[CBSE] Q 17 Accounts for Incomplete Records Solutions (2023-24)

Solution of Question number 17 Accounts for Incomplete Records (Single Entry System) CBSE Board (2023-24)

On 1st April, 2022, X started a business with ₹ 40,000 as his capital. On 31st March, 2023, his position was as follows:

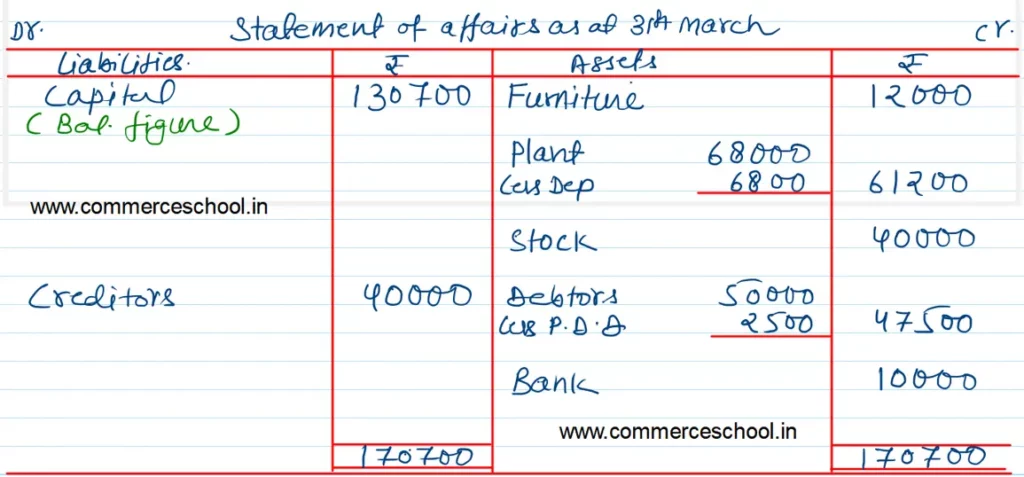

| Creditors | 40,000 |

| Bank | 10,000 |

| Debtors | 50,000 |

| Stock | 40,000 |

| Plant | 68,000 |

| Furniture | 12,000 |

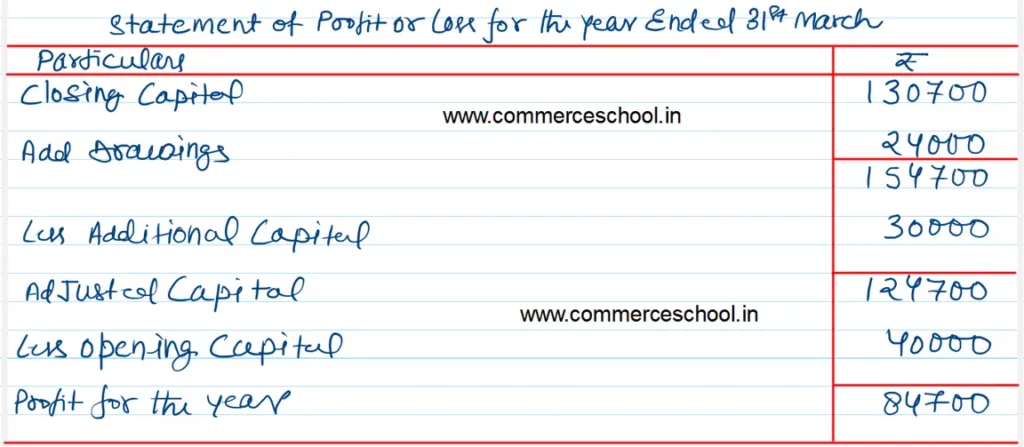

During the year 2022-23, X drew ₹ 24,000. On 1st october, 2022, he introduced further capital amounting to ₹ 30,000. You are required to ascertain profit or loss made by him during the year 2022-23.

Adjustments:

(a) Plant is to be depreciated at 10%.

(b) A provision of 5% is to be made against debtors.

Also prepare the Statement of Affairs as on 31st March, 2023.

[Profit – ₹ 84,700; Adjusted Capital (31st March 2023) – ₹ 1,30,700; Total of Statement of Affiars as on 31st March, 2023 – ₹ 1,70,700.]

Solution:-

Following is the list

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |