[CBSE] Q 17 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 17 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

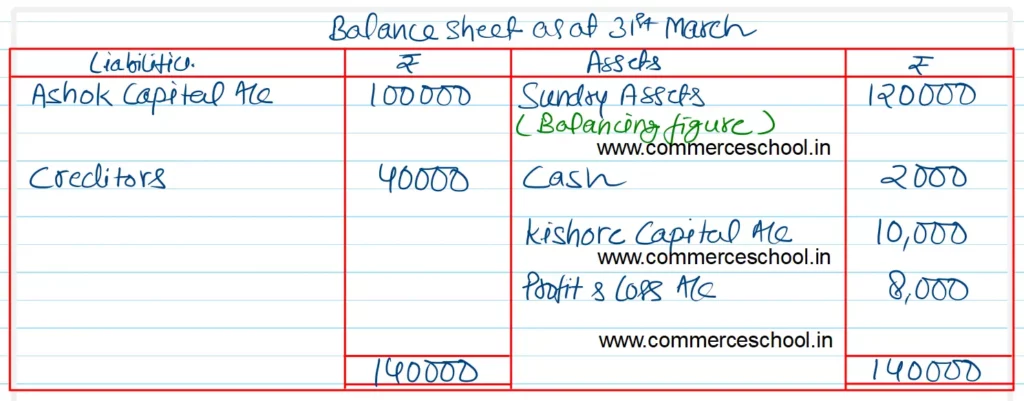

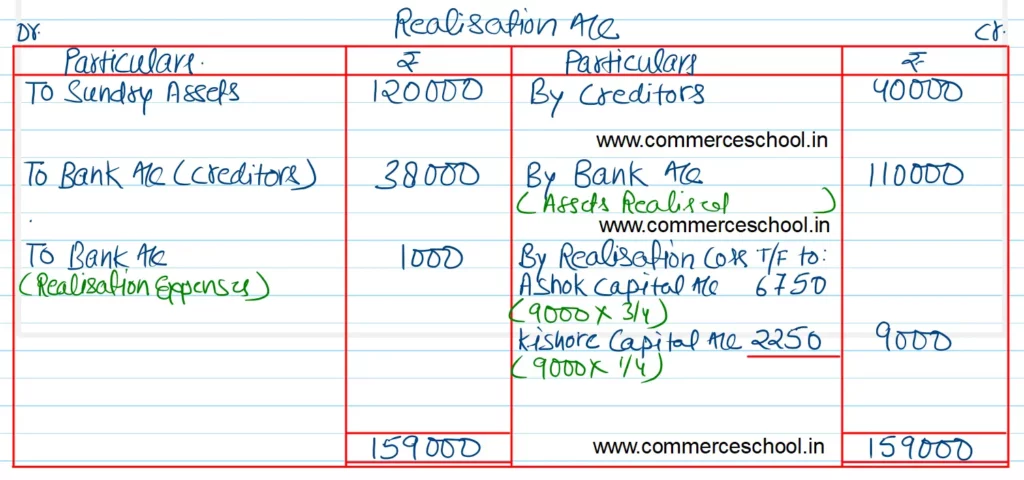

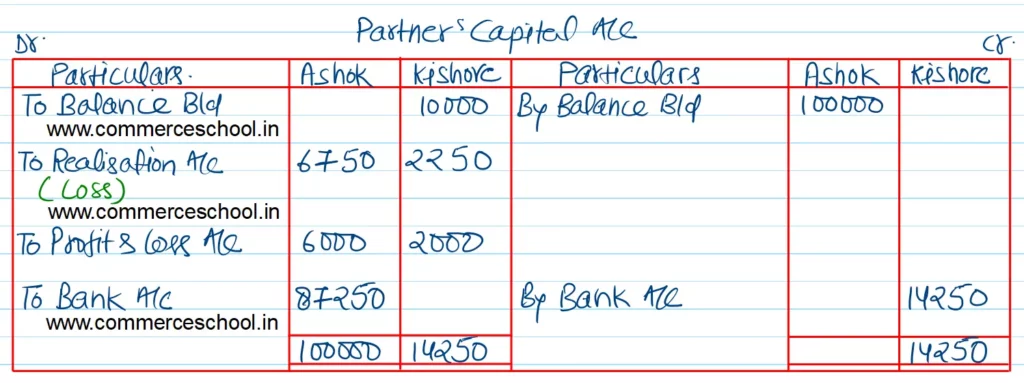

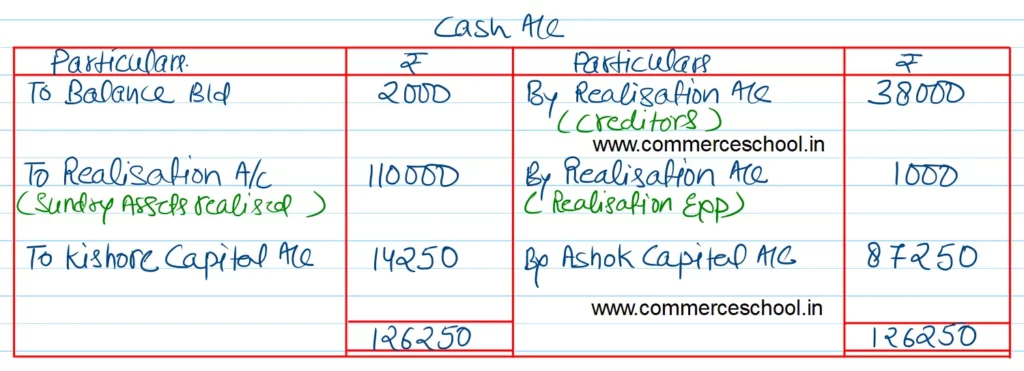

Ashok and Kishore were in partnership sharing profits in the ratio of 3 : 1. They agreed to dissolve the firm. The assets (other than cash of ₹ 2,000) of the firm realised ₹ 1,10,000. The liabilities and other particulars of the firm on that date were as follows:-

| ₹ | |

| Creditors | 40,000 |

| Ashok’s Capital | 1,00,000 |

| Kishor’s Capital | 10,000 (Dr.) |

| Profit & Loss Account | 8,000 (Dr.) |

| Realisation Expenses were | 1,000 |

Creditors were settled in full settlement at ₹ 38,000. Prepare Realisation and Cash Account.

[Ans. Book value of Assets (other than cash) ₹ 1,20,000. Loss on Realisation ₹ 9,000. Final Settlement: Kishore brings in ₹ 14,250 and Ashok is paid ₹ 87,250; Total of Cash A/c ₹ 1,26,250.]

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |