[CBSE] Q. 171 Solution of Accounting Ratios TS Grewal Class 12 (2025-26)

Solution of Q. 171 of Accounting Ratios TS Grewal Class 12 CBSE Board (2025-26)

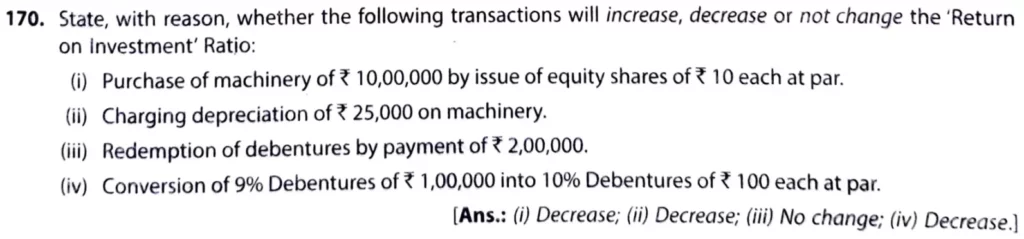

State, with reason, whether the following transactions will increase, decrease or not change the ‘Return on Investment’ Ratio:

(i) Purchase of machinery of ₹ 10,00,000 by issue of equity shares of ₹ 10 each at par.

(ii) Charging depreciation of ₹ 25,000 on machinery.

(iii) Redemption of debentures by payment of ₹ 2,00,000.

(iv) Conversion of 9% Debentures of ₹ 1,00,000 into 10% Debentures of ₹ 100 each at par.

[Ans. (i) Decrease; (ii) Decrease; (iii) No Change; (iv) Decrease.]

Solution:

(i) Purchase of machinery of ₹ 10,00,000 by issue of equity shares of ₹ 10 each at par.

The purchase of machinery worth ₹ 10,00,000 by issuing equity shares at ₹ 10 each (at par) will influence the Return on Investment (ROI) as follows:

Impact of the Transaction:

1. Capital Employed:

- By issuing equity shares worth ₹ 10,00,000, the shareholders’ funds increase, which raises the total capital employed.

- As a result, the denominator in the ROI formula increases.

2. Net Profit:

- The purchase of machinery does not immediately impact net profit unless the machinery starts generating revenue or contributing to cost efficiency. If there’s no immediate increase in earnings, the numerator remains constant.

Effect on ROI:

- Since capital employed increases while net profit remains unchanged, the ROI ratio will decrease in the short term.

- However, in the long term, if the machinery helps boost revenue or profitability, the ROI ratio could improve.

Conclusion:

In the short term, the ROI ratio is likely to decrease, as higher capital employed dilutes the return. Over time, the impact depends on the productivity and profitability added by the new machinery.

(ii) Charging depreciation of ₹ 25,000 on machinery.

Charging depreciation of ₹ 25,000 on machinery will impact the Return on Investment (ROI) ratio as follows:

Impact of Depreciation:

1. Reduction in Net Profit:

- Depreciation is a non-cash expense that is deducted from the gross profit to calculate net profit. Charging ₹ 25,000 as depreciation reduces the company’s net profit.

2. Capital Employed (unchanged):

- Depreciation only impacts the profit-and-loss statement and does not alter capital employed, as it does not directly affect equity or long-term liabilities.

Effect on ROI:

- Net Profit (numerator) decreases due to depreciation.

- Capital Employed (denominator) remains constant.

- With the numerator decreasing and the denominator unchanged, the ROI ratio decreases.

Conclusion:

The ROI ratio declines because depreciation lowers the net profit. However, since depreciation is a non-cash expense, it helps reflect the company’s investment return more realistically by accounting for the wear and tear of machinery.

(iii) Redemption of debentures by payment of ₹ 2,00,000.

The redemption of debentures by paying ₹ 2,00,000 will affect the Return on Investment (ROI) ratio as follows:

Impact of Redemption:

1. Reduction in Capital Employed:

- Since debentures are a part of long-term liabilities, redeeming them reduces the capital employed by ₹ 2,00,000, as the liability decreases.

2. Net Profit Unchanged:

- The payment for redemption typically comes from cash or bank balances and does not directly impact the company’s net profit unless there are associated costs, such as interest or redemption premiums.

Revised ROI:

- As capital employed decreases (denominator in the formula) while net profit remains constant, the ROI ratio increases.

- The company’s investment base becomes smaller, making its returns appear stronger relative to the reduced base.

Conclusion:

The ROI ratio will increase after the redemption of debentures, reflecting a higher return on a reduced investment base.

(iv) Conversion of 9% Debentures of ₹ 1,00,000 into 10% Debentures of ₹ 100 each at par.

The conversion of 9% Debentures worth ₹ 1,00,000 into 10% Debentures of ₹ 100 each at par does not significantly affect the Return on Investment (ROI) ratio. Here’s why:

Impact of the Conversion:

1. Capital Employed:

- Debentures are part of long-term liabilities, which are included in capital employed.

- Since this is merely a conversion from 9% Debentures to 10% Debentures, capital employed remains unchanged as the total amount of debentures (₹ 1,00,000) stays constant.

2. Net Profit:

The increase in the interest rate from 9% to 10% will result in a higher interest expense for the company. This reduces net profit, as the additional ₹ 1,000 interest on the debentures (from ₹ 9,000 to ₹ 10,000 annually) is deducted from the earnings.

Effect on ROI:

- Since net profit decreases while capital employed remains constant, the ROI ratio decreases.

Conclusion:

The ROI ratio decreases slightly due to the higher interest expense, which reduces net profit. While the capital employed remains unaffected, the increase in debenture interest lowers the company’s return on its investment base.

Here is the list of all Solutions.

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

| 49 | Question – 49 |

| 50 | Question – 50 |

| S.N | Questions |

| 51 | Question – 51 |

| 52 | Question – 52 |

| 53 | Question – 53 |

| 54 | Question – 54 |

| 55 | Question – 55 |

| 56 | Question – 56 |

| 57 | Question – 57 |

| 58 | Question – 58 |

| 59 | Question – 59 |

| 60 | Question – 60 |

| S.N | Questions |

| 61 | Question – 61 |

| 62 | Question – 62 |

| 63 | Question – 63 |

| 64 | Question – 64 |

| 65 | Question – 65 |

| 66 | Question – 66 |

| 67 | Question – 67 |

| 68 | Question – 68 |

| 69 | Question – 69 |

| 70 | Question – 70 |

| S.N | Questions |

| 71 | Question – 71 |

| 72 | Question – 72 |

| 73 | Question – 73 |

| 74 | Question – 74 |

| 75 | Question – 75 |

| 76 | Question – 76 |

| 77 | Question – 77 |

| 78 | Question – 78 |

| 79 | Question – 79 |

| 80 | Question – 80 |

| S.N | Questions |

| 81 | Question – 81 |

| 82 | Question – 82 |

| 83 | Question – 83 |

| 84 | Question – 84 |

| 85 | Question – 85 |

| 86 | Question – 86 |

| 87 | Question – 87 |

| 88 | Question – 88 |

| 89 | Question – 89 |

| 90 | Question – 90 |

| S.N | Questions |

| 91 | Question – 91 |

| 92 | Question – 92 |

| 93 | Question – 93 |

| 94 | Question – 94 |

| 95 | Question – 95 |

| 96 | Question – 96 |

| 97 | Question – 97 |

| 98 | Question – 98 |

| 99 | Question – 99 |

| 100 | Question – 100 |

| S.N | Questions |

| 101 | Question – 101 |

| 102 | Question – 102 |

| 103 | Question – 103 |

| 104 | Question – 104 |

| 105 | Question – 105 |

| 106 | Question – 106 |

| 107 | Question – 107 |

| 108 | Question – 108 |

| 109 | Question – 109 |

| 110 | Question – 110 |

| S.N | Questions |

| 111 | Question – 111 |

| 112 | Question – 112 |

| 113 | Question – 113 |

| 114 | Question – 114 |

| 115 | Question – 115 |

| 116 | Question – 116 |

| 117 | Question – 117 |

| 118 | Question – 118 |

| 119 | Question – 119 |

| 120 | Question – 120 |

| S.N | Questions |

| 121 | Question – 121 |

| 122 | Question – 122 |

| 123 | Question – 123 |

| 124 | Question – 124 |

| 125 | Question – 125 |

| 126 | Question – 126 |

| 127 | Question – 127 |

| 128 | Question – 128 |

| 129 | Question – 129 |

| 130 | Question – 130 |

| S.N | Questions |

| 131 | Question – 131 |

| 132 | Question – 132 |

| 133 | Question – 133 |

| 134 | Question – 134 |

| 135 | Question – 135 |

| 136 | Question – 136 |

| 137 | Question – 137 |

| 138 | Question – 138 |

| 139 | Question – 139 |

| 140 | Question – 140 |

| S.N | Questions |

| 141 | Question – 141 |

| 142 | Question – 142 |

| 143 | Question – 143 |

| 144 | Question – 144 |

| 145 | Question – 145 |

| 146 | Question – 146 |

| 147 | Question – 147 |

| 148 | Question – 148 |

| 149 | Question – 149 |

| 150 | Question – 150 |

| S.N | Questions |

| 151 | Question – 151 |

| 152 | Question – 152 |

| 153 | Question – 153 |

| 154 | Question – 154 |

| 155 | Question – 155 |

| 156 | Question – 156 |

| 157 | Question – 157 |

| 158 | Question – 158 |

| 159 | Question – 159 |

| 160 | Question – 160 |

| S.N | Questions |

| 161 | Question – 161 |

| 162 | Question – 162 |

| 163 | Question – 163 |

| 164 | Question – 164 |

| 165 | Question – 165 |

| 166 | Question – 166 |

| 167 | Question – 167 |

| 168 | Question – 168 |

| 169 | Question – 169 |

| 170 | Question – 170 |

| S.N | Questions |

| 171 | Question – 171 |

| 172 | Question – 172 |

| 173 | Question – 173 |

| 174 | Question – 174 |

| 175 | Question – 175 |

| 176 | Question – 176 |

| 177 | Question – 177 |

| 178 | Question – 178 |

| 179 | Question – 179 |

| 180 | Question – 180 |

| 181 | Question – 181 |

| 182 | Question – 182 |

| 183 | Question – 183 |

| 184 | Question – 184 |