[CBSE] Q 18 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 18 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

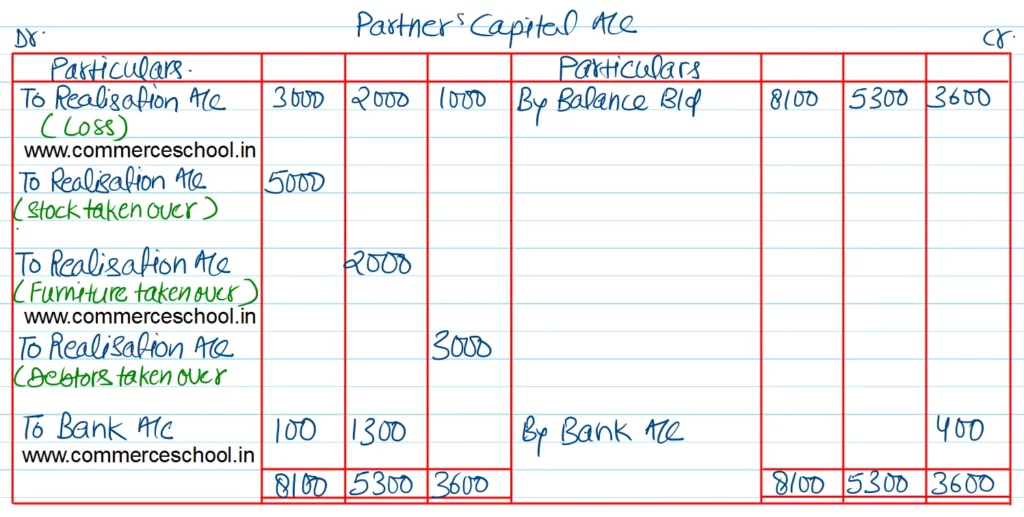

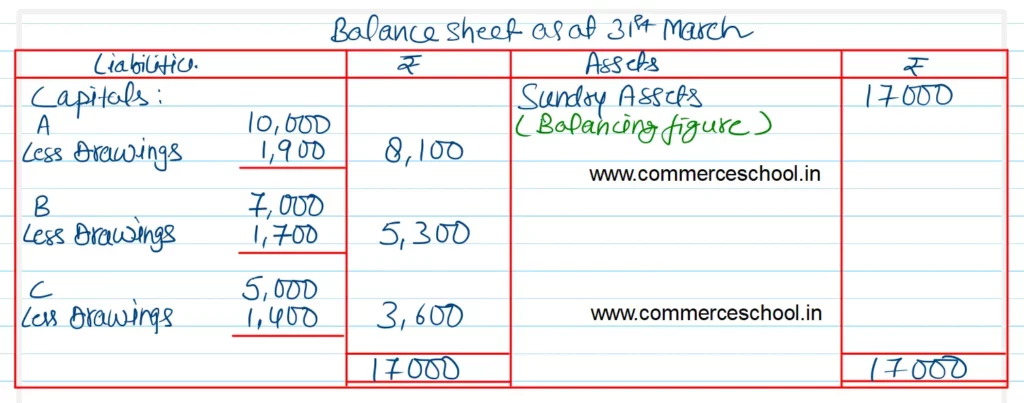

Q. 18. On 1st April, 2023, A, B and C commenced business in partnership sharing profit and losses in proportion of 1/2, 1/3 and 1/6 respectively. They paid into their Bank A/c as their capital ₹ 22,000 being ₹ 10,000 by A, ₹ 7,000 by B and ₹ 5,000 by C. During the year they drew ₹ 5,000, being ₹ 1,900 by A, ₹ 1,700 by B and ₹ 1,400 by C.

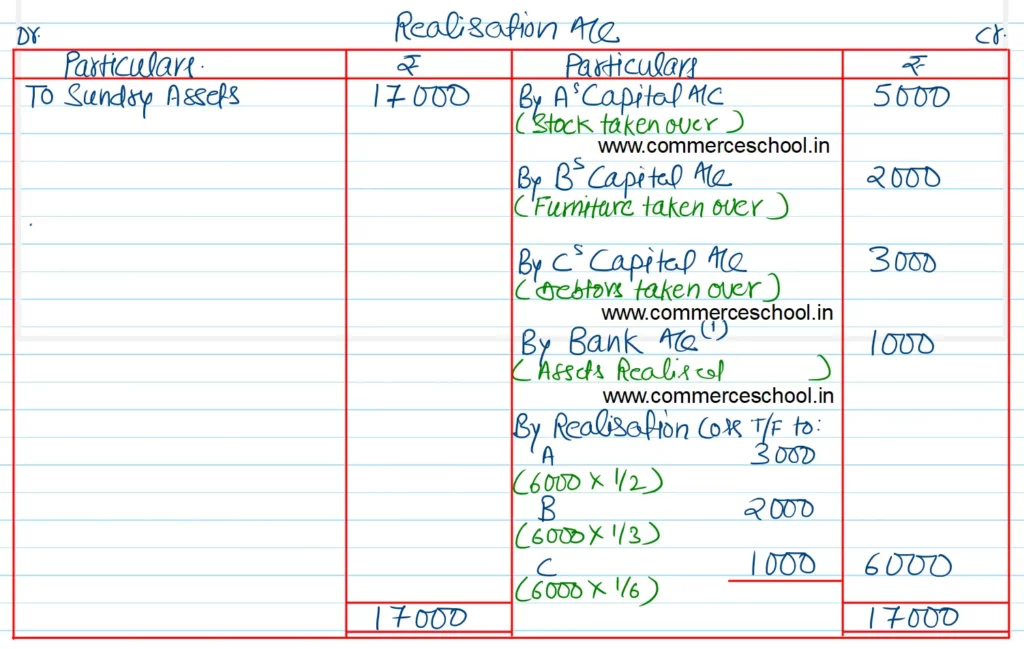

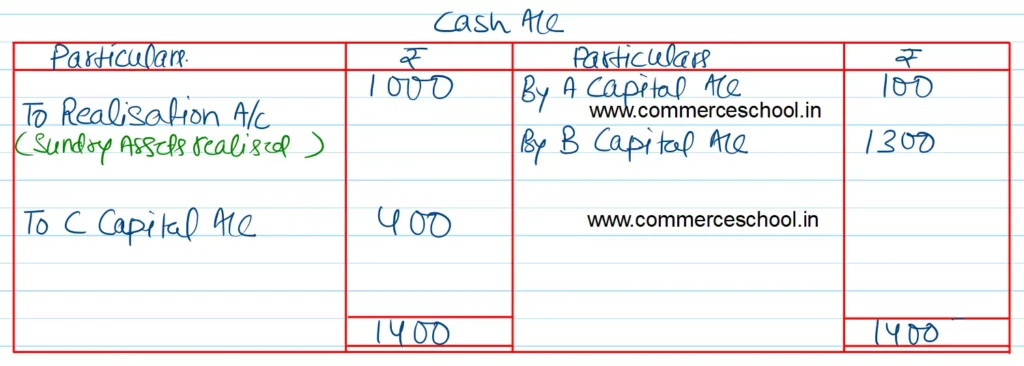

On 31st March, 2024, they dissolved their firm. A taking up stock at an agreed valuation of ₹ 5,000, B taking up furniture at ₹ 2,000 and C taking up debtors at ₹ 3,000. After paying up their creditors, there remaining a balance of ₹ 1,000 at Bank. Prepare the necessary accounts showing the distribution of the cash at the Bank and of the further cash brought in by any partner as the case required.

[Ans. Sundry Assets ₹ 17,000. Loss on Realisation ₹ 6,000; Amount paid to A ₹ 100; Amount paid to B ₹ 1,300. Amount brought in by C ₹ 400; Total of Bank A/c ₹ 1,400.]

Solution:-

Working Notes:-

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |