[CBSE] Q 19 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 19 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

X, Y and Z entered into partnership on 1st October 2021 sharing profits and losses in the proportions of 4 : 3 : 2, respectively, and with capitals of ₹ 30,000, ₹ 20,000 and ₹ 10,000.

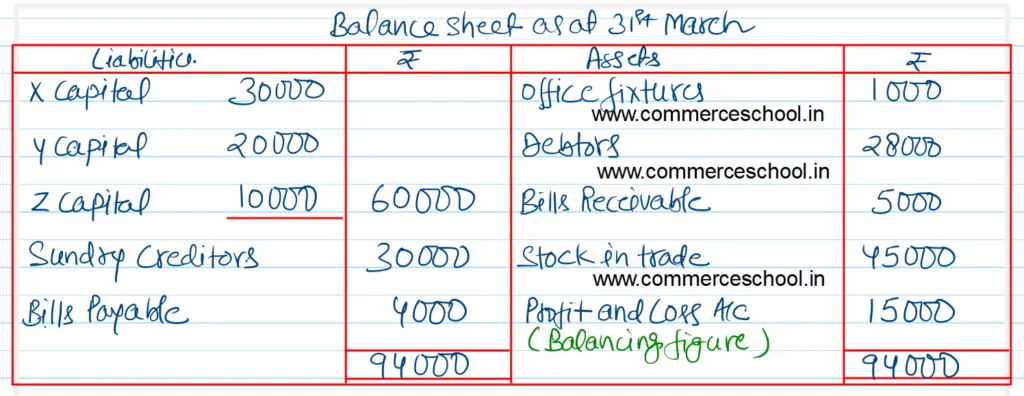

Their assets and liabilities on 1st October 2022, the date on which they decided to wind up their affairs, were as follows:

Office Fixtures ₹ 1,000; Debtors ₹ 28,000; Bills Receivable ₹ 5,000; and Stock-in-trade ₹ 45,000. Sundry Creditors were ₹ 30,000; Bills Payable ₹ 4,000.

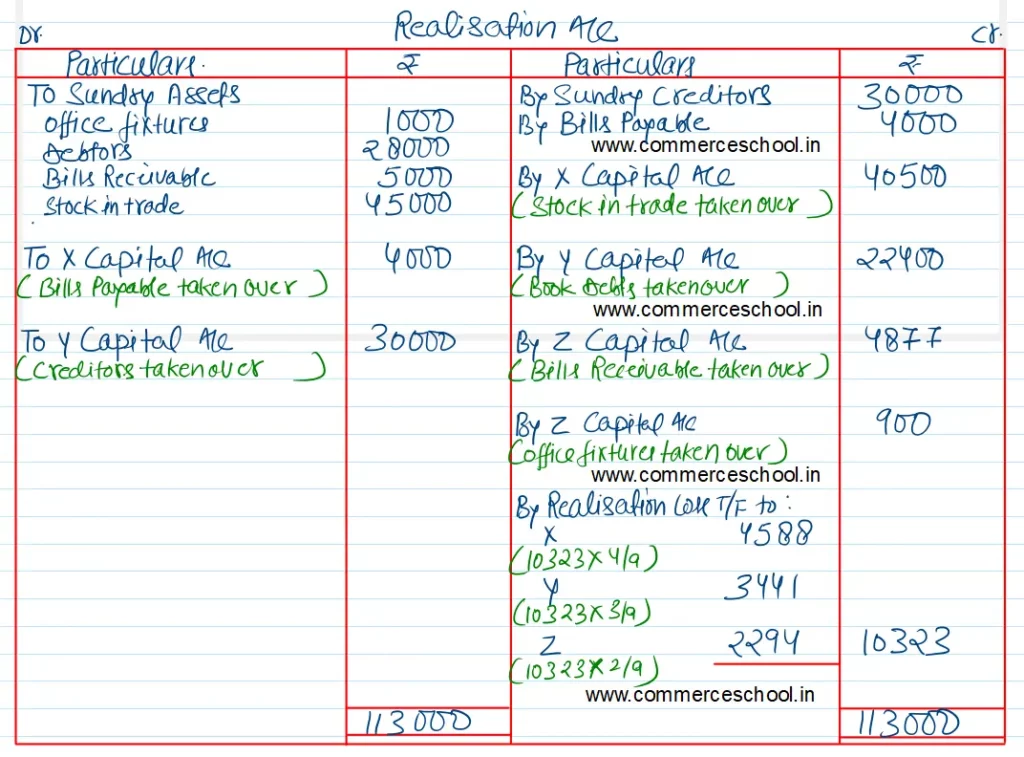

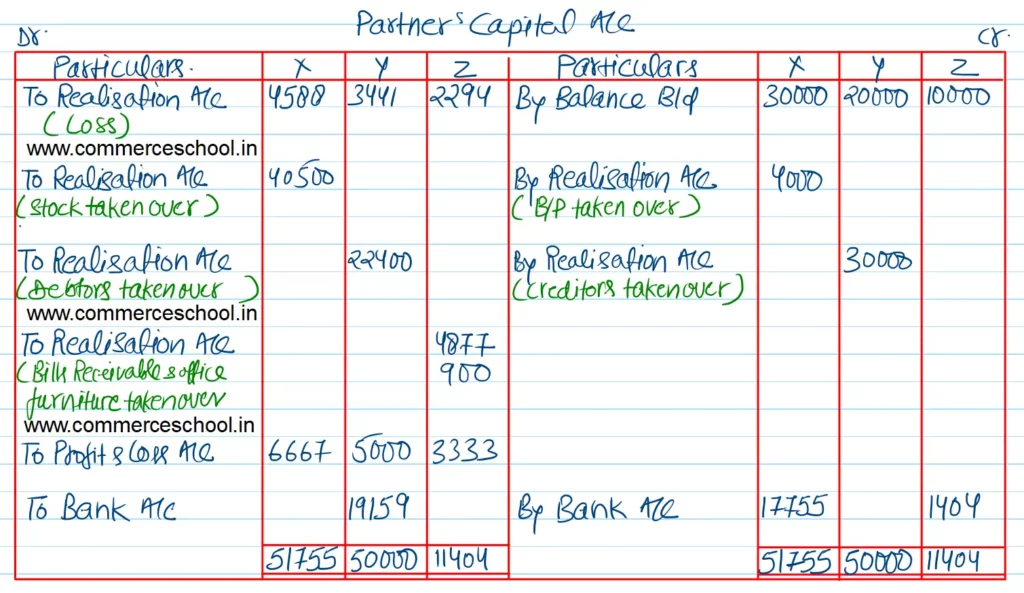

X agreed to take over the Stock-in-trade at a discount of 10% and pay off the Bills Payable.

Y agreed to take over the Book Debts at a discount of 20% and pay off the Creditors.

Z took over the Bills Receivable at ₹ 4,877 and Office Fixtures at a depreciation of 10%.

5% p.a. interest is to be credited to each partner on his capital.

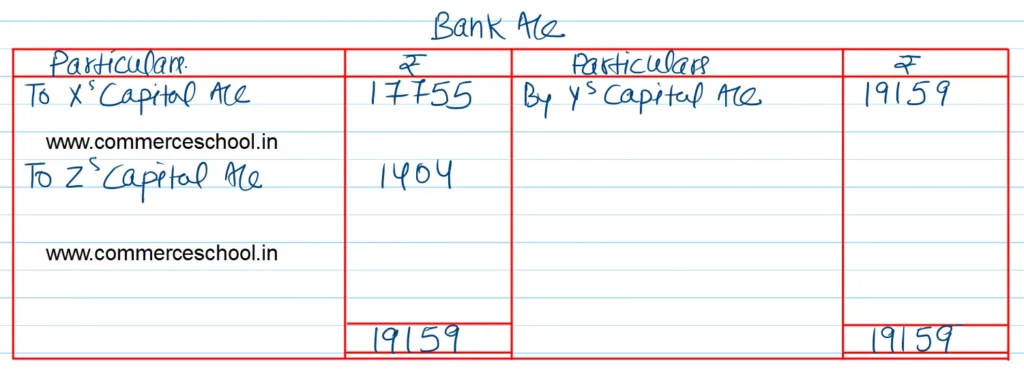

Prepare Realisation a/c and Capital A/cs of the partners and an account showing adjustment of profits or losses in the business.

[Ans. Loss (P&L A/c Dr. Balance) ₹ 15,000; Realisation loss ₹ 10,323; Cash brought in by X ₹ 17,755 and Z ₹ 1,404; Cash paid to Y ₹ 19,159.]

Solution:-

Hint: Interest on Capital will not be allowed, because there is loss in the business.

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |