[CBSE] Q 20 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 20 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

Q. 20 (A) Following is the Balance Sheet of Deepak and Jyoti, who were sharing profit and losses in the ratio of 3 : 2, as at March 31, 2024:-

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 38,000 | Cash | 1,500 |

| Mrs. Deepak’s Loan | 10,000 | Bank | 10,000 |

| Bank Loan | 15,000 | Debtors 20,000 Less: Provision for Doubtful Debts 1,000 | 19,000 |

| Capital A/cs: Deepak Jyoti | 10,000 8,000 | Stock | 12,000 |

| Current A/cs: Deepak Jyoti | 2,000 500 | Furniture | 6,000 |

| 83,500 | Plant | 30,000 | |

| P & L A/c (Dr. Balance) | 5,000 | ||

| 83,500 | 83,500 |

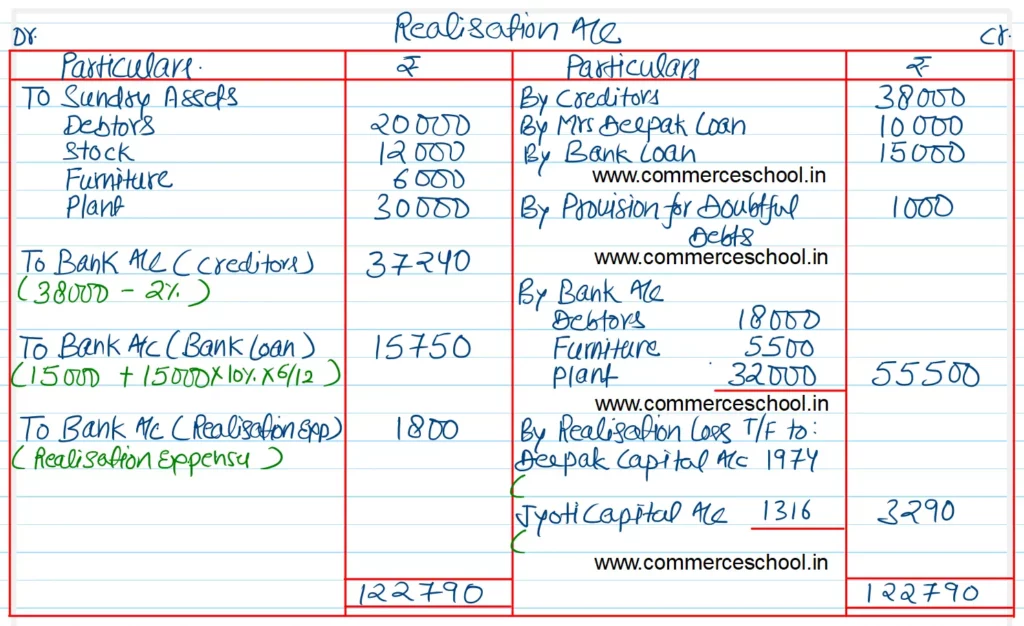

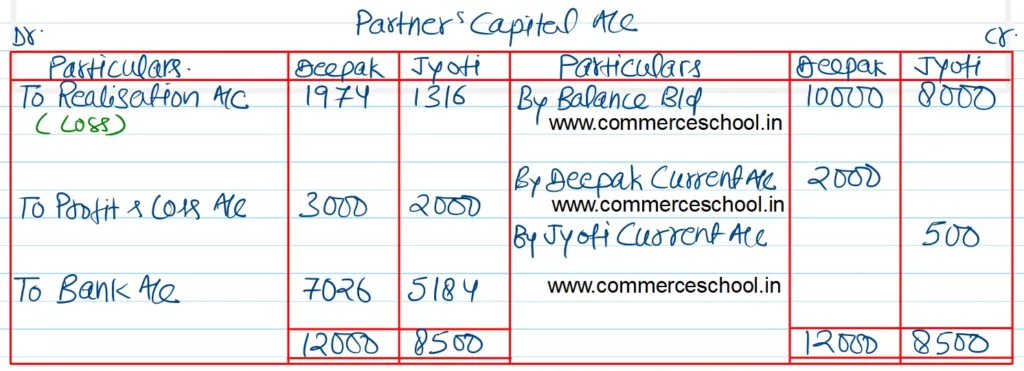

The firm was dissolved on that date and the following arrangements were made:-

(I) Assets realised as follows: Debtors ₹ 18,000; Furniture ₹ 5,500; Plant ₹ 32,000.

(ii) Deepak agreed to take over stock in full settlement of his wife’s loan.

(iii) Creditors were paid at 2% discount and Bank Loan was discharged along with interest due for six months @ 10% p.a. and

(iv) Expenses of realisation amounted to ₹ 1,800.

Show the necessary ledger accounts to close the books of the firm.

[Ans. Loss on Realisation ₹ 3,290; Final Payments : Deepak ₹ 7,026 and Jyoti ₹ 5,184; Total of Cash/Bank A/c ₹ 67,000.]

Solution:-

Hint:

Interest on capital will not be allowed, because there is loss in the business.

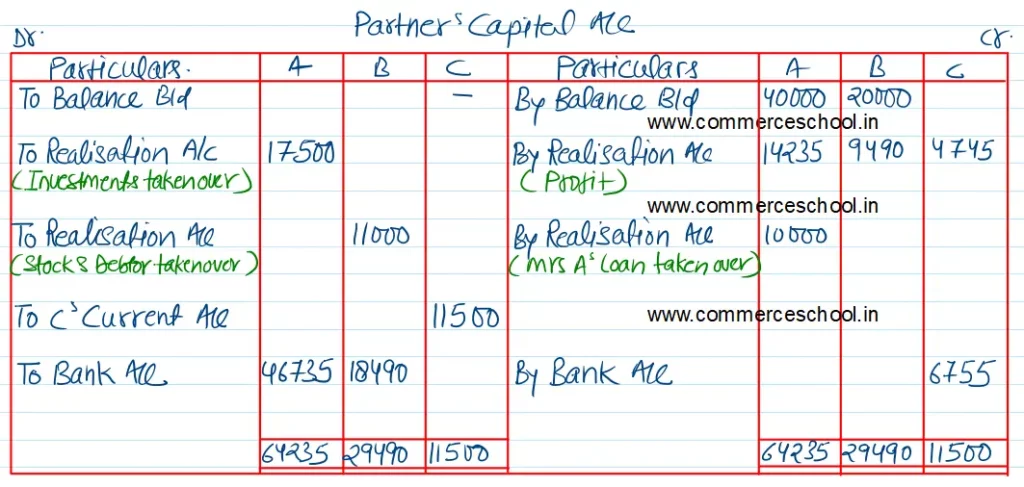

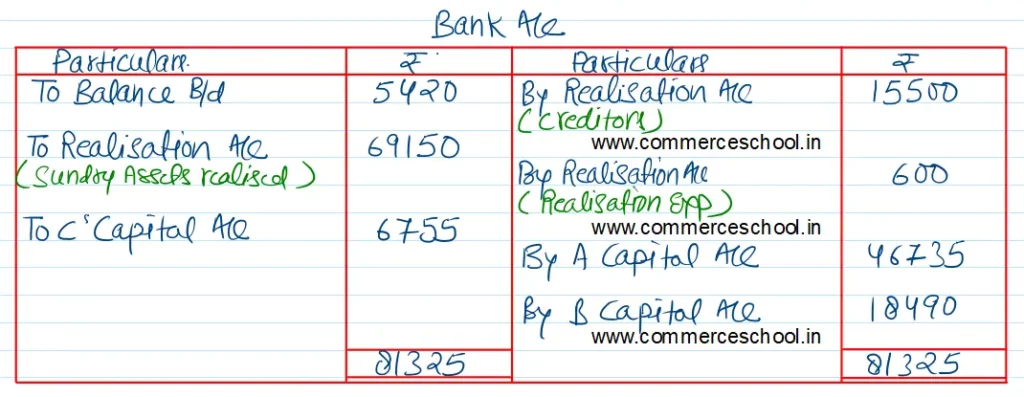

Q. 20(B) A, B and C sharing profits in the proportion of 3 : 2 : 1 agreed upon dissolution of their partnership firm on 31st March, 2024 on which date their balance sheet was as under:

| Liabilities | ₹ | Assets | ₹ |

| Capital A/cs: A B | 40,000 20,000 | Machinery | 40,500 |

| Mrs. A’s Loan | 10,000 | Stock-in-trade | 7,550 |

| Creditors | 18,500 | Investments | 20,000 |

| Investments Fluctuation Fund | 6,000 | Accrued Income | 830 |

| Debtors 9,300 Less: Provision for Doubtful Debts 600 | 8,700 | ||

| Current A/c – C | 11,500 | ||

| Cash at Bank | 5,420 | ||

| 94,500 | 94,500 |

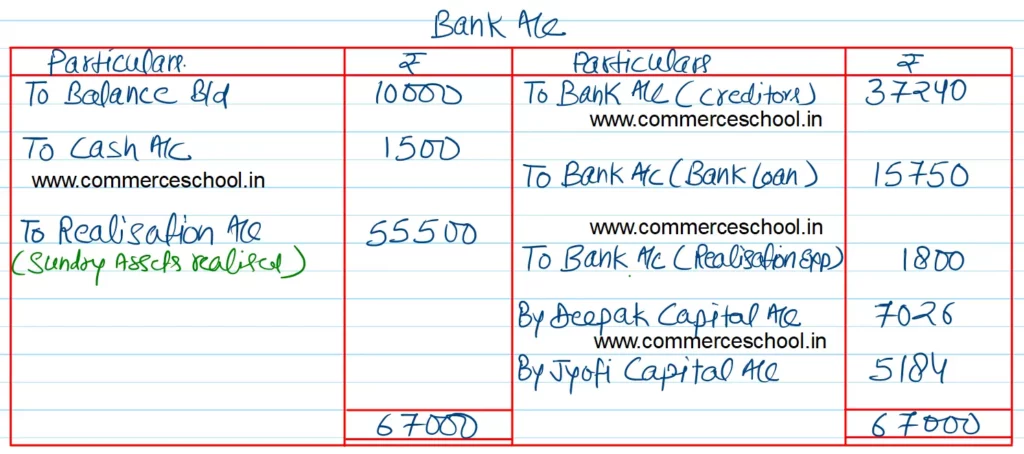

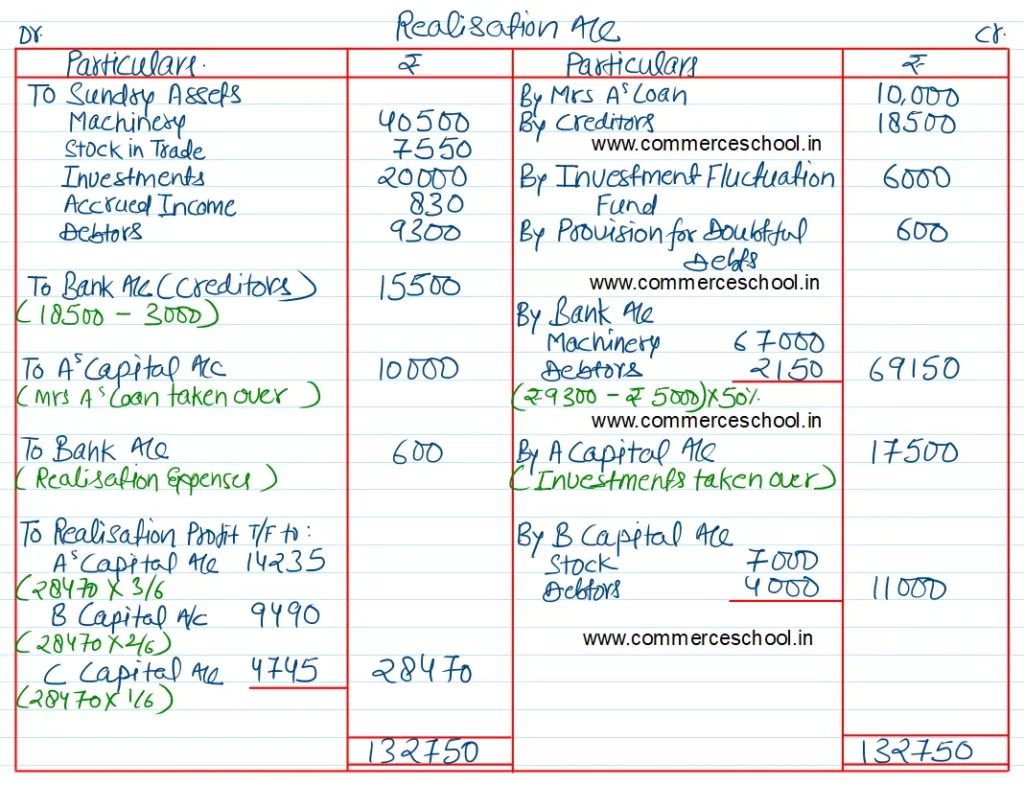

The investments are taken over by A for ₹ 17,500. A agrees to discharge his wife’s loan. B takes over all the stock at ₹ 7,000 and debtors amounting to ₹ 5,000 at ₹ 4,000. Machinery is sold for ₹ 67,000. The remaining debtors realise 50% of book value. The expenses of realisation amount to ₹ 600.

It is found that an investment not recorded in the books is worth ₹ 3,000 and it is taken over by one of the creditors at this value.

Show the necessary ledger accounts on completion of the dissolution of firm.

[Ans. Gain on realisation ₹ 28,470; Cash brought in by C ₹ 6,755; Payment to A ₹ 46,735 and B ₹ 18,490. Total of Bank A/c ₹ 81,325.]

Solution;-

Notes:-

(1) C’s Current A/c appears on the assets side, which means that is has a debit balance. As such, it will be transferred to the Debit Side of C’s Capital Account.

(2) Accrued income will not be realised.

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |