[CBSE] Q. 17 Death of Partner Solution TS Grewal Class 12 (2024-25)

Solution of Question number 17 of the Death of Partner Chapter of TS Grewal Book 2024-25 Edition CBSE Board.

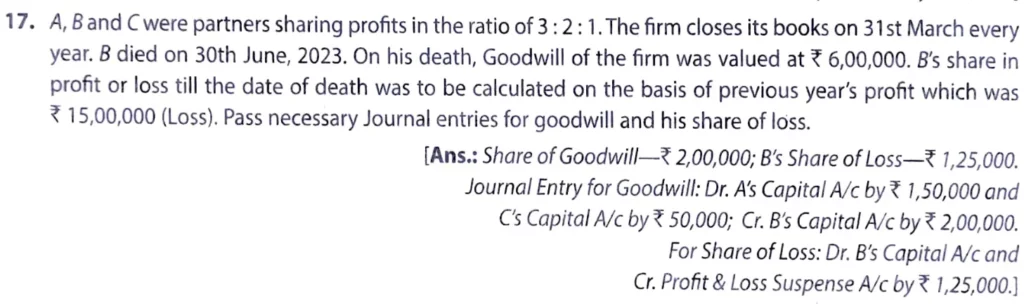

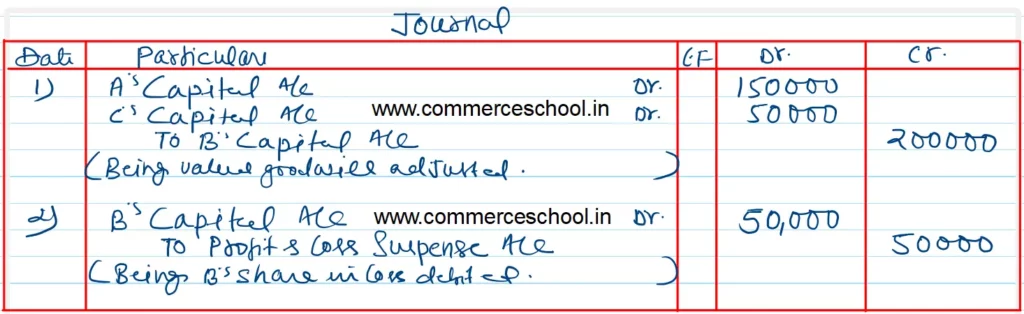

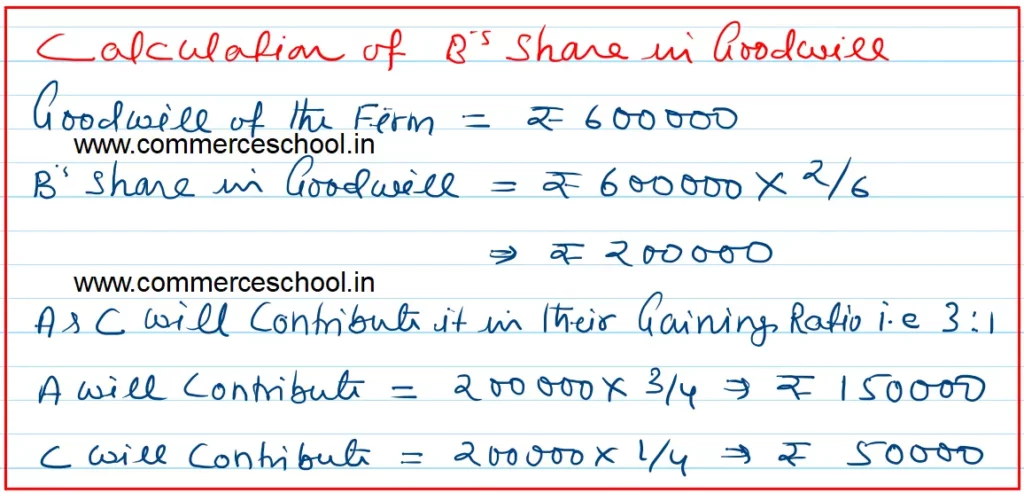

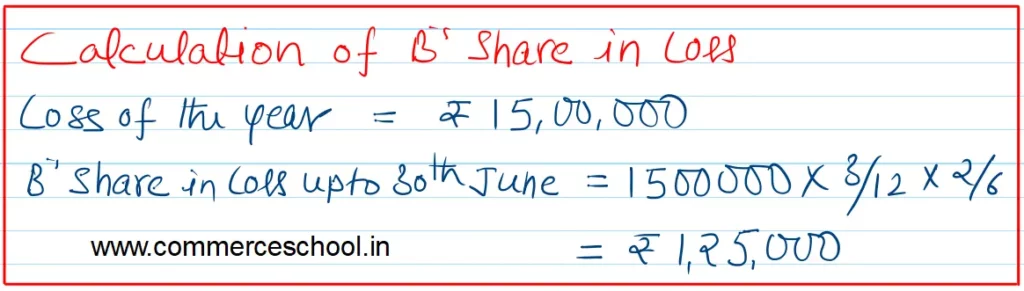

A, B and C were partners sharing profits in the ratio of 3 : 2 : 1. The firm closes its books on 31st March every year. B died on 30th June, 2022. On his death, Goodwill of the firm valued at ₹ 6,00,000. B’s share in profit or loss till the date was to be calculated on the basis of previous year’s profit which was ₹ 15,00,000 (Loss). Pass necessary Journal entries for goodwill and his share of loss.

[Ans. Share of Goodwill – ₹ 2,00,000; B’s Share of Loss – ₹ 1,25,000. Journal Entry for Goodwill: Dr. A’s Capital A/c by ₹ 1,50,000 and C’s Capital A/c by ₹ 50,000; Cr. B’s Capital A/c by ₹ 2,00,000. For Share of Loss: Dr. B’s Capital A/c and Cr. Profit & Loss Suspense A/c by ₹ 1,25,000.

Solution:-

Solutions of Death of Partner chapter 7 of TS Grewal Book class 12 Accountancy 2024-25 CBSE Board

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

Please correct the mistake in Q17 of death of a partner

The loss for the year is 15,00,000 not 1,50,000.

B’s share of loss is 15,00,000× 2÷6 × 3÷12 = 125,000

and also rectify the entry

Please correct the mistake in Q17 of death of a partner

The loss for the year is 15,00,000 not 1,50,000.

B’s share of loss is 15,00,000× 2÷6 × 3÷12 = 125,000