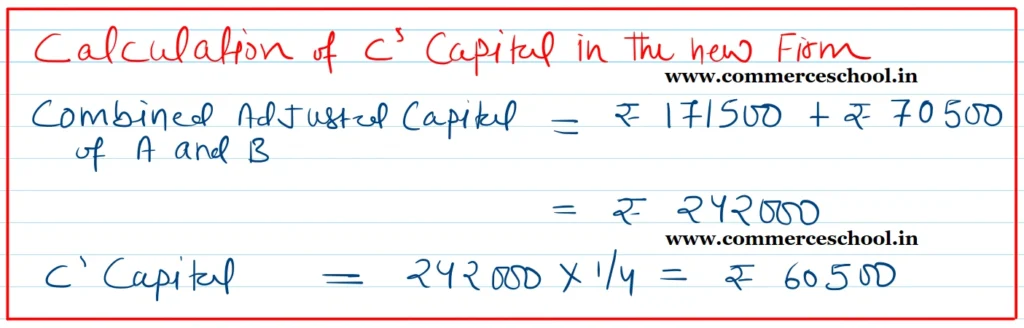

(2) C agrees to contribute 1/4 of the combined capital of A and B in the new firm.

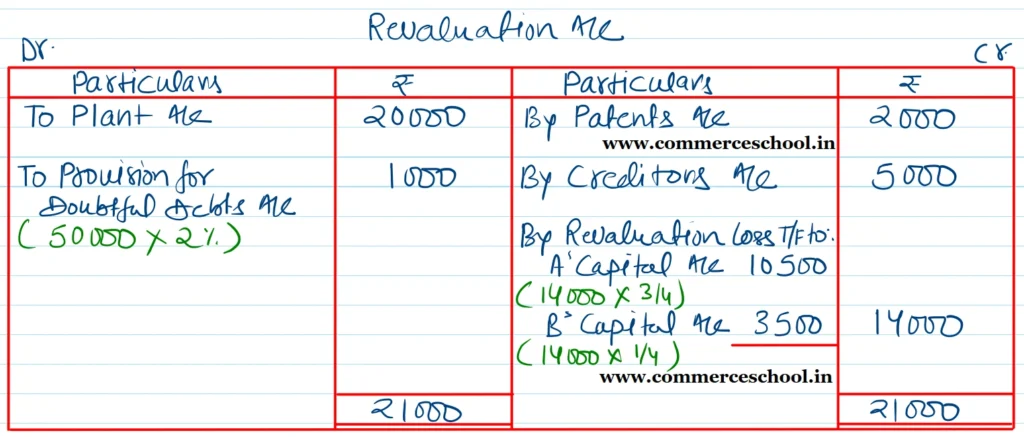

(3) Plant is to be written down to ₹ 80,000 and Patents written up to ₹ 12,000. A provision of 2% on debtors is required. A liability of ₹ 5,000 included in Sundry Creditors is not likely to arise.

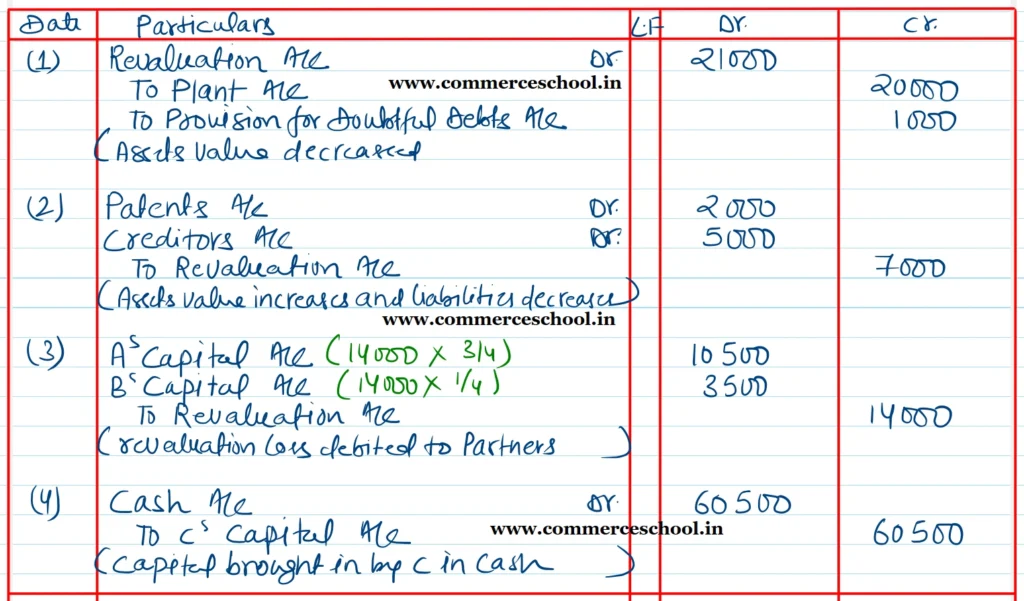

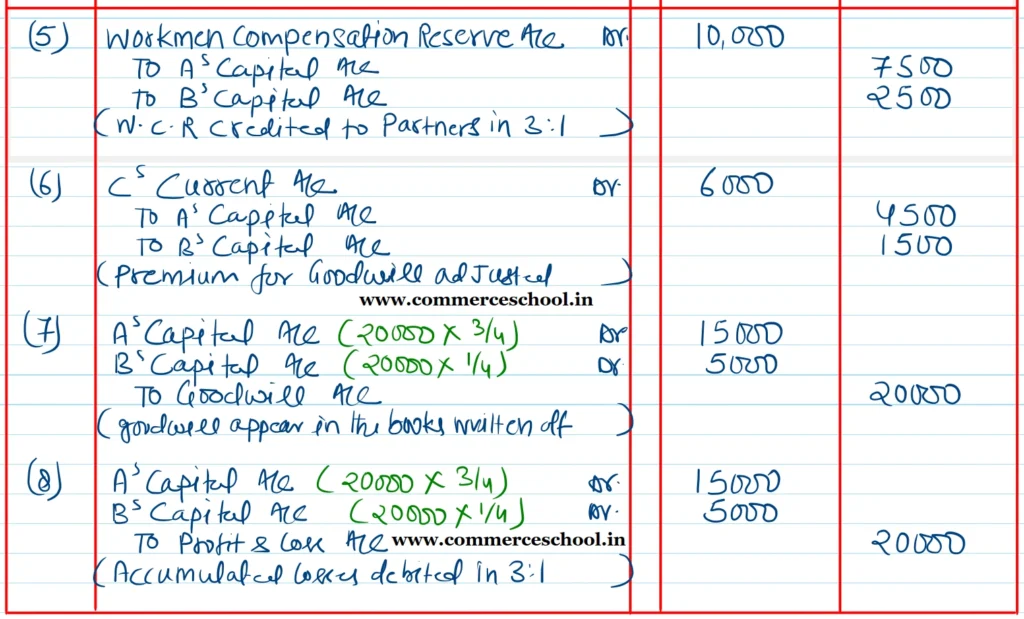

Give the Journal entries and Balance Sheet after the admission of C.

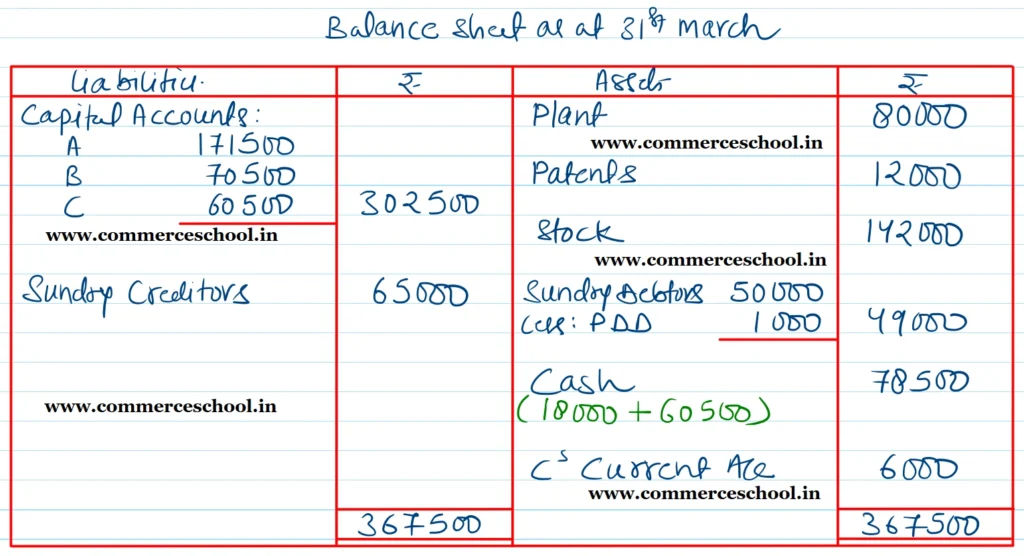

[Ans. Loss on Revaluation ₹ 14,000; Capital Accounts A ₹ 1,71,500; B ₹ 70,500 and C ₹ 60,500; C’s Current A/c (Dr.) ₹ 6,000; Cash Balance ₹ 78,500; B/S Total ₹ 3,67,500.]

Solution:-