[CBSE] Q 15 Accounts for Incomplete Records Solutions (2023-24)

Solution of Question number 15 Accounts for Incomplete Records (Single Entry System) CBSE Board (2023-24)

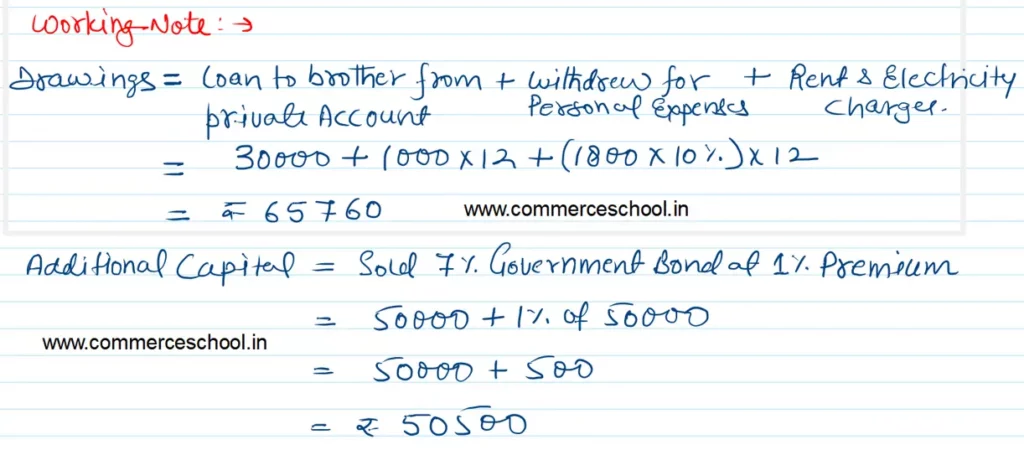

Vikas is keeping his accounts according to Single Entry System. His capital on 31st March, 2022 was ₹ 2,50,000 and his capital on 31st March, 2023 was ₹ 4,25,000. He further informs you that during the year he gave a loan of ₹ 30,000 to his brother on private account and withdrew ₹ 1,000 per month for personal purposes. He used a flat for his personal purpose, the rent of which @ ₹ 1,800 per month and electricity charges at an average of 10% of rent per month were paid from the business account. During the year, he sold his 7% Government Bonds of ₹ 50,000 at 1% premium and brought that money into the business.

Prepare a Statement of Profit or Loss for the year ended 31st March, 2023.

[Profit – ₹ 1,90,260.]

Solution:-

Following is the list

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |