[CBSE] Q 21 DK Goel Dissolution of a Partnership Firm Solutions Class 12 (2024-25)

Solution of Question number 21 of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

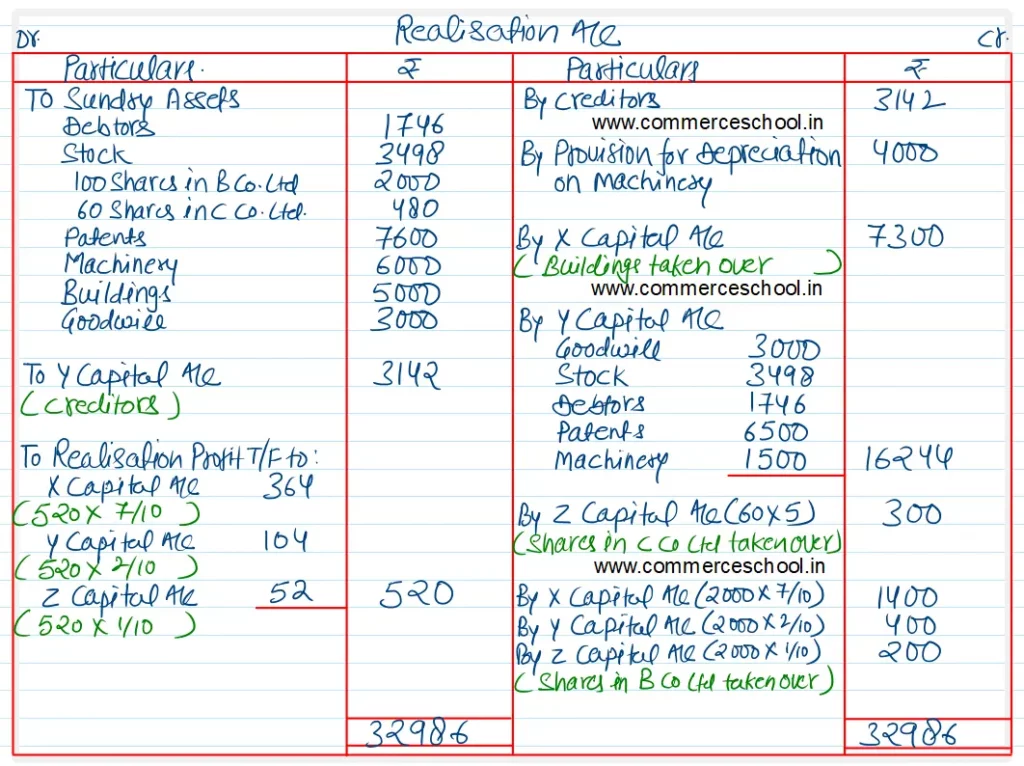

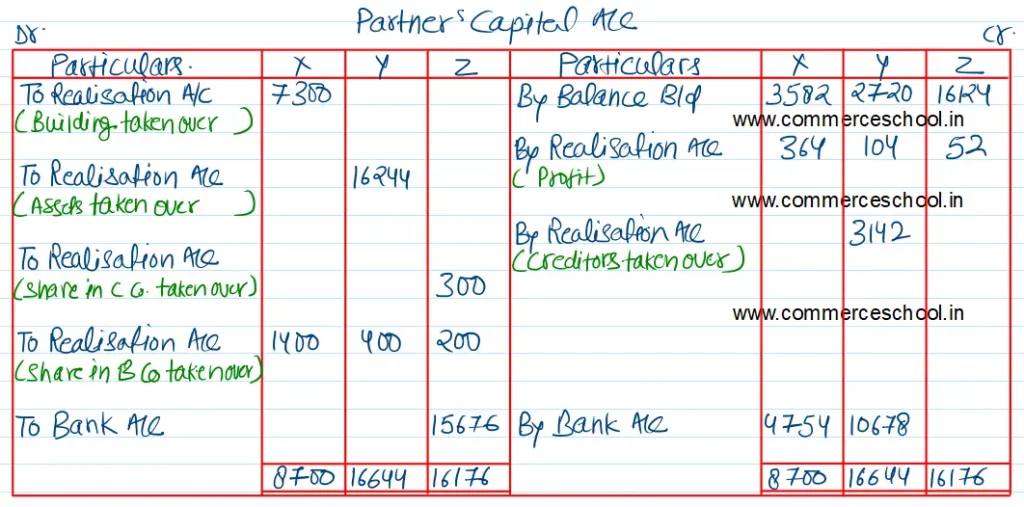

Q. 21 (A). X, Y and Z were in partnership sharing profits and losses in the ratio of 7 : 2 : 1 and the Balance Sheet of the firm stood on 31st March, 2024, as under:-

| Liabilities | ₹ | Assets | ₹ |

| Creditors | 3,142 | Cash in Hand | 244 |

| Provision for Depreciation on Machinery | 4,000 | Debtors | 1,746 |

| Capital Accounts: X Y Z | 3,582 2,720 16,124 | Stock | 3,498 |

| 100 Shares in B Co. Ltd 60 Shares in C Co. Ltd. | 2,000 480 | ||

| Patents | 7,600 | ||

| Machinery | 6,000 | ||

| Buildings | 5,000 | ||

| Goodwill | 3,000 | ||

| 29,568 | 29,568 |

On 31st March, 2024, it was decided to dissolve the firm on the following terms:

(i) X is to take over the buildings at ₹ 7,300.

(ii) Y, who will continue with business, to take over Goodwill, Stock and Debtors at book values, Patents at ₹ 6,500 and Machinery at ₹ 1,500. He also agreed to pay the creditors.

(iii) Z agreed to take the shares in C Co. Ltd at ₹ 5 each.

(iv) The shares in B Co. Ltd. to be divided in profit sharing ratio.

Show the ledger accounts to record the dissolution.

[Ans. Gain on realisation ₹ 520; Cash brought in by X ₹ 4,754 and Y ₹ 10,678; Final Payment to Z ₹ 15,676: Total of Cash A/c ₹ 15,676.]

Solution:-

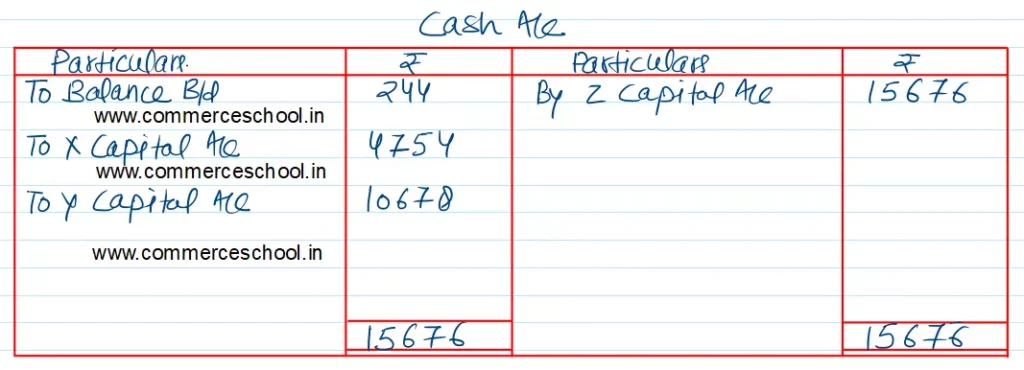

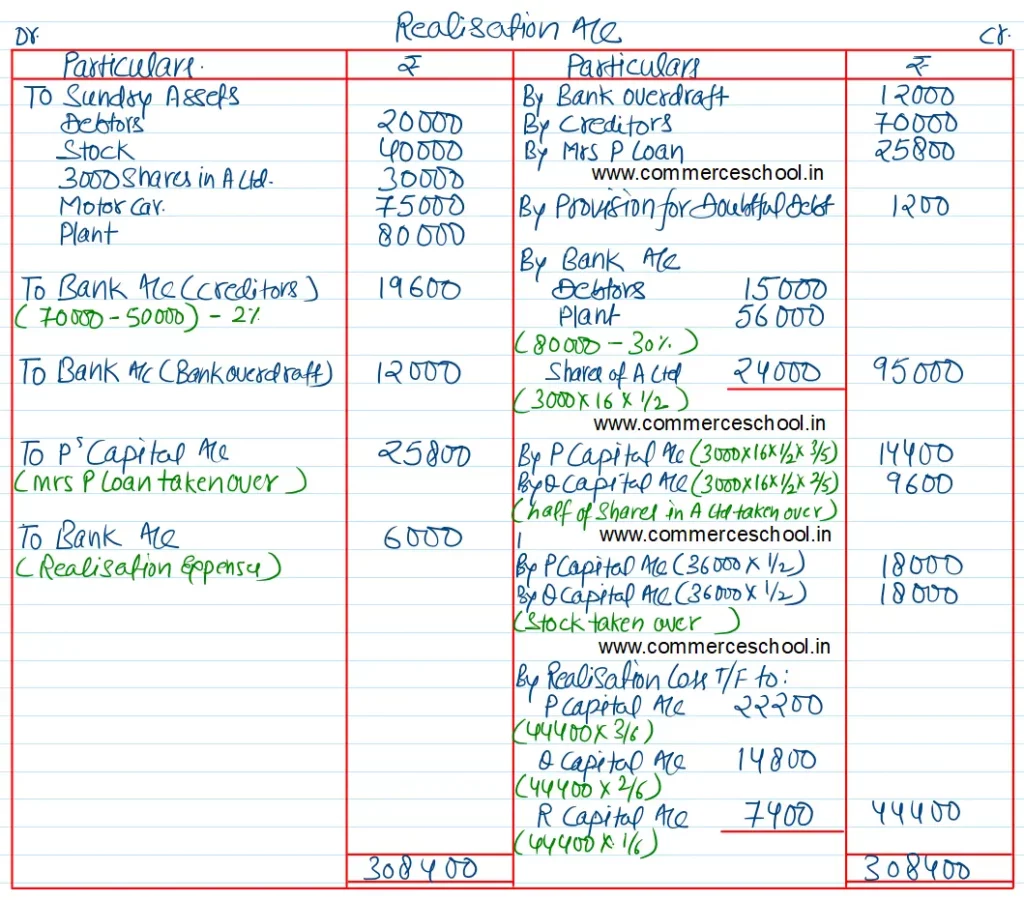

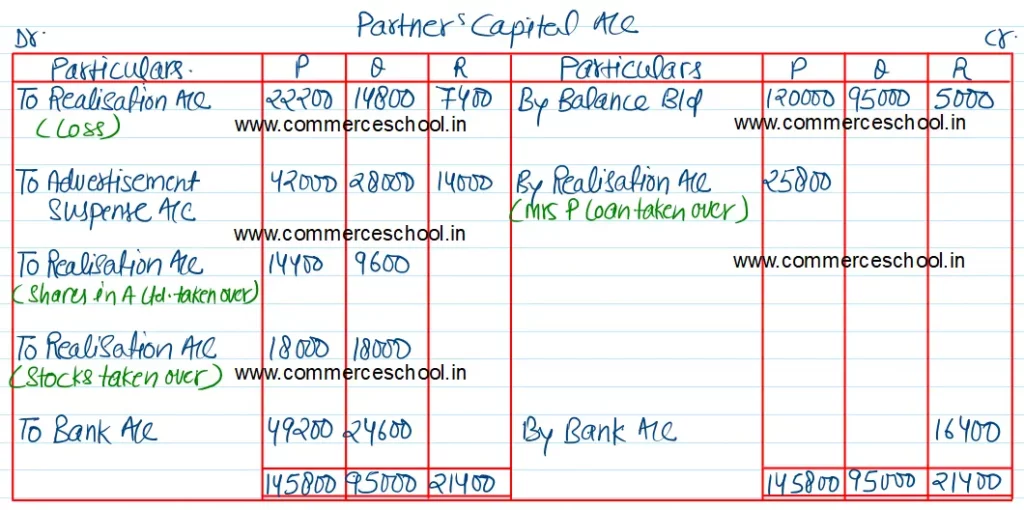

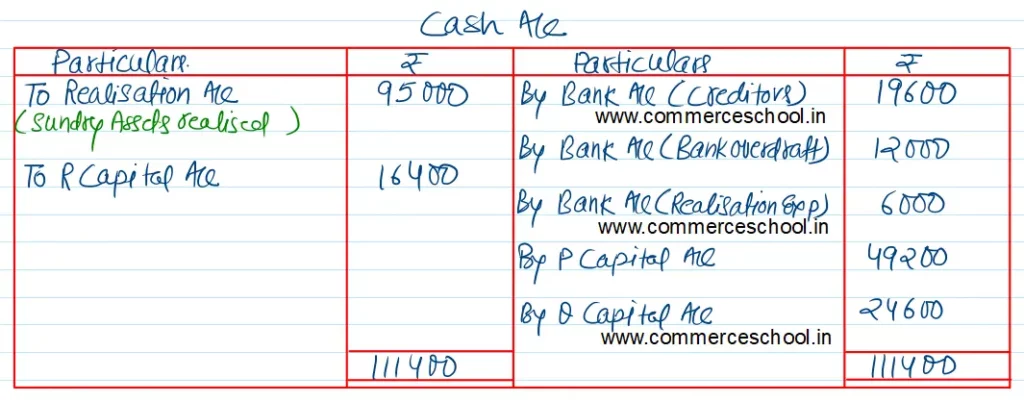

Q. 21 (B). Following is the balance sheet of P, Q and R who were sharing profits and losses in the ratio of 3 : 2 : 1.

| Liabilities | ₹ | Assets | ₹ |

| Bank Overdraft | 12,000 | Debtors 20,000 Less: Provision 1,200 | 18,800 |

| Creditors | 70,000 | Stock | 40,000 |

| Mrs. P’s Loan | 25,800 | 3,000 Shares in ‘A’ Ltd. | 30,000 |

| Capital Accounts: P Q R | 1,20,000 95,000 5,000 | Motor Car | 75,000 |

| Plant | 80,000 | ||

| Advertisement Suspense A/c | 84,000 | ||

| 3,27,800 | 3,27,800 |

The firm was dissolved on that date and the following arrangements were made:

(i) Assets realised as follows: Debtors ₹ 15,000; Plant and 30% discount.

(ii) Stock was valued at ₹ 36,000 and this was taken over by P and Q equally.

(iii) Market value of the shares of A Ltd. is ₹ 16 per share. Half the shares were sold in the market and the balance half were taken over by P and Q in their profit sharing ratio.

(iv) A creditor for ₹ 50,000 took over Motor Car in full settlement of his claim and the balance of creditors were paid at a discount of 2%.

(v) Expenses of realisation amounted to ₹ 6,000. P agreed to discharge his wife’s Loan.

Prepare Journal entries and Ledger accounts.

[Ans. Loss on Realisation ₹ 44,400. R brings in ₹ 16,400; Final Payment to P ₹ 49,200 and Q ₹ 24,600. Total of Bank A/c ₹ 1,11,400.]

Solution:-

Note:

Bank Overdraft is short-term borrowing. It will be first transferred to the Cr. of Realisation A/c and then paid off.

Here are the solutions of Dissolution of a Partnership Firm chapter 5 of DK Goel Class 12 CBSE (2024-25)

| S.N | Questions | |

| 1 | Question – 1 | |

| 2 | Question – 2 | |

| 3 | Question – 3 | |

| 4 | Question – 4 | |

| 5 | Question – 5 | |

| 6 | Question – 6 | |

| 7 | Question – 7 | |

| 8 | Question – 8 | |

| 9 | Question – 9 | |

| 10 | Question – 10 |

| S.N | Questions | |

| 11 | Question – 11 | |

| 12 | Question – 12 | |

| 13 | Question – 13 | |

| 14 | Question – 14 | |

| 15 | Question – 15 | |

| 16 | Question – 16 | |

| 17 | Question – 17 | |

| 18 | Question – 18 | |

| 19 | Question – 19 | |

| 20 | Question – 20 |

| S.N | Questions | |

| 21 | Question – 21 | |

| 22 | Question – 22 | |

| 23 | Question – 23 | |

| 24 | Question – 24 | |

| 25 | Question – 25 | |

| 26 | Question – 26 | |

| 27 | Question – 27 | |

| 28 | Question – 28 | |

| 29 | Question – 29 | |

| 30 | Question – 30 |

| S.N | Questions | |

| 31 | Question – 31 | |

| 32 | Question – 32 | |

| 33 | Question – 33 | |

| 34 | Question – 34 | |

| 35 | Question – 35 | |

| 36 | Question – 36 | |

| 37 | Question – 37 | |

| 38 | Question – 38 | |

| 39 | Question – 39 | |

| 40 | Question – 40 |