[CBSE] Q. 21 Dissolution of Partnership Firm Solution TS Grewal Class 12 2024-25

Solution to Question number 21 of the Dissolution of Partnership Firm Chapter of TS Grewal Book 2024-25 Edition for the CBSE Board.

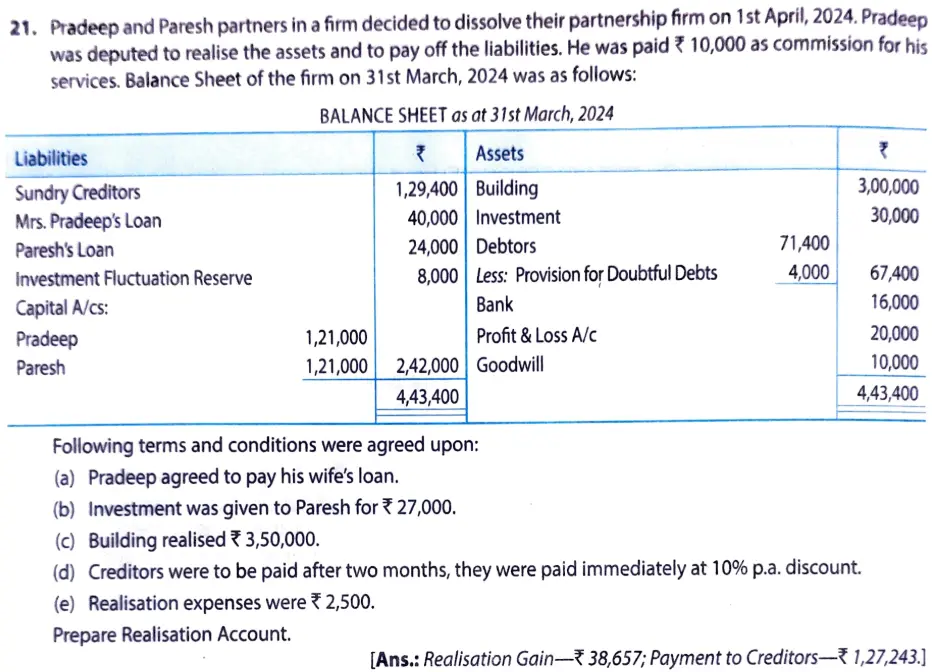

Pradeep and Paresh partners in a firm decided to dissolve their partnership firm on 1st April, 2024. Pradeep was deputed to realise the assets and to pay off the liabilities. He was paid ₹ 10,000 as commission for his services. Balance Sheet of the firm on 31st March, 2024 was as follows:

Balance Sheet as at 31st March, 2024

| Liabilities | ₹ | Assets | ₹ | |

| Sundry Creditors Mrs. Pradeep’s Loan Paresh’s Loan Investment Fluctuation Reserve Capital A/cs: Pradeep Paresh | 1,29,400 40,000 24,000 8,000 1,21,000 1,21,000 | Building Investment Debtors Less: Provision for Doubtful Debts Bank Profit & Loss A/c Goodwill | 71,400 4,000 | 3,00,000 30,000 67,400 16,000 20,000 10,000 |

| 4,43,400 | 4,43,400 |

Following terms and conditions were agreed upon:

(a) Pradeep agreed to pay his wife’s loan.

(b) Investment was given to Paresh for ₹ 27,000.

(c) BUilding realised ₹ 3,50,000.

(d) Creditors were to be paid after two months, they were paid immediately at 10% p.a. discount.

(e) Realisation expenses were ₹ 2,500.

Prepare Realisation Account.

[Ans.: Realisation Gain – ₹ 38,657; Payment to Creditors – ₹ 1,27,243.]

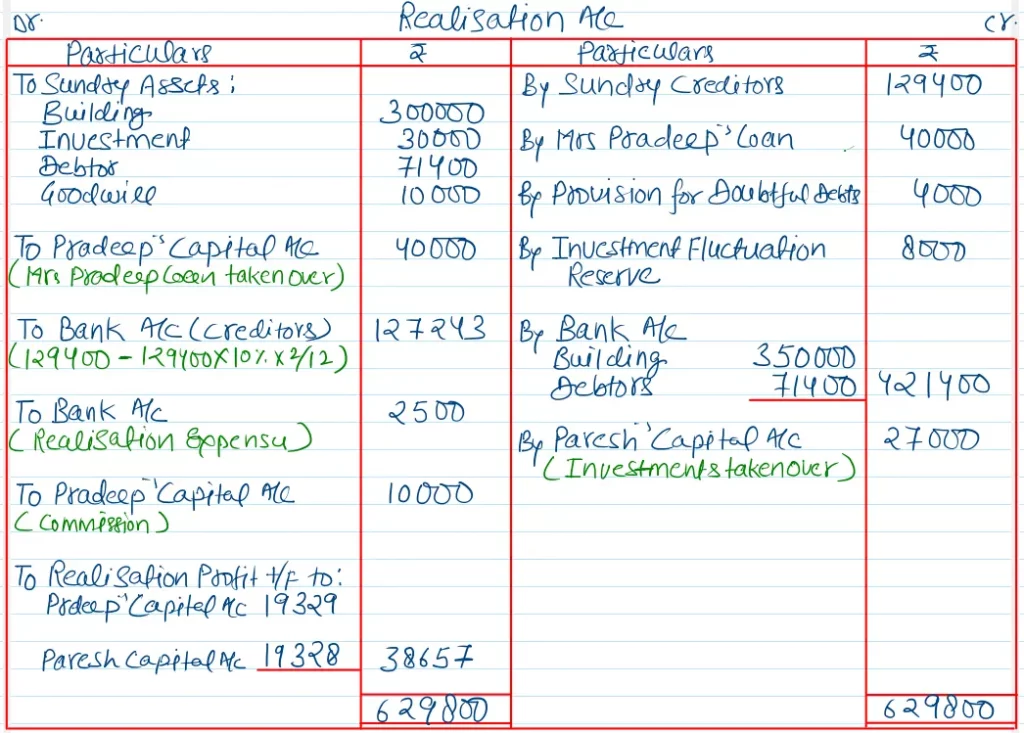

Solution:-

Here is the list of solutions

| S.N | Questions |

| 1 | Question – 1 |

| 2 | Question – 2 |

| 3 | Question – 3 |

| 4 | Question – 4 |

| 5 | Question – 5 |

| 6 | Question – 6 |

| 7 | Question – 7 |

| 8 | Question – 8 |

| 9 | Question – 9 |

| 10 | Question – 10 |

| S.N | Questions |

| 11 | Question – 11 |

| 12 | Question – 12 |

| 13 | Question – 13 |

| 14 | Question – 14 |

| 15 | Question – 15 |

| 16 | Question – 16 |

| 17 | Question – 17 |

| 18 | Question – 18 |

| 19 | Question – 19 |

| 20 | Question – 20 |

| S.N | Questions |

| 21 | Question – 21 |

| 22 | Question – 22 |

| 23 | Question – 23 |

| 24 | Question – 24 |

| 25 | Question – 25 |

| 26 | Question – 26 |

| 27 | Question – 27 |

| 28 | Question – 28 |

| 29 | Question – 29 |

| 30 | Question – 30 |

| S.N | Questions |

| 31 | Question – 31 |

| 32 | Question – 32 |

| 33 | Question – 33 |

| 34 | Question – 34 |

| 35 | Question – 35 |

| 36 | Question – 36 |

| 37 | Question – 37 |

| 38 | Question – 38 |

| 39 | Question – 39 |

| 40 | Question – 40 |

| S.N | Questions |

| 41 | Question – 41 |

| 42 | Question – 42 |

| 43 | Question – 43 |

| 44 | Question – 44 |

| 45 | Question – 45 |

| 46 | Question – 46 |

| 47 | Question – 47 |

| 48 | Question – 48 |

In a comment, a discrepancy was brought to your attention, kindly ignore it. That was an error on my part.

Thank you

Regards

There’s a discrepancy in the gain calculation. While the answer provided is Rs. 38,657 and it matches what’s in the book, the actual calculation, considering all entries, should result in Rs. 48,657. It seems that an error of Rs. 10,000 was overlooked. Both the credit and debit sides have correct entries, so the gain should reflect Rs. 48,657, not Rs. 38,657. Please rectify this mistake and adjust the entries accordingly to reflect the correct gain.